10 February 2020

Weekly Market Review (10 Feb 2020) - What happened & What's next?

Market update

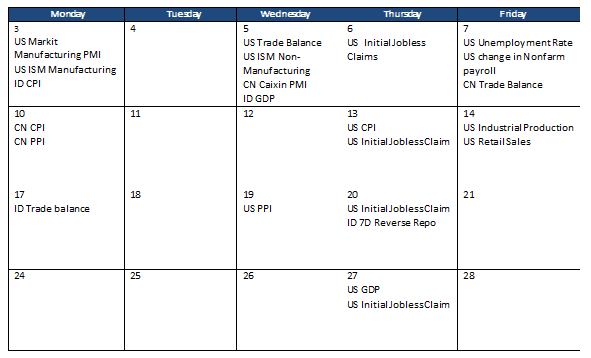

- Global indexes were closed higher last week buoyed by strong earnings report, job market data as well as stimulus by China’s central bank. US economy added 225,000 jobs in Jan’20, well above consensus’ expectation of 165,000 jobs. In addition, People’s Bank of China has injected CNY1.7trn of liquidity into the financial system to stem the impact from the Wuhan virus that has hurt travel and economic output. However, the gain was lessened on Friday after China’s National Health Commission confirmed more than 31,000 cases of coronavirus with more than 630 deaths. The disease also continues to spread outside the country with Singapore raised coronavirus outbreak alert from yellow to orange. On the domestic side, JCI also booked a gain with agriculture sector as the most outperformed sector, up by +2.8% WoW. On the other hand, basic industry was the most sluggish sector, down by -0.6% WoW. News flows within this week: US CPI, US initial jobless claims, US industrial production, US retail sales, CN CPI and CN PPI.

- Rupiah depreciated by -0.1% WoW to IDR 13,650 in-line with EM average. On the contrary, DXY index has strengthened by 1.3% WoW.

- Positive sentiment from Increasing Indonesia foreign reserve data by USD2.5bn to USD131.7bn made IDR bond yield decreased by 3-9 bps along the curve. 10 year yield decreased the most.

- Foreign investor continue to decreased position by IDR11.54trn, while BI increasing ownership by IDR18.25trn over the week.

- Positive sentiment from strong US January jobs report, US economy added 225.000 jobs last month beat estimate of 158.000. This made 10 year US treasury yield increased from 1.54% to 1.59%.

Global news

- US ISM manufacturing grow for the first time in 6 months in Jan’20. The index rose to 50.9% last month from 47.8% in the previous month.

- US created a robust 225,000 new jobs in Jan’20, better than consensus’ number of 165,000. While the unemployment rate edged up to 3.6% from a 50-year low of 3.5% as more people entered the labor force in search of work.

- New US jobless claims fall 15,000 to 202,000 last week, signaling the US labor market is still rock solid despite stiffer economic headwinds.

- Caixin China services PMI hits 3 month low at 51.8 in Jan’20 from 52.5 in Dec’19.

Domestic News

- Indonesia’s economy grew by 5.02% YoY in FY19, implying 4.97%YoY growth in 4Q19 (below consensus’ number at 5.03% YoY). Investment number has slowed down further to 4.06% YoY from 4.21% in 3Q19 as demand for machineries was contracting. In similar manner, domestic demand also declined to 4.16% YoY in 4Q19 from 5.8% in the previous quarter.

- Indonesia’s foreign reserves were recorded at USD 131.7bn, USD 2.5bn higher than the previous month. The position was equal to 7.5 months of imports and debt servicing.

- Government stated that the IMEI regulation will be applied effectively in Apr’20. Electronic goods sold to public such as laptops, phones and tablets need to have a legal IMEI code and Government already build an IMEI database, called Sibina to detect and monitor it.

Calendar

February 2020

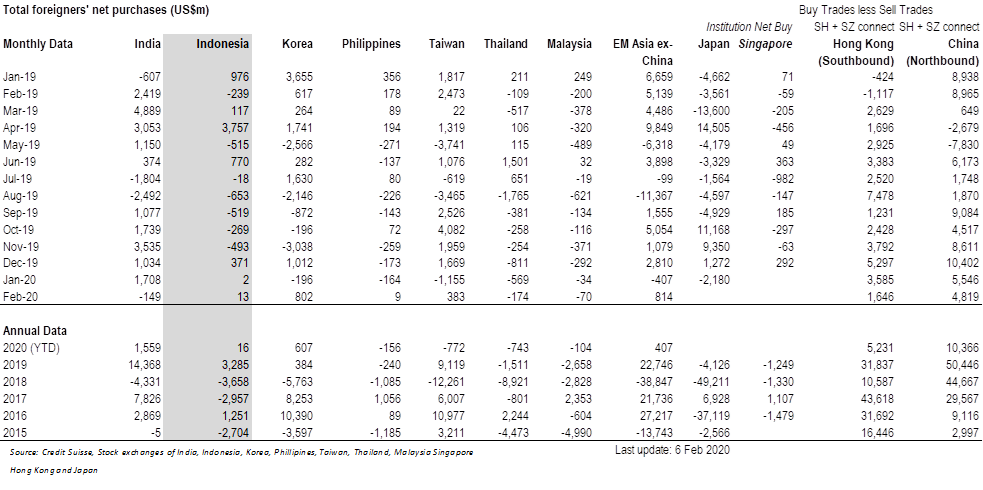

Foreign net purchases of Indonesia equities