16 March 2020

Weekly Market Review (16 March 2020) - What happened & What's next?

Market update

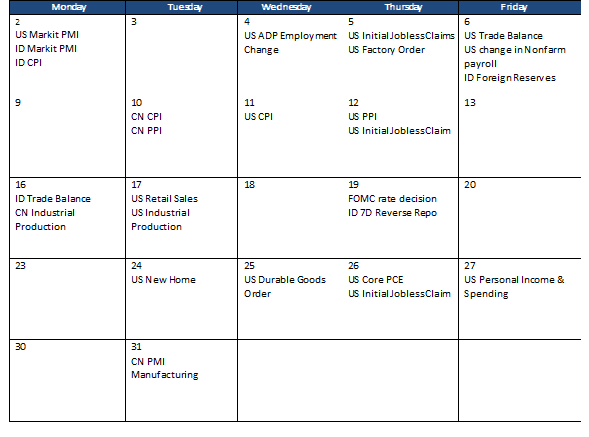

- All global indexes witnessed another turmoil as escalating of coronavirus crisis fears and global economy downturn risk (the SPX fell by 8%WoW, MXASJ fell by -10%WoW, NKY fell by -16%). World policy makers (e.g. The Fed, BOE, RBA, BOC, Norway, etc) have propelled support to financial market such as cut rate, ban on short selling, liquidity injection over the week. Trump announced a national emergency on Friday, follows federal funds injection to manage the pandemic effect. Significant new cases of coronavirus outside China remain becomes market focus going forward (as of 16 March 20, confirmed case in China 80,860 cases; outside China 88,624 cases; with reported deaths of 6,517 cases (49% China, 51% outside China). On the domestic side, JCI tumbled by -10.7%WoW, reached below 5,000. All sectors were in the red but the most underperformed was basic industry sector (-18.7% WoW). On the other hand, sector with the least loss was consumer sector (-5.8% WoW). News flows within this week: Indonesia Trade Balance, China Industrial Production, US Retail Sales, US Industrial Production, FOMC rate decision, Indonesia 7-days reverse repo

- Rupiah depreciated by -3.8%WoW to IDR14,778 in line with EM average. On the contrary, DXY index appreciated by 2.9%WoW to 98.7

- Increasing global investor fears on growth made IDR bond market yield increased by 49-69 bps along the curve. 5 years series increased the most.

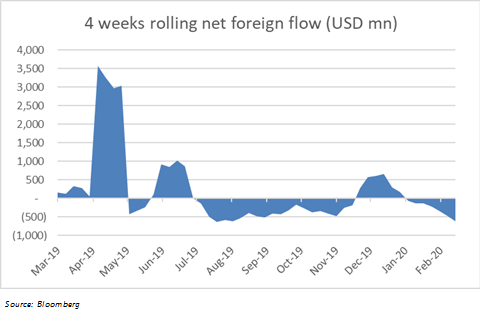

- Foreign investor decreased bond position by IDR14.2trn mostly on 5-10 years’ maturity bucket.

- Concern on the spread of coronavirus and its impact on the slower global economy remained high. The US Central Bank cut its benchmark interest rate by 100 bps to 0.00% - 0.25% on unscheduled meeting last night (Sunday local time). In addition, The Federal Reserve launched USD700bn of quantitative easing program to shelter the economy from the effects of the virus. The Fed will buy USD500bn of Treasuries and USD200bn of Mortgage-backed Securities (MBS).

- Previously in Thursday (local time), The Fed announced liquidity injection of USD1.5trn into the short-term money market in REPO operation to address unusual market disruption over coronavirus fears. The injection split to several tranches: USD 500bn on Thursday March 12; USD 500bn on Friday March 13, and another USD 500bn in each week for the rest of the month.

Global news

- WHO announced that Covid-19 outbreak as a global pandemic (Wed, 11 March 20). This term is used following the deep concern on alarming levels of spread and inaction over the virus. There have now been over ~169,000 confirmed cases in 114 countries.

- China Feb CPI increased by +5.2% YoY vs consensus of +5.2% YoY, previously +5.4% YoY. On the other hand, China Feb PPI fell by -0.4% YoY vs consensus – 0.3% YoY, previously -0.1% YoY

- US Feb CPI increased by +0.1% MoM and +2.3% YoY vs consensus 0% MoM and +2.2% YoY. Core CPI increased by +0.2% MoM and +2.3% YoY vs consensus +0.2% MoM and +2.3% YoY.

- US Feb PPI fell by -0.6%mom but +1.3% YoY vs consensus -0.1%MoM but +1.8% YoY, while core PPI -0.3%MoM but +1.4% YoY.

- US initial jobless claims added 211K vs consensus of 220K, previously 215K.

- US Feb monthly budget statement was -USD235.3bn vs consensus -USD236.8bn.

Domestic News

- The Ministry of Finance launched stimulus of USD1.55bn to anticipate covid-19 impact to economy, includes import tax waived for 6 months on some goods, corporate tax reduced by 30% for 6 months in 19 sectors, income tax waiver for some manufacturing employees with annual gross income less than IDR200m (this will be effective as per 1 April 2020). This to add the last month stimulus of USD745m targeting direct affected industry such as tourism, aviation, and housing.

- Following countercyclical policy implemented in response global and domestic economic pressure, the government expected budget deficit to be widening to 2.2-2.5% of GDP to provide stimulus, from initial target of 1.76% in 2020 state budget.

- After OJK relaxed share buyback administration requirement, some SOEs prepare to have buyback plan. The Ministry of SOE stated that total buyback amount is expected approx. IDR7– 8trn, from banking sector (BBRI, BMRI, BBNI, BBTN), construction sector (WIKA, ADHI, PTPP, JSMR, WSKT), and mining sector (ANTM, PTBA, TINS)

- Prolonged covid-19 fears and lack signal of recovery have weakened Indonesia consumer confidence. Bank Indonesia released Consumer Confidence Index in Feb 2020 down to 117.7, which prior month was 121.7.

- Pre-employment cards, with budget of IDR10trn, are ready to be distributed for ~2m beneficiaries at the end of March 2020 sooner that initial plan in April 2020. This action is to also mitigate the covid-19 outbreak impact.

- Indonesia Feb’20 trade balance was surplus of USD2.3bn with detail as follow export grew by 11%YoY and import declined by -5.11% YoY. Meanwhile, trade deficit in Jan 2020 was revised to –USD637m from –USD864m.