24 February 2020

Weekly Market Review (24 Feb 2020) - What happened & What's next?

Market update

- Global indexes return to post losses particularly Asian equities, as another wave of coronavirus - related risk aversion. Risk-sentiment increases along the rising cases of COVID – 19 outside China. South Korea even announced at the highest level of alert (red-alert) as the cases surpassed over 760 cases, and become the biggest infected country after China. As result, Korea Kospi recorded the sluggish result, down by –3.6% WoW. Meanwhile on the domestic side, JCI moved to positive territory (+0.3% WoW), buoyed by foreign inflow of USD106m. Mining sector outperformed other sector by +2.4% WoW after the coal related names to bounce back after the fall. However, Agriculture and Industry sectors tumbled respectively by -1.5% WoW and -1.3% WoW. News flows within this week: US GDP and US Initial Jobless Claim; Indonesia CPI.

- Rupiah depreciated by -0.5% WoW to IDR 13,760 in-line with EM average (-0.8% WoW). On the contrary, DXY index has appreciated by 0.1% WoW to 99.3.

- Bank Indonesia decided to cut 7 Days Reverse Repo from 5% to 4.75%. This is done amid the global coronavirus outbreak fear that might trigger economic slowdown. Noting that central bank lower its GDP growth forecast from 5.1% - 5.5% to 5.0%-5.4% growth range.

- Following this cut rate, IDR bond market yield decreased by 3-15 bps along the curve. 5-year series decreased the most.

- Foreign investor increased bond position by IDR3.4trn mostly on short tenor series.

- 30-year US treasury yield decreased from 2.04 to 1.90% on Friday as the coronavirus outbreak intensified fears about slowing global economic growth and caused investors to add more position to bond market. 10 years yield also decreased from 1.59% to 1.42%. A weak reading on the U.S. services economy also helped send yields lower. IHS Markit services purchasing manager’s index dipped into contraction territory for February, hitting its lowest level since 2013.

Global news

- As the covid-19 outbreak pressured China SMEs, the central authorities announced social insurance payment made by SMEs, representing the employees that cancelled between February and June. This Chinese government fiscal support to mitigate SMEs cash flow strains.

- US initial jobless claims added 210,000 vs last week 205,000. This week figure is the same as consensus expectation.

- US PPI for final demand increased by +0.5% in January, higher than expectation of +0.1%. The increase is contributed by higher service cost in healthcare and accommodation sectors.

Domestic News

- The Ministry of Finance draft the regulation to impose excise tariff on the ready-to drink sweetened beverages and plastic bags (up to 75 mikron). The House of Representative (DPR) has approved the implementation of the excise tax on plastic, targeting IDR1.6trn of revenue.

- Finance minister released the state budget realization in January 2020 reaching deficit of IDR36.1trn or 0.2% of GDP. At the detail breakdown, the state revenue was IDR103.7trn (4.6% of FY20 target) vs expenditure IDR139.8trn (5.5% of FY20 target)

- SOE ministry formulated new minimum dividend payout for SOEs. Subsequently, the minister targets net profit of IDR300trn in 2024, or up 50% from 2019 target.

- BPS reported Indonesia trade deficit –USD864.2m in Jan’20 larger than Dec’19 of –USD61.7m, in which exports and imports contracted by -3.7 YoY and -4.8 YoY, respectively. This is deeper than consensus of –USD 375m.

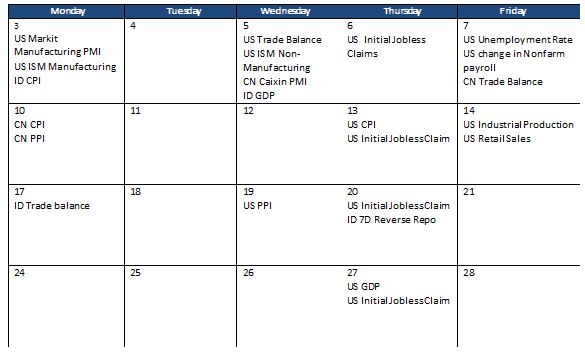

Calendar

February 2020

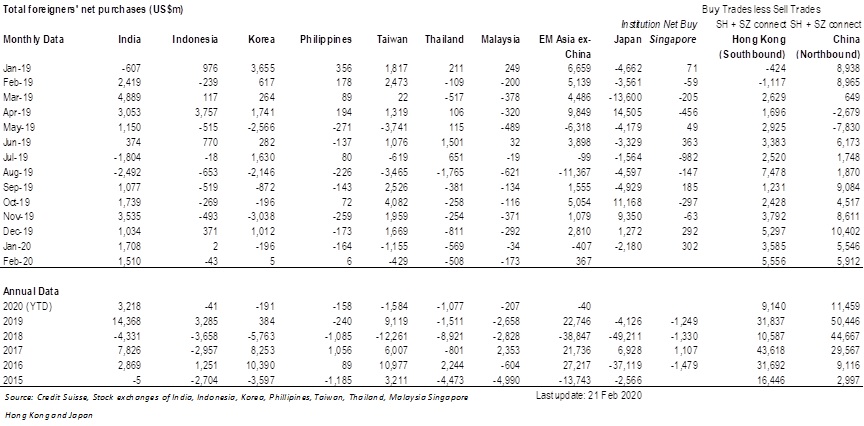

Foreign net purchases of Indonesia equities