26 February 2019

Weekly Market Review (28 January 2019) What happened & What's Next?

Market Update

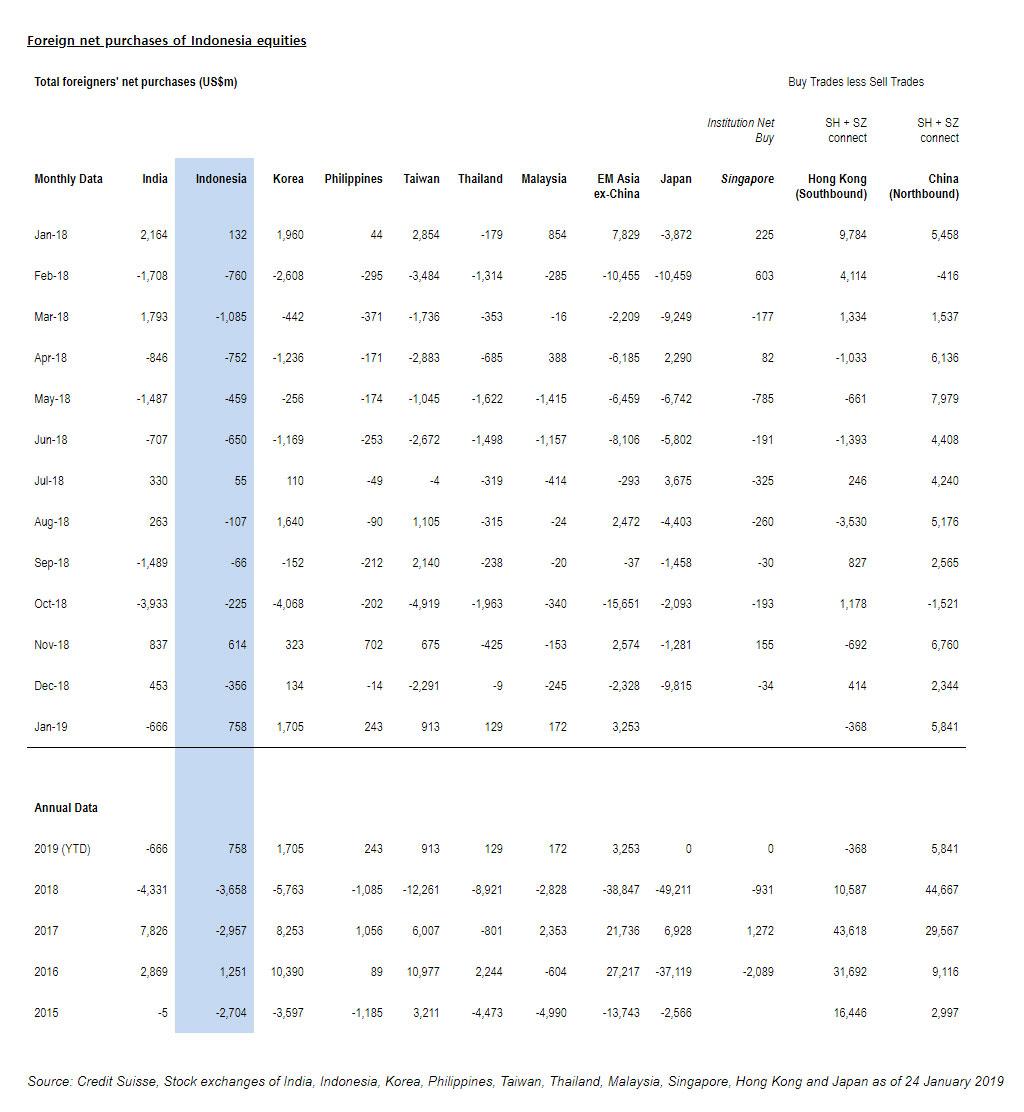

- Global indexes continued their positive momentum with Dow Jones (+0.1% WoW) booked its gain for a fifth week in a row. While S&P 500 and Nasdaq Composite each rose by +0.85% WoW and +0.1% WoW. Optimism was boosted by upbeat earnings results as well as expectation that the Fed will take a much more dovish stance this year. The Wall Street Journal reported that Fed officals are close to a decision on whether to end the shrinking of the central banks’ balance sheet early. On domestic side, JCI gained +0.54% WoW last week, led by agriculture (+5.0% WoW) and basic industries (+2.7 WoW) sectors. On the other hand, biggest underperformed sectors are infrastructure (-0.42% WoW), mining (-0.37% WoW) and miscellaneous industry (-0.28% WoW).

