30 March 2020

Weekly Market Review (30 March 2020) - What happened & What's next?

Market update

- Global indexes ended the week with a strong rebound as investors expecting massive stimulus to be released in the midst of accelerating number of Covid-19 cases globally. In the US, S&P 500 and Dow Jones Index posted +10.3% WoW and +12.8% WoW as investors awaited massive US stimulus package worth of USD2tn that was signed by the end of the week. Globally, more than 722k cases have been confirmed with total death around 34k, led by the spike in number of new cases in US. On the domestic side, JCI joined the global equity rebound by gaining +8.4% WoW. All sectors were in the positive territory with Financial sector gaining +11.2% WoW outperforming other sectors. Trading sector underperformed the rest by gaining only +1.9% WoW as the plunge in mall traffic adding pressure to retailers. News flows within this week: US durable goods order, US core PCE, US initial jobless claim, US personal income and spending.

- Rupiah depreciated by 1.3%WoW to IDR16,170, slightly outperforming other currencies in EM. On the other hand, DXY index weakened by -4.3% WoW to 98.4

- Massive monetary and fiscal stimulus globally drove positive sentiment to EM bond yield. Indonesia bond market yield decreased by 29-51 bps. 10 year yield decreased the most.

- Foreign investors continued to lower bond positions, declining IDR23tn mostly on 20 years series.

- BI reiterated to maintain IDR stability using triple intervention in spot market, domestic NDF and buying government bonds in secondary market.

Global news

- US announced economy stimulus package worth of USD2.2tn (10% of US GDP) to combat impact from Covid-19 that included direct cash transfers and loan guarantees. This is the largest fiscal stimulus package in the US history.

- US weekly unemployment benefits claim jumped to 3.3mn, the highest in the US history.

- Germany announced EUR750bn, Singapore SGD48.4bn, Thailand THB117bn, India USD22.5bn, and Malaysia announced USD53bn economy stimulus packages.

- BoC lowers 7d repo rate by 20bp to 2.20% and launched a RMB50bn reverse repurchase operation. It is the largest cut since 2015 and takes the 7-day reverse repo rate to its lowest on record.

- Central Banks continued their proactive responses such as Fed announcing open ended purchases of Treasury and MBS, along with new emergency credit facilities.

- US Markit Manufacturing flash PMI declined to 49.2 from 50.7 in Feb and Euro area composite PMI came at 31.4, the lowest ever levels.

- China’s Fiscal revenue growth plunged to -9.9% YoY in Jan-Feb from 3.8% in 2019, driven by a slump in tax revenue growth.

Domestic News

- Ministry of Finance instructed regional governments to halt the procurement process using Physical Special Allocated Funds (DAK Fisik) 2020. Allocated DAK Fisik is IDR72.3tn in 2020.

- Gov’t to discuss on public transport restriction. AirAsia Indonesia will stop domestic flights on 1 – 21 April 2020 while international flights are stopped from 1 April to 17 May. Sriwijaya Air has also stopped flight to Timika and Papua from 26 March – 9 April.

- Election Commission (KPU) has issued regulation to delay 2020 election to Sep2021 from Sep2020. If the plan is approved, gov’t needs to quickly revise the existing laws or to issue Government Regulation in lieu of law (Perppu).

- OJK released the procedure for applying for loan relief to banks and leasing companies. Minimum requirements include: 1) debtors with loan value below IDR10bn for informal workers, daily income earners, micro businesses and small businesses (MSME and KUR loans), and 2) loan relief can be given within a maximum period of one year in the form of adjustment of principal / interest installment payments, extension of time, or other matters determined by banks / leasing companies.

- Govt is considering to quarantine almost 30 million people in Greater Jakarta Area to curb the spread of COVID-19 and ban “Mudik”, a tradition which sees millions of Indonesians going back to home village at the end of Moslem fasting month.

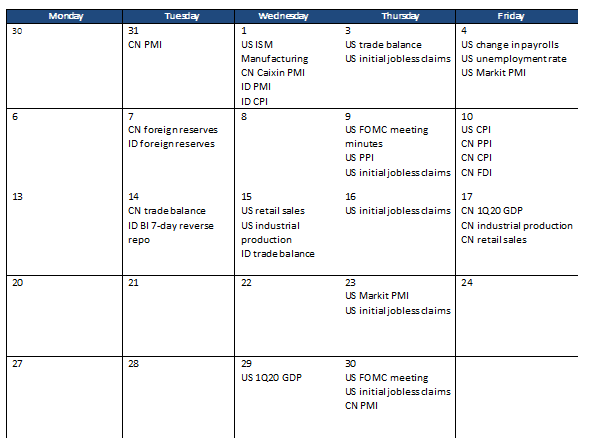

Calendar

April 2020

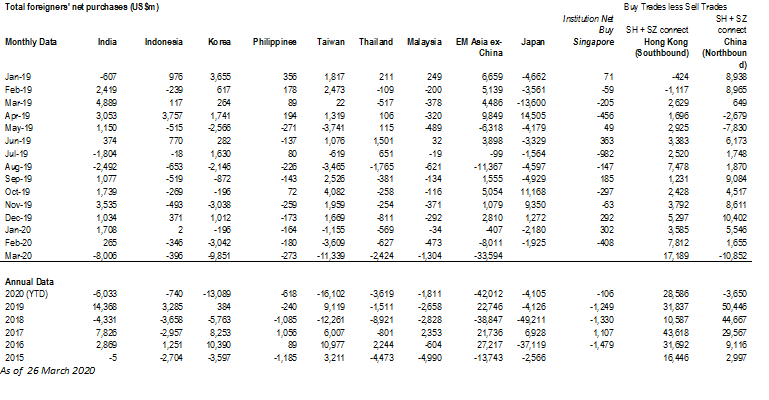

Foreign net purchases of Indonesia equities

Source: Credit Suisse, Stock exchanges of India, Indonesia, Korea, Phillipines, Taiwan, Thailand, Malaysia Singapore Hong Kong and Japan