25 January 2022

Weekly Market Review (24 Jan 2022) - What happened and What's Next?

Market update

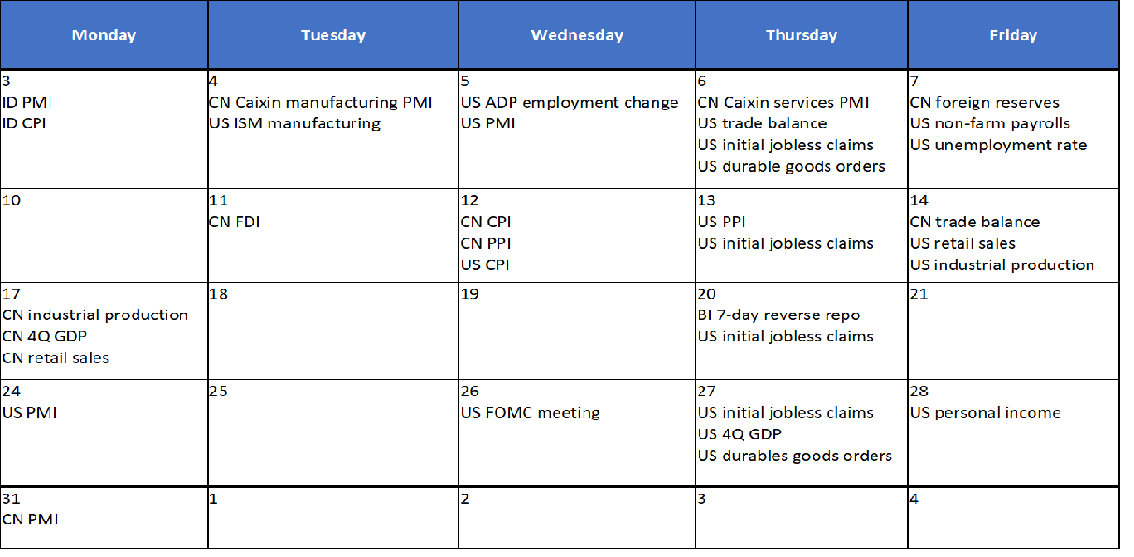

- Global indexes were lacklustre last week with S&P and Dow Jones continuing the 3rd weekly losses each down by -5.7% and -4.6% WoW, respectively, as Fed’s monetary policy normalization theme continued to weigh on stocks. Near term focus will be on the Fed’s FOMC where consensus expectations are that the Fed is likely to signal rate hikes and balance sheet normalization plans. Meanwhile, Asian stocks were relatively better with MSCI Asia ex-Japan down by -1% WoW driven by HK/China stocks on the back of more policy easing signals from China and easier-than-expected Macau casinos gaming bill. On the fiscal side, President Biden suggested the Democrats might need to split the USD 2tn Build Back Better Act stating difficulty in achieving support. In Asia, China’s activity data was mixed, with IP and FAI growth numbers coming in above market expectations while retail sales declined to 1.7% YoY below market expectations due to a resurgence of COVID-19. However, policy easing is well underway now in China which is helping boost the appeal of local stocks. On policy, PBoC cut the 1y MLF and 7-day OMO repo rate by 10bp followed by lowering of 1y and 5y LPR by 10bp and 5bp. Tensions between Russia and Ukraine have been rising and bear close monitoring, which could potentially lead to further supply side disruptions for energy markets (oil/gas prices) and agricultural markets, thus creating further inflationary pressures for the global economy. On domestic side, JCI outperformed the region by delivering +0.5% WoW. The main outperformer was the Energy sector, up by +5.2% WoW following the rise in oil price. On the other hand, Technology sector was the main underperformer, down by -5.3% WoW. News flows to be watched within this week: US FOMC meeting, PMI, 4Q GDP, durable goods orders, personal income, initial jobless claims.

