20 September 2021

Weekly Market Review (20 Sept 2021) - What happened and What's Next?

Market update

- Global equities closed lower with S&P 500 and MSCI Asia ex-Japan down by -0.6% and -2.7% WoW, respectively. Asian equities gave up recent gains, driven down by MSCI China (-4.8% WoW) and MSCI HK (-6.2% WoW, on the crackdown on Macau casinos). In addition, the on ongoing credit issues with property developer Evergrande also adds to the negative sentiment. Slowing momentum in US economic data along with still-elevated inflation has led to some investors worrying about stagflation. Meanwhile, US Congress made minimal progress in making a legislative strategy for dealing with the upcoming debt limit and government shutdown deadlines. In other fiscal developments, the US Democrats released additional details of tax increases, proposing to generate USD 2tn in revenue over 10 years (USD 1tn from high-income individuals and USD 960bn from corporations). On the domestic side, JCI outperformed by gaining +0.6% WoW. The main outperformer are Infrastructure and Transportation sectors, up by +4% WoW and +8.3% WoW, respectively, on the back of telco consolidation between Indosat and Hutch. On the other hand, Basic Material sector is the main underperformer, down by -1.1% WoW. News flows to be watched within this week: FOMC meeting, US manufacturing PMI, initial jobless claims; ID 7-day reverse repo rate decision.

- Rupiah slightly weakened by 0.1% WoW to IDR 14,233/USD, the outperforming other EM currencies. Meanwhile, DXY index strengthened by +0.7% WoW to 93.2.

- Indonesian government bonds yields were broadly lower by 1-4bps with yield on the 10y unchanged at 6.12%.

- Incoming bids in the conventional bond auction on Tuesday reached IDR 80.66tn, was lower compared to the previous auction at IDR 116.11tn. Demand was supported by medium tenors, with incoming bid for 5yr and 10y reaching a total of IDR 40.4tn. The government finally issued IDR 21tn.

- The government also successfully priced the debut of the long 12yr SDG (Sustainable Development Goals” amounted EUR 500mn. The debut of the SGD bond shows the government’s commitment to finance social and environmental projects to realize the 2030 agenda for sustainable development.

- Based on DMO data, the foreign ownership as of 16th Sept was reported at IDR 977.887tn or 22.14%.

- US Treasury yields rose ahead of Fed meeting on Wednesday as they expected to give further details regarding the schedule for slowing down its asset purchases, which will also give a rough timeline for when the next rate increase could come. By the end of last week, 10y UST was reported at 1.37% (+2bps WoW).

Global news

- US core CPI inflation missed market expectations in Aug, rising only +0.102% MoM, mainly driven by the impact of the Delta wave in Aug and significant declines in the prices of lodging and airline fares.

- US retail sales +0.7% MoM for August however surprised on the upside, partly due to downward revisions to the July print.

- China’s August activity data came in below market expectations : IP (5.7% YoY vs cons: 5.8% YoY), retail sales (2.5% YoY vs cons: 7.0% YoY) and FAI growth (1.1% YoY vs cons: 1.7% YoY) due to tightening measures on high polluting sectors, rising raw material prices and stricter social distancing rules amidst the delta wave.

- China adds USD 14bn cash as Evergrande’s pain roils markets. The move comes as the trouble facing China Evergrande Group fuels investor concern over the health of real estate and credit markets. Adding to the stress is a seasonal spike in demand for cash as banks are hesitant to lend toward the end of the quarter ahead of regulatory checks.

Domestic News

- Indonesian statistics agency reported surplus of USD 4.7bn in Aug-21 (+81.5% MoM), the record-high figure and also it was the 17 consecutive months of surplus. Export reached USD 21.4bn (+20.9% MoM), supported by increasing volume and price of commodities, including palm oil and coal. Import was at USD 16.7bn (+10.4% MoM) - there is higher imports of raw materials at USD 12.4bn (+8.39% MoM).

- The budget for nine ministries was added and the target for state expenditure in the state budget bill increased by IDR 5.5tn to IDR 2,714tn. The Energy and Mineral Resources Ministry budget added IDR 0.85tn to IDR 5.85tn and the finance ministry received an additional IDR 1tn budget to IDR 445tn. According to the agreement between the government and the People’s representatives council (DPR), next year's GDP growth is targeted at 5.2%.

- Sales tax discounts on luxury goods for motorized vehicles (PPnBM) which are valid from Mar-21 and are extended until the end of the year are believed to increase the performance of supporting industries such as automotive components and tires.

- Due to intense business competition, the number of fintech players continues to decrease. From the records of the Financial Services Authority (OJK), as many as 42 players have closed their businesses this year. As of 8-Sept, the remaining fintech players totalled 107 players. OJK will continue to support consolidation in the fintech industry.

