12 September 2022

Weekly Market Review (12 Sept 2022) - What happened and What's Next

Market update

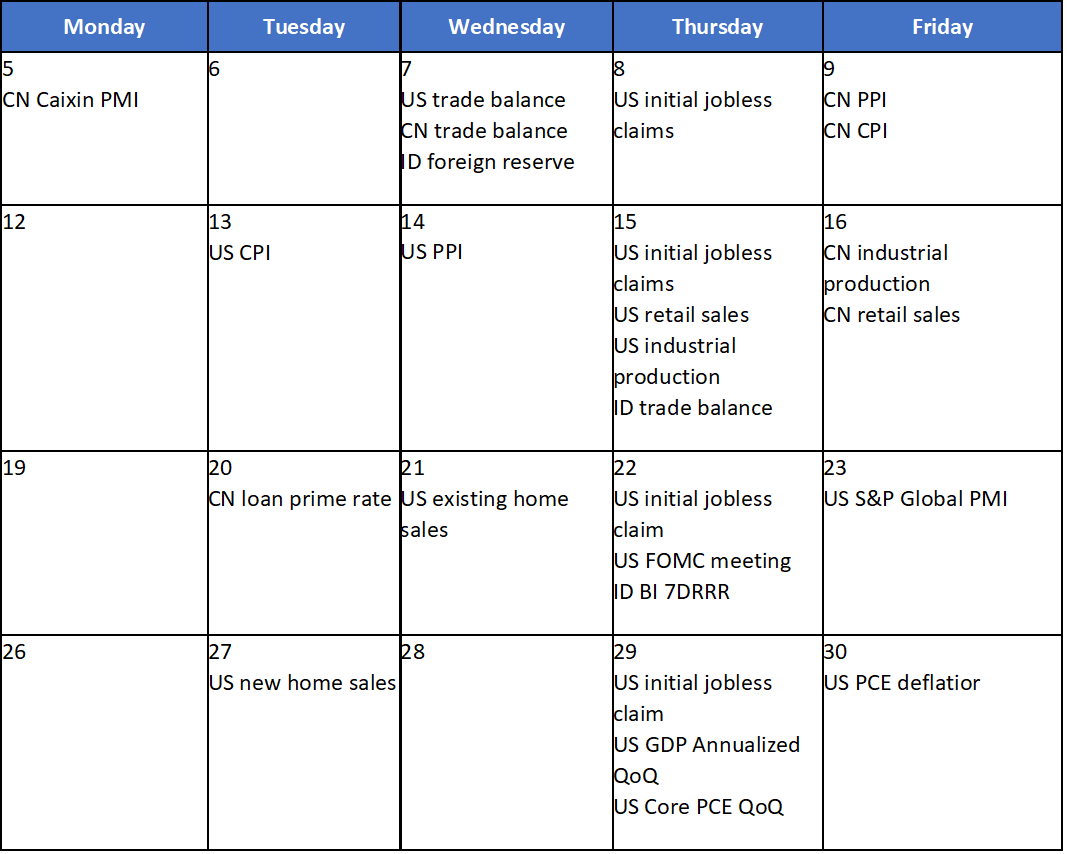

- Global indexes were closed higher last week with US indexes snapped their three straight weeks of losses (SPX +3.6% WoW and DJI +2.7% WoW). US indexes rebounded sharply likely on technically oversold conditions as investors appeared to have priced in a larger rate hike in September. Since the start of the week, markets have absorbed a barrage of hawkish speeches from Federal Reserve officials, as well as 75-basis point interest rate hikes from the European Central Bank. On the domestic side, JCI continued to record gain by +0.9%WoW. Energy and basic material sector were the main outperformers, up by +3.7% and +3.6% WoW. Meanwhile, transportation & logistic experienced the deepest decline of -3% WoW. News flows to be watched within this week: ID trade balance, US CPI, US PPI, US initial jobless claims, US retail sales, US industrial production, CN industrial production and CN retail sales.

- Rupiah appreciated by +0.4% WoW to IDR 14,830, one of the outperformers in EM currencies. In contrast, DXY weakened by -0.5% WoW to 109.

- INDOGB were well bid for the week after reversal tone in UST movement and rebound in global equity spurred risk on tone. 5yr CDS was lowered by 11bps along with improving risk appetite. By the end of the week, 10yr INDOGB was reportedly at 7.17% (+3bps WoW) meanwhile 5yr INDOGB was at 6.54% (-6bps WoW).

- The republic of Indonesia successfully issued USD 2.65bn notes on Wednesday. The issuance was divided in three tranches, 5yr, 10yr and 30yr and reportedly oversubscribe for all tenors.

- Based on DMO data, foreign ownership as of 8th Sept was reported at IDR 748.20tn or 14.94%.

- US Treasury yields have retraced some overnight declines as ECB raised its key interest rate by 0.75% and signaled more rate increases ahead to tackle soaring inflation. By the end of the week, 10yr UST was reported at 3.33% (+13bps WoW).

Global news

- US IS services index was at 56.9% in Aug-22, higher than prior month's figure and consensus forecast at 56.7% and 55.5% respectively.

- US initial jobless claims was at 222k lower than consensus' expectation 235k and prior months figure of 228k.

- China's exports rose +7.1% YoY in Aug-22, slowing from +18.0% gain in Jul-22 and missed expectations of +12.8% increase. While imports were again tepid, rising only +0.3% in Aug-22 from +2.3% in the month prior and well below a forecast for +1.1% rise. This left a narrower trade surplus of USD 79.4bn, compared with a USD 101.26bn surplus in Jul-22.

- China CPI increased +2.5% YoY in Aug-22, slowing from +2.7% growth in Jul-22 as covid saps demand.

Domestic News

- The government is starting the disbursement of the 2022 Wage Subsidy Assistance (BSU) today. First stage will be to distribute IDR 2.61tn to 4.36mn workers.

- FX reserve in Aug-22 was unchanged from previous month at USD 132.2bn. Rupiah stabilization measure was offset by O&G export receipt of USD 2.7bn.

- Ministry of Transportation’s regulation on the new 2W tariff and cap rate was implemented last Saturday (10th of September). Under the new regulation, 2W ride hailing tariff was increased by 8-13% while platform fees got reduced from 20% to 15%.

Calendar

September 2022

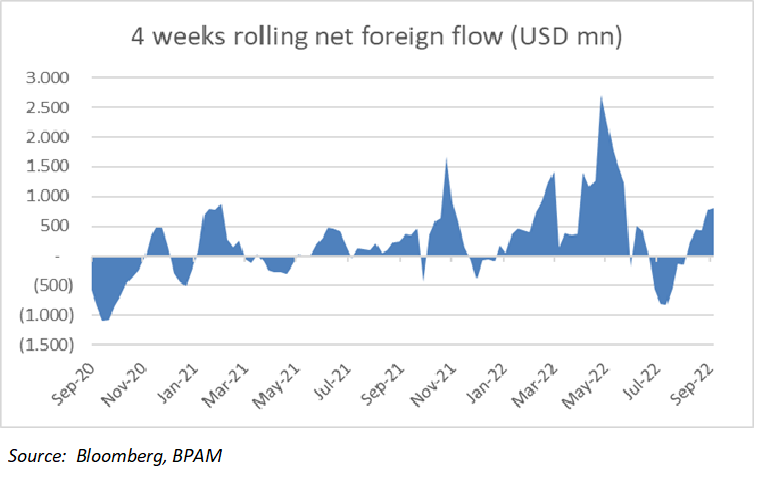

EM Equities Net Foreign Flow