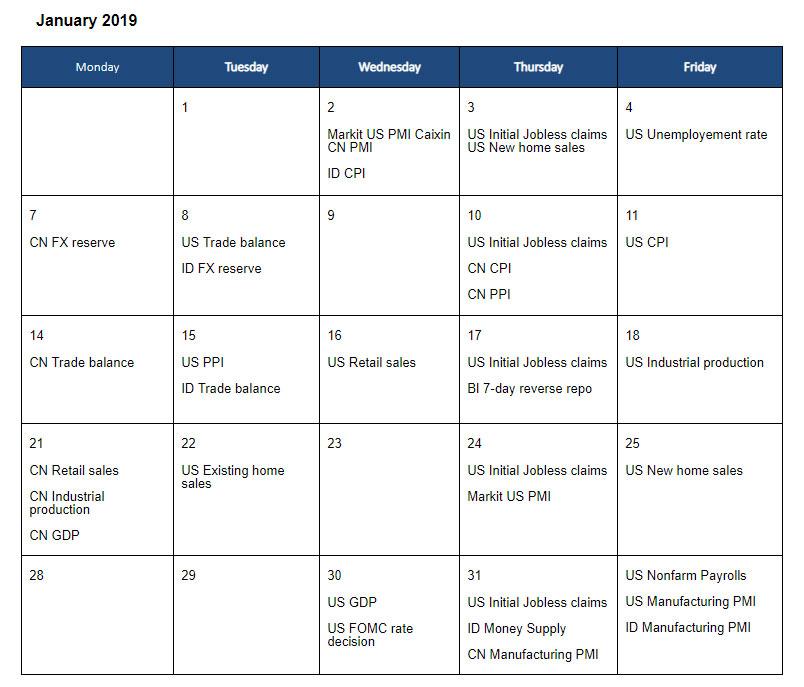

- Newsflows to be watched within this week include Indonesia’s money supply, Indonesia’s manufacturing PMI, US GDP, US FOMC rate decision, US nonfarm payrolls, US manufacturing PMI and China’s manufacturing PMI.

- IDR continued to rally by +0.6% WoW to IDR14,093, one of the best currency performances among emerging markets. On the other hand, DXY dipped to 95.8 (-0.6%WoW).

- Anticipating the next US - China trade talk, bond market was relatively quiet with low trading volume. Across the curve, yield decreased by 0-8 bps and 20 years series decreased the most.

- Foreign investor decreased position by IDR 2.4Tn mostly on 5 and 10 years benchmark series.

- 3 year lock up period for IDR 146 Tn tax amnesty fund will end on March 31 2019. MoF is preparing bond private placement to accommodate the tax amnesty fund.

Global News

- US existing home sales decreased by 10.3% YoY in FY18, reached a 3 year low.

- US initial jobless claims fell by 13,000 to 199,000 last week, indicating the lowest reading since November 1969.

- China’s GDP grew 6.6% in FY18, the slowest pace in 28 years. Fourth quarter GDP is 6.4% YoY, in-line with expectations (vs 6.5% YoY in 3Q18).

- China’s industrial output expanded 6.2% YoY in FY18, slowing from 6.6% YoY in FY17.

Domestic News

- The National Development Planning Agency (Bappenas) projects economic growth Indonesia to be 5.4%-6.0% for 2020-2024. The Ministry believes that manufacturing will be the backbone of Indonesia’s economy, especially the automotive sector. The Ministry of Finance added that Indonesia’s economic growth in 2019 may reach 5.3-5.4%.

- The government issued regulation PP no. 1 Year 2019. Under the regulation, export proceeds for natural resources (including mining, plantation, forestry and fishery) must stay onshore.

- BI projects inflation target in Jan-19 at +0.48% MoM and +2.98% YoY. As of third week of January, inflation reached +0.50% MoM and 2.98% YoY.