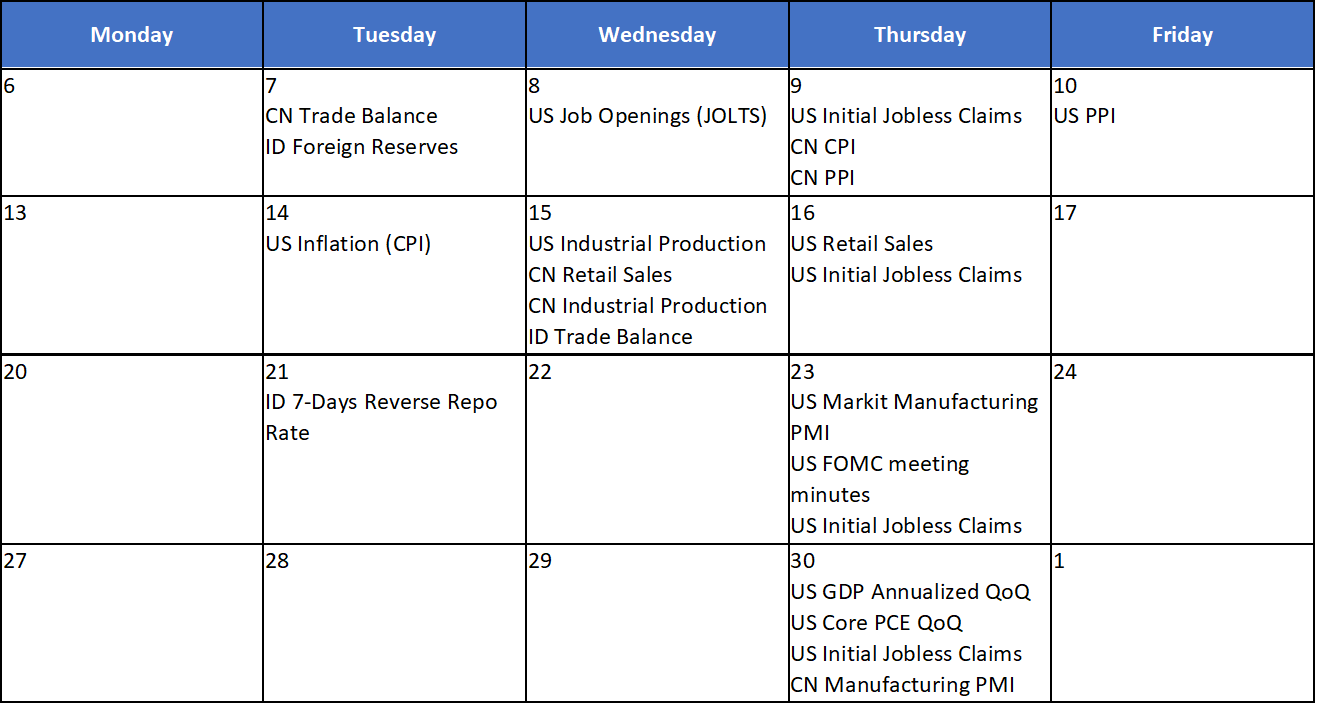

Calendar

September 2021

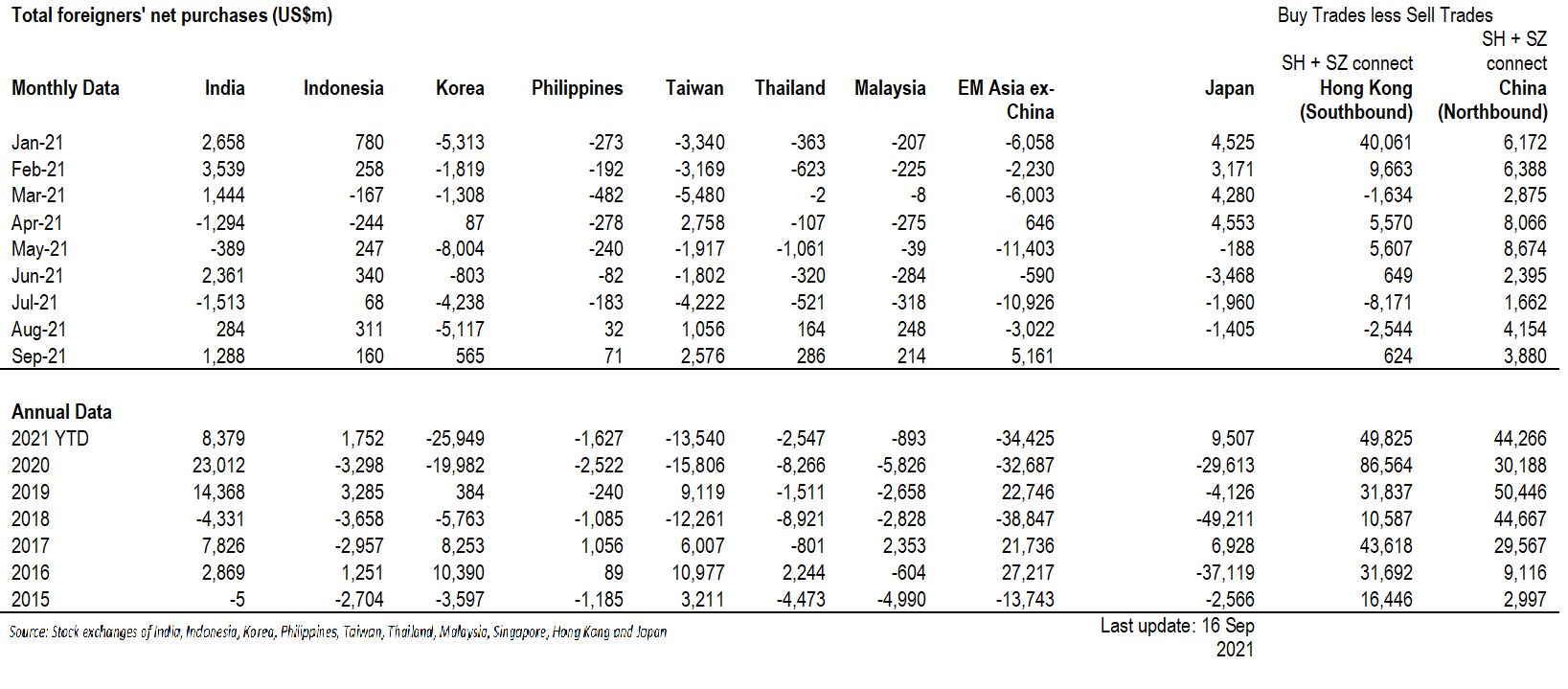

EM Equities net foreign flow

EM Equities net foreign flow