18 August 2020

Weekly Market Review (18 August 2020) - What happened and What's Next?

Market update

- Majority of global equity indexes ended the week with moderate gains as there is no clear cut catalysts to move the market in either direction. US indexes were closed mixed on Friday but still posted gains for the week on the back of mixed economic data. Retail sales growth in Jul-20 was at 1.2%, weaker than consensus expectation at 2%. However, job openings and jobless claims numbers are better than expected. CPI also rose for the second month in a row and higher than consensus’ estimation. Meanwhile, Democrats and Republicans remained to be at a stalemate over the new stimulus package. On US-China front, Trump issued an executive order on Friday forcing ByteDance to sell or spin off its US TikTok business in 90 days. Similarly, domestic was also closed higher with JCI index up by +2% WoW. This is drive by financial sector which booked a +4.1% WoW gain. In addition, consumer sector also posted a modest weekly gain of +2.2% WoW. On the other hand, the major underperformance came from trading and mining sector, down by -1.3% WoW and -0.5% WoW respectively. News flows to be watched this week: US housing starts, US initial jobless claims, US FOMC minutes, US manufacturing PMI and US existing home sales.

- Rupiah weakened by -1.2% WoW, one of the most underperformed currencies in EM. DXY index also declined by -0.4% WoW to 93.1

- Indonesian government bonds yield declined by an average of 23 bps on the front end last week as yield curve continued to be bull steepened. 3 year tenor declined the most by 30bps, meanwhile the 10 year tenor yield declined by 4bps to 6.74%. On Friday, government targets GDP growth for 2021 to be at 4.5%-5.5% while budget deficit was set lower at 5.5% vs 6.34% this year.

- Based on DMO data, foreign ownership decreased by IDR 4.1tn to IDR 941.52tn over the week.

- Demand on this week conventional auction was very strong with incoming bid reported at IDR 106tn (vs. IDR 72.8tn incoming bid on previous auction). Government also issued two new series: FR86 and FR87 which many suggest to be the new 5 year and 10 year benchmark for next year. Government finally issued IDR 22tn, slightly higher than IDR 20tn target.

- Hopes on additional stimulus to combat the pandemic faded on Friday as Senate and House of Representatives are in recess and no fresh talks scheduled with U.S. President Donald Trump's negotiators. Trump, however, announced that his administration is ramping up to send money to families, state and local governments, and businesses. A review on U.S.-China trade deal which was initially slated for Saturday was delayed due to scheduling issues and no new date has been agreed upon. Markets are also looking forward to the Fed minutes (will be released this Wednesday) for any hints on the possibility of change in policy outlook. Yield on 10 year US treasuries rose by 12bps to 0.69%.

Global news

- US retail sales rose +1.2% in Jul-20, the third straight monthly increase but weaker than 2% rise forecast by economist.

- US industrial production saw a 3% rise, topping forecasts for an increase of 2.7% although index remains far below pre-pandemic level. Capacity utilization rose to 70.6% from 68.5% in Jun-20, vs expectation for a reading of 70.5%.

- An initial reading on the University of Michigan’s Aug-20 consumer sentiment index came in at 72.8 compared with expectation of 72.

- US jobs openings rose 518,000 to 5.9mn in Jun-20 according to the Labor Department. That’s above the median forecast of 5.3mn jobs. The increase follows a gain of 375,000 in the previous month. However, number is still well below pre-pandemic level at 7mn.

- US initial jobless claims fell below 1mn in Aug-20 for the first time since the coronavirus pandemic began about five months ago. New applications declined to 963,000 from 1.19mn in the previous week. The number is better than consensus’ estimation at 1.08mn new claims.

- US CPI rose 0.6% in Jul-20 for the second month in a row, higher than an expectation of 0.4%.

- China’s retail sales continued to fall for the seventh consecutive month in Jul-20, down by -1.1% YoY. The number is worse than estimation of +0.1% YoY.

- China’s industrial output up by +4.8% YoY and +0.98 MoM in Jul-20, missing consensus of +5.2% YoY.

Domestic News

- Draft state budget 2021 targets a fiscal deficit of 5.5% of GDP while GDP growth is projected at 4.5-5.5%. Key macro assumptions include a steady inflation rate of 3%, rupiah at IDR 14,600/USD and crude price at USD 45/barrel.

- Indonesia trade balance was USD 3.26bn surplus vs consensus’ expectation of USD 889mn. Export was down by -9.9% YoY (cons -14.3% YoY) while import fell by -32.6% YoY (cons -19.4% YoY).

- Governor Jakarta, Anies Baswedan continued to extend large scale social distancing relaxation phase 1 until 27 Aug-20.

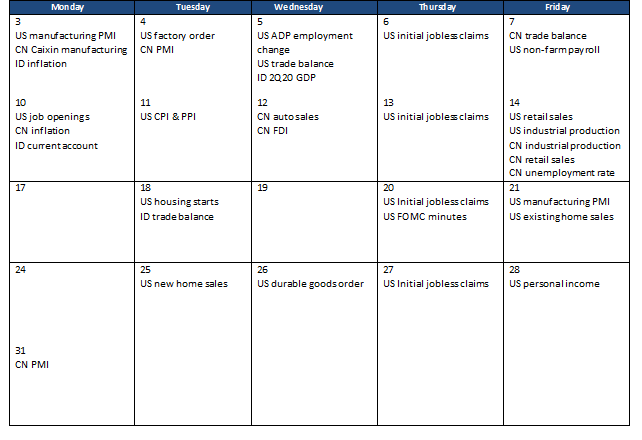

Calendar

August 2020

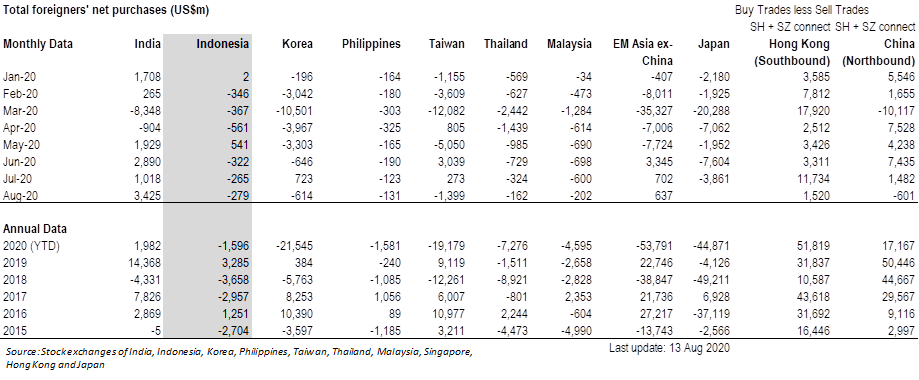

Foreign net purchases of Indonesia equities