22 March 2021

Weekly Market Review (22 March 2021) - What happened and What's Next?

Market update

- Global equities declined for the past week (S&P 500 -0.8%WoW; DJIA -0.5%WoW; MSCI ex Japan -0.8%WoW), as US 10Y bond yield continue to rise, despite The Fed’s dovish message. The investors seem to perceive that The Fed’s stronger economic projections indicated that the Fed would let inflation overshoot, hence, the long end remains unanchored for now. In near time, some broad-based consolidation in equities cannot be dismissed if yield continue to increase. The key discussion remains on the inflation whether it will be transitory or structural, as well as ‘tapering’ topic, although this time might be less disruptive for Asian vs 2013 given current better macro backdrop shape. Investors also continue to watch closely the demand for US treasuries given the Fed’s decision not to extend a capital relief for big banks. Meanwhile, oil price fell by -7%WoW due to global reopening uncertainties, which might hold the increasing inflation expectation. US-China relations see a potential corporation after Alaska talks. On the domestic side, JCI was relatively flat over the week end 19-March to IDR 6,356. Sectors were mixed whereby Miscellaneous Industry sector gained the most with up by 5.1%WoW. In contrast, Property and Agriculture sector were underperformed respectively down by -3.1%WoW and -2.9%WoW. News flows to be watched within this week: US Durable goods orders, Markit PMI, Initial jobless claim, GDP Annualized QoQ; China Current Account Balance.

- Rupiah weakened by 0.2% WoW to USD/IDR 14,408, with EM currencies were mixed. In contrast, DXY index slightly strengthened by 0.3% WoW to 91.9.

- Indonesian government bonds continued to trade lower with yield increased by 7bps along the curve tracking the surge of US treasury yield. Yield on the belly and the end of the curve rose, with 7yr and 15yr increased the most by 9bps and 16bps, respectively. As market has expected, BI decided to leave its policy rate unchanged at 3.5% on the back of low inflation expectation and the need to maintain IDR stability. By the end of the week, 10y yield was reported at 6.78% (+7bps WoW).

- Incoming bids on Tuesday conventional auction continued lower with demand only reached IDR40tn compared to previous demand of IDR49.7tn. All series’ bids were lower than in the previous auction, except for the SPN3mo which increased slightly by IDR1tn. The biggest drop was for the 5yr note which fell by almost 30% to IDR8.32tn (vs. previous IDR12.49tn). With the slowing demand, the government issued only IDR18.9tn and announced GSO on Wednesday. The government then accepted only IDR9.1tn and adding to the previous regular auction, the government has issued IDR28tn or lower than IDR30tn initial target.

- Based on DMO data foreign ownership as of 18 Mar 2021 reported at IDR953.24tn or 23.10%.

- The FOMC meeting on 18 on Wednesday resulted in Fed keeping its policy rate on hold at 0-0.25%. The pace of asset purchases also unchanged at USD 120bn/month. Meanwhile, on the economic projections, the Fed revised up GDP growth to 6.5% (vs. 4.2% projected in Dec). Yield on the US Treasuries have surged to their highest to 1.74% (+10bps WoW) by the end of the week.

Global news

- In the last FOMC meeting, the Fed sticked to hold benchmark rate with the median policy rate forecast remained at effective lower bound through 2023. The Fed also indicated no changes in the forward guidance for asset purchases of Treasury Bonds and mortgage-backed securities (maintain at USD120bn/month). Further, the Fed updated its economic outlook, with 2021 GDP growth projection midpoint to 6.5% (prior 4.2%), inflation to 2.4% (prior 1.8%), unemployment to 4.5% (prior 5.0%).

- US Feb-21 Retail Sales fell by -3%MoM, deeper than consensus expectation -0.5%MoM, and prior that up by +7.6%MoM. Unseasonably cold weather gripped the country, with deadly snowstorms lashing Texas and some South region weighed on the figure.

- US Feb-21 Industrial Production unexpectedly slumped by -2.2%MoM, contrary with consensus expectation climb by +0.3%MoM and upward result in Jan-21 by +1.1%MoM. This figure was due to manufacturing output that plunged by -3.1%MoM (vs 1.2%MoM in Jan).

- US Initial Jobless Claims for the week ending 13-March-21 added +770k, higher than consensus expectation of +700k and prior figure of +725k.

- China's retail sales of consumer goods up 33.8%yoy in Jan-Feb 2021 (vs Dec-20 4.6%yoy), due to low base last year figure distorted by pandemic.

Domestic News

- Bank Indonesia decided to hold 7DRRR unchanged at 3.5%, in line with consensus expectation. Further, BI retained its GDP forecast 2021 at 4.3%-5.3% with inflation target range of 2-4%. BI has purchased IDR65.03tn of govt bond YTD as of 16-March 21 – IDR22.9tn from the main auction and IDR42.13tn from the GSO auction.

- Indonesia Feb-21 booked another trade surplus of USD2,010mn (vs Jan-21 of USD 1,959mn; consensus expectation USD2,229mn). Export increased by +8.56%yoy (consensus expectation 8.2%; vs 12.24%yoy in Jan-21). While import also up by +14.86%yoy (consensus expectation +11.85%yoy; vs prior +6.49%yoy)

- DKI Jakarta targets to vaccinate 10mn citizens in total whereby 8.8mn domiciled in Jakarta and 1.2mn are labours from outside Jakarta. The vaccination for the prioritized group (3mn) is targeted to finish in Jun21 and 150k vaccination/day is currently aimed.

- The government decided to reduce the income tax (PPh) of construction service stipulated in PP 51/2008 that final PPh for construction workers borne by the service providers classified as individual or small business would be reduced from 2% to 1.75%.

- The government plans to implement 0% PPnBm policy on vehicles with engines of 2,500cc (previously the relaxation only for car with engines up to 1500cc) and local purchase (TKDN) level of 70%.

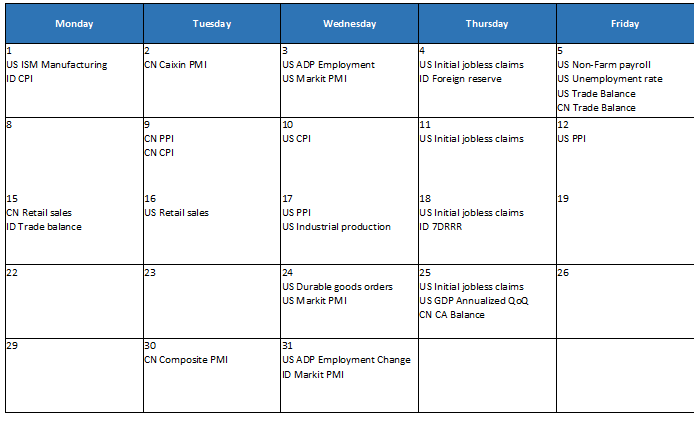

Calendar

March 2021

EM Equities net foreign flow