- Rupiah weakened by 0.3% WoW to IDR 14,338, in-line with EM currencies. Meanwhile, DXY strengthened by +0.5% WoW to 95.6.

- INDOGBs’ yields were higher by 3-5bps along the curve. INDOGBs were relatively stable despite higher US rates and USD earlier in the week. INDOGB closed the week quiet as market seems to be digesting yesterday surprise from Bank Indonesia with the plan to gradually raising banks reserve requirement in the next 8 months. 10yr INDOGB was reported at 6.42% (+6bps WoW).

- Total incoming bids in Tuesday’s auction continued to increase to IDR 84.4tn compared to the previous incoming bid at IDR 77.6tn. Short tenor bonds still attracted the biggest demand with both SPN 3mo and 12mo accounted for 38.7% of total incoming bids. The government issued IDR 25tn as initial target.

- Based on DMO data, foreign ownership as of 19th Jan was reported at IDR 888.96tn or 19.15%

- The 10y UST hit 1.9% earlier the week with focus still on the Fed timeline for raising rates and broadly tightening monetary policy. By the end of last week, 10y UST was reported at 1.75% (-3bps WoW).).

Global news

- China industrial production in Dec 2021 recorded +4.3% YoY, higher than expectation of +3.7% YoY and previous month of +3.8% YoY.

- China GDP in 4Q21 recorded +4.0% YoY, higher than expectation of +3.3% YoY.

- China retail sales in Dec 2021 recorded +1.7% YoY, lower than expectation of +3.8% YoY.

- China surveyed employment rate in Dec 2021 recorded 5.1%, worse than expectation of 5.0%.

- US initial jobless claims recorded 286k, worse than expectation of 225k and previous week of 230k.

Domestic News

- Indonesia trade balance in Dec 2021 recorded USD 1bn, lower than expectation of USD 3.1bn.

- BI kept 7-day reverse repo rate unchanged at 3.5%.

- The gov't has set the 2022 Covid-19 Handling and National Economic Recovery (PC-PEN) budget to be IDR 455.62tn, an increase of IDR 41.62tn (+10%) from the original IDR 414tn.

- The gov't has set a policy of one cooking oil price with a price equivalent to IDR 14k/litre for all packages. However, this has not been applied to bulk cooking oil sold in traditional markets. For this reason, bulk cooking oil will adjust to the price of packaged cooking oil.

- Bank Indonesia recorded e-commerce transactions in 2021 at IDR 401tn (99.5% of target, +50.8% YoY). BI projects e-commerce transactions in 2022 will grow to IDR 530tn.

- Minister of Public Works and Housing stated that the ministry has made the development plan for the new capital city in Panajam Paser Utara, East Kalimantan, however development could only start once the funding is ready. Initial funding is sourced from the State Budget, which is still being prepared by the gov’t.

- The Minister of Finance is optimistic that last year's overall economic growth can reach 4% in line with various recovery indicators which are considered to have contributed to the overall economic growth for the year. This projection is based on the assumption that the economic growth performance in the fourth quarter of 2021 can reach 5%.

Calendar

January 2022

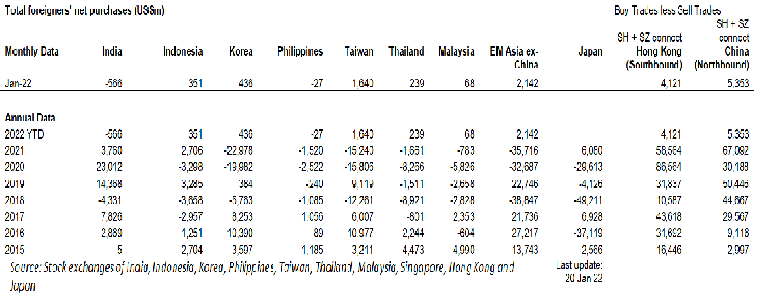

EM Equities Net Foreign Flow