31 August 2020

Weekly Market Review (31 August 2020) - What happened and What's Next?

Market update

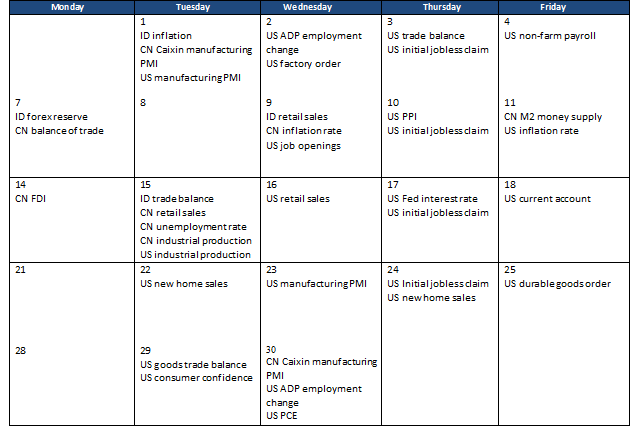

- Global indexes posted strong gains last week with SPX hit record high, up +3.3% WoW and Asia ex Japan gained +2.9% WoW. Support for equities came from multiple fronts such as positive newsflows on Covid-19, US-China phase I deal as well as tailwinds from central bank accommodative monetary policies. FDA approved emergency use authorization for convalescent plasma as potential promising Covid-19 treatment and the use of Abbot’s affordable rapid testing. In addition, US and China reaffirmed their commitment to the phase I trade deal in a bi-annual review. The two countries discussed steps China has taken including ensuring greater protection for intellectual property rights and removing impediments to American companies in financial services and agriculture. Both sides agreed to create conditions to push the deal forward. On a separate note, the Fed Chairman Jerome Powell announced that the central bank would target inflation to average 2% over time and that the central bank won’t feel obliged to raise interest rates if it believes the economy is running at full employment. This means rates could be kept low for a longer than previously expected. JCI also continued to book a positive growth +1.4% WoW. Financial and property were the best performing sectors, up +3.2% and +2.2% WoW respectively. Whereas the most underperformed sectors were mining and infrastructure, each down -0.7% WoW. News flows to be watched this week: US manufacturing PMI, US ADP employment change, US factory order, US trade balance, US initial jobless claim and US non-farm payroll.

- Rupiah strengthened by +1.0% WoW, better than most EM currencies. DXY index declined by -0.6% WoW to 92.4.

- Indonesian government bonds traded lower this week with yield along the curve went up by 12bps. Yield on the 10 year benchmark rose by 20bps or yielding 6.84% by the end of the week. 5 year benchmark outperformed the other series with yield declined by -11bps WoW, mainly supported by local banks. On Friday, government launched retail sukuk SR-13 series with 6.05% yield in which offering period will end at 23rd of September.

- Demand on conventional auction were at IDR 78.3tn, lower than the previous auction demand at IDR 106tn. Demand was lower due to low excess liquidity in the market as BI has absorbed more during reverse repo auction. Government finally issued IDR 22tn, higher than initial target of IDR 20tn. On 27th of August, government has issued four series of VR paper amounted to IDR 16.98tn which proceed will be used to finance the PEN program.

- Based on DMO data foreign ownership increased by IDR 4tn to IDR 940.7tn.

- On Thursday, Jerome Powell announced a major shift in central bank policy to achieve maximum employment and stable prices. Equity rose post the announcement and sent the 10 year us treasury yield to close the week higher at 0.74% (+10bps WoW).

Global news

- US durable goods order jumped by +11.2% MoM in Jul-20 due to strong demand on cars and trucks. The number is much better than consensus expectation of 4.8% MoM.

- US new home sales rose by 14% MoM and 36% YoY in Jul-20 to a seasonally adjusted annual rate of 901,000 units, the highest level since 2006. The number is much better than expectation of 785,000 units.

- US consumer confidence index dropped to 84.8 in Aug-20 from 91.7 in Jul-20, worse than consensus expectation of an increase to 93.0.

- US initial jobless claim declined by 98,000 to 1mn last week, in-line with market expectation.

- US PCE index rose 0.3% MoM in Jul-20 following a 0.5% MoM gain in the following month. On a yearly basis, PCE index came at 1%, missed the market expectation of 1.2%.

- China’s official PMI came in at 51 in Aug-20 as compared to 51.1 in the previous month, slightly below expectation of 51.2. Japanese Prime Minister Abe resigned last Friday due to health reason.

Domestic News

- Jakarta officially announced extension of phase I PSBB transition for the 5th time until 10th of September. Nevertheless, some relaxation to happen such as reopening of cinema, live music, gym, despite with stricter protocol.

- On 27th of August, government started to disburse wage subsidy program transfers (BLT) of IDR 600,000 for four months. The subsidy is given to workers participating in Workers Social Security Agency (BPJS Ketenagakerjaan) with a monthly salary under IDR 5mn/month. As of 24th August 2020, there were 2.5mn workers eligible to receive this subsidy.

- Indonesia President plans to issue decree on vaccine procurement. President Joko Widodo is expected to sign the decree soon according to coordinating Minister for Economic Affairs Airlangga Hartarto.

Calendar

August 2020

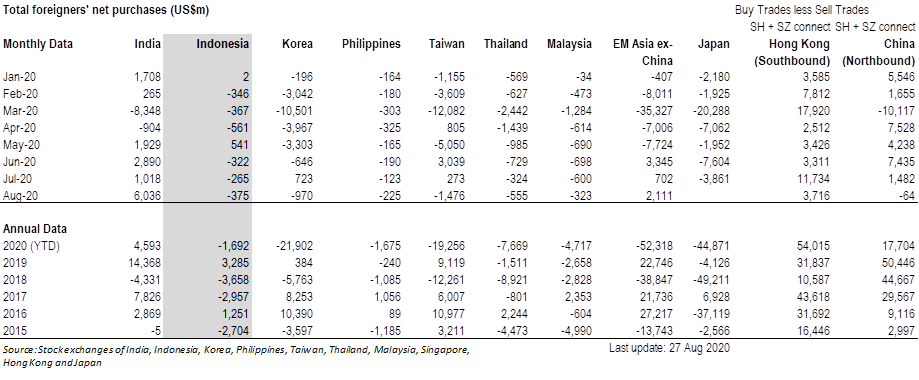

Foreign net purchases of Indonesia equities