14 September 2020

Weekly Market Review (14 Sep 2020) - What happened and What's Next?

Market update

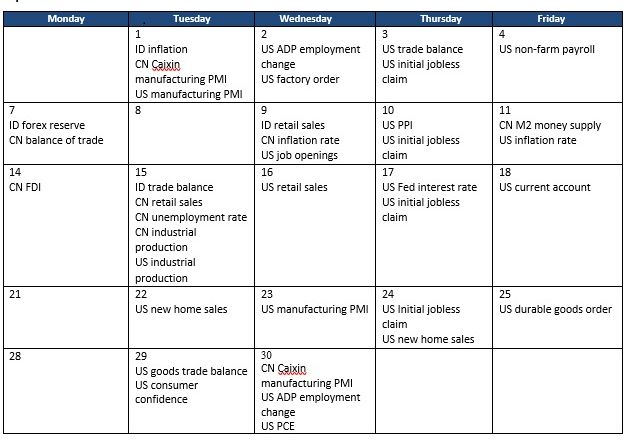

- Global equities were closed lower last week as technology stocks pulled back, marked a second straight weekly drop. On a separate note, progress on another fiscal stimulus bill in Washington remains muted. Democrats blocked Senate Republican bill on the Senate floor last Thursday, raising the possibility that a stimulus bill would have to wait until after the November Presidential election. Meanwhile, US economic data was mixed: unemployment rate and core CPI beat expectation whereas initial jobless claims came weaker than expected. On domestic side, JCI booked a loss of -4.3% WoW. The index plunged after Governor announced Jakarta will return to strict large scale social distancing (PSBB). The main underperformers were miscellaneous (-7.3% WoW), financial (-6.6% WoW) and agriculture sectors (-6.6% WoW). Whereas the most best performing sector was property, up by +4.5% WoW. News flows to be watched this week: US industrial production, US retail sales, US Fed interest rate decision, US initial jobless claims, US current account, CN FDI, CN unemployment rate, CN retail sales, CN industrial production and ID trade balance.

- Rupiah weakened by -0.9% WoW to USD/IDR 14,890, one of the worst performing currencies in EM. On the contrary, DXY index strengthened by +0.7% WoW to 93.3.

- Indonesia government bond yield along the curve rose by an average of 4 bps with 10 year stood at 6.86% by the end of the week. Yield increased as Jakarta plan to re-impose large scale social distancing (PSBB). Another PSBB means economy will experience a deeper contraction, hence BI will maintain its low rates policy.

- Demand on conventional auction on Tuesday was lower at IDR 52.3tn vs previous auction at IDR 78.3tn. Government finally issued IDR 22tn vs initial target of IDR 20tn.

- Based on DMO data, foreign ownership as of 9 Sep-20 reported at IDR 943.82tn or 28.22% from total outstanding.

- Global investors turned risk averse as external pressure increases from Brexit, US-China tension as well as stalled in US stimulus package. European Union is ramping up preparation for a tumultuous end of the four year Brexit saga after Britain explicitly said that it plans to break international law by breaching parts of the withdrawal agreement treaty that was signed in Jan-20. UST 10 year yield fell by 5 bps to 0.67% in response to global pressure.

Global news

- US nonfarm payroll increased by 1.37mn in Aug-20, slightly below expectation of 1.32mn. On the other hand, unemployment rate dropped to 8.4% from 10.2% in Jul-20, beating expectation of 9.8%.

- US core annual CPI came at 1.7% in Aug-20, higher than expectation of 1.6%.

- US weekly initial jobless claims were worse than expected, increased by 884k last week vs expectation of 850k.

- China trade balance narrowed to USD 58.93bn in Aug-20 from USD 62.33bn in the previous month. Export surged by +9.5% YoY better than consensus’ median at +7.5% YoY. On the other hand, import number was disappointing, fell by -2.1% YoY (vs expectation of +0.2% YoY). In addition, China trade surplus with US widened by 27% YoY despite vowing to buy more US products.

- China CPI rose 2.4% YoY in Aug-20, down from 2.7% YoY in the previous month but in-line with expectation.

Domestic News

- Jakarta Governor announced another large scale social distancing (PSBB) which turned out to be not as strict as what was initially thought. Basic sectors are still allowed to operate while places to be totally closed down include school and education center, recreation area, city parks, public sports area and wedding venues. Private offices will operate with 25% of capacity from previously 50%. In addition, malls are allowed to operate with 50?pacity but no dine-in for restaurants and cafes. The regulations is effective for 2 weeks starting from 14th of September.

- Government recently added 12 more companies to a list of digital goods and services businesses that must pay a 10% value-added tax (VAT) on sales. The companies must start charging VAT to advertisers and other customers from 1 Oct-20

- Government is finalizing on regulation Number 3/2020 regarding Mineral and Coal (Minerba) mining. Based on the draft, government will be able to expand or shrink the land and plans to require miners to set aside reserve funds. In addition, miners who hold KK and PKP2B who receive a contract extension in a form of IUPK, are also required to have a 100% success rate of post-mining reclamation. The exact date of the release has not been disclosed.

Calendar

September 2020

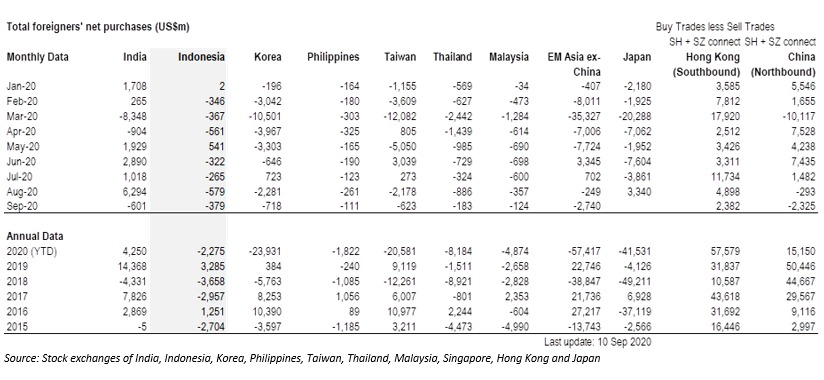

Foreign net purchases of Indonesia equities