02 June 2020

Weekly Market Review (2 June 2020) - What happened and What's Next?

Market update

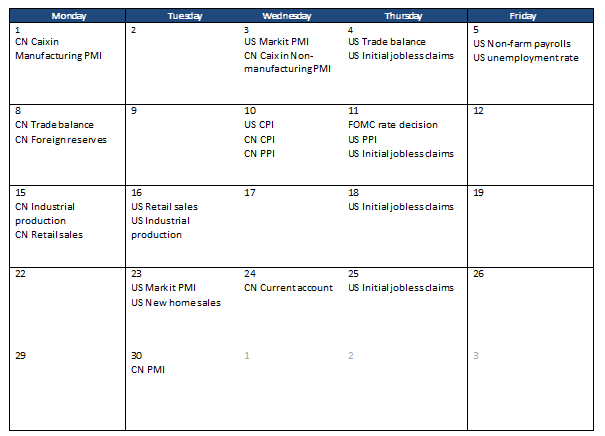

- Global indexes ended the week higher with S&P 500 gaining +3.0% WoW, DJI +3.8% WoW and Asia ex-Japan +2.4%. The positive sentiment was supported by the risk-on mode as investors focuses on re-opening of the economy. Improving global economic data such as PMI, new home sales, durable and capital goods orders, and declining jobless claims were adding to the optimism. Similarly, domestic was also in positive territory with JCI index up by +4.6% WoW, supported by net foreign inflow of USD6mn despite MSCI rebalancing. The most outperformed sectors are miscellaneous and basic industries (increased by +14.1% and +9.5% WoW respectively). Whereas the most underperformed sector was consumer, down by -0.8% WoW. News flows within this week: US Markit PMI, trade balance, initial jobless claims, non-farm payrolls, unemployment rate; China Caixin non-manufacturing PMI.

- Rupiah strengthened by 0.7% WoW to IDR14,610, in-line with other EM currencies. On the contrary, DXY index weakened by -0.8% WoW to 98.3.

- Indonesia asset classes continue to advance for the week with yield lowered by 8bps along the curve. 10-Y government bonds declined by 15bps while rupiah appreciated by 0.7% against USD for the week. Improving demand for Indonesia government bond saw in the previous auction continue to bring the yield down for two consecutive weeks amid news that our budget deficit might widen again to 6.3% from previous 6.27% as stated by Deputy Finance Minister.

- Foreign ownership increased by IDR2.2tn to IDR931.6tn over the week.

- Global optimism of improving PMIs data from China and US was offset by the civil unrest across the US and tension between US and China. China planned to pause some goods purchases from US might threaten the trade deal between two countries. Market remained defensive as 10-Y UST declined by 1bps to 0.65% for the week.

Global news

- China Caixin Manufacturing PMI recorded 50.7 for May (vs. consensus estimate of 49.6), improving from 49.4 in April.

- US initial jobless claims reached 2.1mn last week (vs. consensus estimate of 2.1mn), improving form 2.4mn the previous week.

- US construction spending in April was down -2.9% MoM (vs. consensus estimate of -7% MoM).

- US new home sales reached 623,000 in April (vs. consensus estimate of 480,000).

- US durable goods orders reached -17.2% YoY (vs. consensus estimate of -19% YoY), while durables ex-transportation reached -7.4% YoY (vs. consensus estimate of -15% YoY).

Domestic News

- Indonesia May CPI inflation fell to 2.2% YoY from 2.7% in April, in line with consensus estimate of 2.2%.

- Bank Indonesia (BI) data shows Indo debt to service ratio (DSR) at 27.65% in 1Q20 from 18% in 4Q19.

- Legislative and government agreed to hold simultaneous election on Dec 2020, from initially September.

- World Bank has agreed to provide USD250mn or IDR3.75tn of financial assistance to help Indonesia in combating covid-19 pandemic.

- Government considers to lower fuel and electricity price for industry and business. This is part of the IDR90.4tn economy recovery program (PEN) budget allocated for SOE energy PLN and Pertamina.

Calender

June 2020

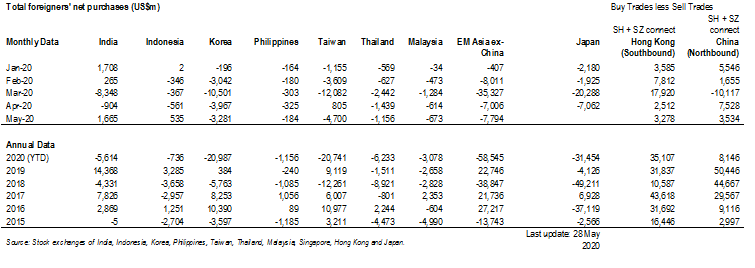

Foreign net purchases of Indonesia equities