13 July 2020

Weekly Market Review (13 July 2020) - What happened and What's Next?

Market update

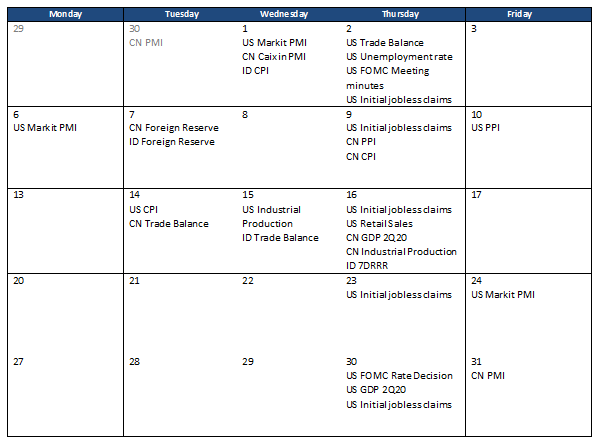

- Global equity saw another good week with S&P500 and MSCI Asia ex-Japan gaining +1.8% WoW and +3.6% WoW, respectively, as economic data continued its strong trend with US continuing claims declined to 18.1mn from 18.8mn and US ISM non-manufacturing index positively surprised. In China, new CNY loans and new aggregate financing loans surged to CNY 1,810bn and a stronger than expected CNY 3,430bn in June. On the negative side, the number of new virus cases in the US has been rising and more recently an uptick in daily deaths in hot spots of US states. Number of states/countries continued to re-impose some targeted restrictions amid rising new cases like Melbourne, Hong Kong, and California rolled back some reopening plans. In addition, US-China tensions continue to notch up as Trump administration imposed sanctions on four Chinese officials and is expected to make an announcement related to South-China sea dispute in the coming week. On the domestic side, JCI also closed higher by +1.2% WoW. The most outperformance came from Finance sector, increased by +3.6% WoW, while the worst performing sector was Consumer, down by -0.9% WoW. News flows within this week: US CPI, retail sales, industrial production, initial jobless claims; China 2Q GDP, trade balance, industrial production; ID trade balance, 7-day reverse repo decision.

- Rupiah appreciated by +0.6% WoW to USD/IDR 14,435, one of the best performing currencies in EM. DXY index weakened by -0.5% WoW to 96.7.

- Indonesian government bonds prices inched up over the week, thus decreasing the yield by 15 bps along the curve as details on burden sharing scheme came out. BI will purchase IDR 397.6tn of marketable securities through private placement at the BI Reverse Repo Rate. Market foresee this stimulus as a positive impact to the bond market as its ease the supply risk, but market began to worry on inflationary risks from this action.

- This week sukuk auction was a success with incoming bid reached IDR 41.6tn, the highest number after Covid19 in March. Government also introduced new series PBS28, with tenor 26.3yr, but rejected all bids because market asking for a relatively high yields ranging 8.16-8.375%.

- Foreign ownership decreased by IDR 0.42tn over the week to IDR 934.24tn

- Risk off tone in market on growing fears of ever-rising Covid-19 infection globally. Globally, total coronavirus cases have reached more than 12 million cases. Increasing investors’ worries on the coronavirus pandemic erased the positive sentiment from the declining the US initial jobless claims data, in which last week’s claims was recorded at 1.31 million, lower than the previous week’s level of 1.41 million. 10y UST closing the week at 0.65% (-3bps WoW).

Global news

- US ISM non-manufacturing index recorded 57.1, better vs consensus expectation of 50.2.

- US initial jobless claims recorded 1.31mn, better vs consensus expectation of 1.38mn.

- US June PPI recorded -0.8% YoY, worse vs consensus expectation of -0.2% YoY.

- China June foreign reserves stood at USD 3.1bn, in-line vs consensus expectation.

- China June CPI recorded 2.5% YoY, in-line vs consensus expectation.

- China June PPI recorded -3.0% YoY, better vs consensus expectation of -3.2% YoY.

- China new CNY loans in June picked up to CNY 1.8tn from CNY 1.5tn in May, in-line vs consensus expectation.

Domestic News

- Indonesia’s foreign exchange reserves increases at the end of June 2020, near its historical high. Foreign exchange reserves as of June 2020 is at USD 131.7bn, increased by USD 1.2bn from May2020 at USD 130.5bn.

- Ministry of Finance (MoF) issued Ministerial Regulation (PMK) No. 85/PMK.05/2020 on the procedures of interest rate subsidy disbursement to MSMEs, replacing the PMK No 65/2020. Changes including the disbursement scheme where the funds will be directly transferred into the creditors' account, instead of debtors on the previous regulation. In addition, the creditors are no longer required to express its willingness to be involved in the program, which means the program will apply to all the all the creditors of MSMEs.

- The government has issued a regulation that gives the Indonesian Deposit Insurance Corporation (LPS) more room to manage its own liquidity and to prevent banks from failing in an effort to help strengthen the country’s financial system stability. Under Government Regulation (PP) No. 33/2020 on the LPS’ authority in imposing measures to deal with financial stability issued on July 7, the corporation can now place funds in banks during the economic recovery from the impacts of COVID-19, among other things.

- Gov’t plan to do Rupiah denomination is currently enter the Ministry of Finance strategic plan in 2020-2024 as mentioned in Finance Ministerial Decree No.77/PMK.01/2020.

- Indonesia Tax Office stated that gov’t will impose 10% VAT for digital goods and services from 1Aug onwards.

- Bank Indonesia (BI) reported retail sales in May drop by 20.6% YoY as reflected in the retail sales index, continuing April trend which -16.9% YoY. However, BI estimates that this figure will start to improve in June and estimates the contraction will be at -14.4% YoY.

Calender

July 2020

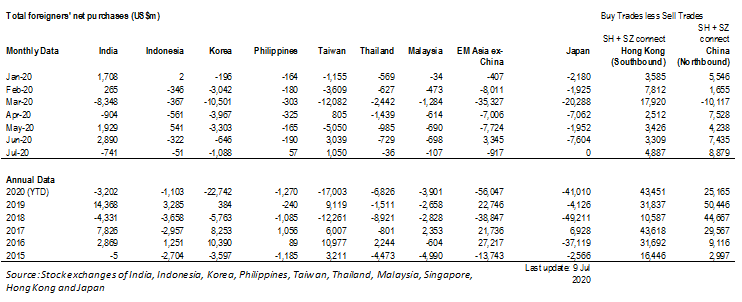

Foreign net purchases of Indonesia equities