19 October 2020

Weekly Market Review (19 Oct 2020) - What happened and What's Next?

Market update

- Global equities edged up slightly with S&P 500 +0.2% WoW and MSCI Asia ex-Japan +0.3% WoW on the back of positive 3Q earnings results announced and some supporting economic data. In the US, out of the 10% of the S&P 500 companies that have reported 3Q20 results, 86% have reported a positive EPS surprise. S&P 500 blended earnings growth currently stands at -18.4% YoY for 3Q20 (vs. -21.0% YoY on 30 Sep), majorly due to positive earnings surprises reported by the financial sector this past week. Economic data continued to show mixed trend as US retail sales gained 1.9% MoM in September, although industrial production growth declined 0.6% MoM (first decline after 4 months gain) and initial jobless claims rose 53k to 898k, suggesting that the deceleration in layoff activity has moderated. On the virus front, cases continue to surge prompting certain countries to re-impose restrictions/lockdown. France imposed a curfew in the greater Paris region, while Germany unveiled a new series of restrictions and the U.K. government imposed tougher restrictions in London. In Asia as well, Malaysia imposed a two-week partial lockdown in major cities this week after reporting a recent surge in the cases. On the positive note, Pfizer said it will know if the vaccine is effective by October-end, and will apply to the FDA for emergency use authorization (EUA) by the third week of November. However J&J and Eli Lilly paused vaccine and antibody treatment trials earlier this past week. On the domestic side, JCI booked a gain of +1.0% WoW on the back of optimism on the Omnibus Law. The main outperformance was driven by the Mining sector due to rising commodity prices and positive newsflows on potential mining projects. On the other hand, property was the worst performer with -2.7% WoW. Newsflows to be watched this week: China 3Q GDP, unemployment rate, retail sales, industrial production; US Markit PMI, existing home sales and initial jobless claims.

- Rupiah ended the week flat at USD/IDR 14,698, the best performer among the EM countries. On the contrary, DXY index strengthened by +0.7% WoW to 93.7.

- Indonesian government bonds rallied with yield declined by 5-20bps (WoW) along the curve. The long end bonds were chased by both local and foreign names with 10y yield dropped to its lowest to 6.67% (-20bps WoW) by the end of the week. Bank Indonesia held their monthly meeting on Tuesday and kept its 7DRR at 4% as market has expected. This marks the fourth BI meeting with the BI 7DRR flat at the lowest level of 4%. The decision was taken as BI need to continue maintaining the rupiah and macroeconomic stability on the back of low inflation environment.

- Demand in Sukuk auction rebounded to IDR 25.8tn compare to previous auction at IDR 19.9tn. The issuance in was also higher at IDR 11.9tn compare to government initial target of IDR 10tn and IDR 8.5tn average issuance per auction YTD.

- Based on DMO data as of 15 Oct, foreign ownership reported at IDR 945.12tn (+4.76tn WoW) or 26.64% of total outstanding.

- Global market uncertainty remained as market expect the US government to only unveil additional fiscal stimulus after the election on 3rd Nov. UST 10y down by 3bps to 0.76% from previous week.

Global news

- China 3Q GDP recorded +4.9% YoY, lower than consensus expectation of +5.5% YoY, higher than previous quarter of +3.2% YoY.

- China September industrial production recorded +6.9% YoY, higher than consensus expectation of +5.8% YoY and previous month of +5.6% YoY.

- US September CPI recorded +0.2% MoM, in-line with consensus expectation of +0.2% MoM, down from previous month of +0.4% MoM.

- US September PPI recreded +0.4% MoM, higher than consensus expectation of +0.2% MoM, higher from previous month of +0.3% MoM.

- US initial jobless claims recorded 898k, higher than consensus expectation of 825k and previous week of 840k.

- US September retail sales recorded +1.9% MoM, higher than consensus expectation of +0.8% MoM, and previous month of +0.6% MoM.

- US September industrial production recorded -0.6% MoM, lower than consensus expectation of +0.5% MoM and previous month of +0.4% MoM.

- China September trade balance recorded USD 37bn surplus, lower than consensus expectation of USD 60bn and previous month of USD 58.9bn.

- China September PPI recorded -2.1% YoY, lower than consensus expectation of -1.8% YoY and previous month of -2.0% YoY.

- China September CPI recorded +1.7% YoY, lower than consensus expectation of +1.9% YoY and previous month of +2.4% YoY.

Domestic News

- Indonesia September trade balance recorded USD2.4bn, higher than consensus expectation of USD 2.1bn and previous month of USD 2.3bn.

- BI kept 7-day reverse repo rate unchanged at 4.0%, in-line with consensus expectation.

- The Ministry of Manpower stated that it currently prepares 4 regulations to give more clarity on the Omnibus Law related to the Manpower cluster. The 4 derived regulations will govern 1) foreign workers 2) working hours, job termination, and work status, 3) wages, 4) job loss allowance.

- The Omnibus Law includes change in the taxation law. Several points include: 1) The exemption of income tax for dividend if the dividend is invested domestically, under certain conditions. 2) Profit from cooperation and hajj fund which is managed by Hajj fund management agency (BPKH) is exempted from income tax object. 3) Income tax art 26 on domestic interest income received by foreign tax subject (SPLN) can be lower than 20% (current tariff is at 20%). 4) Equity capital injection in the form of asset is not subject to VAT.

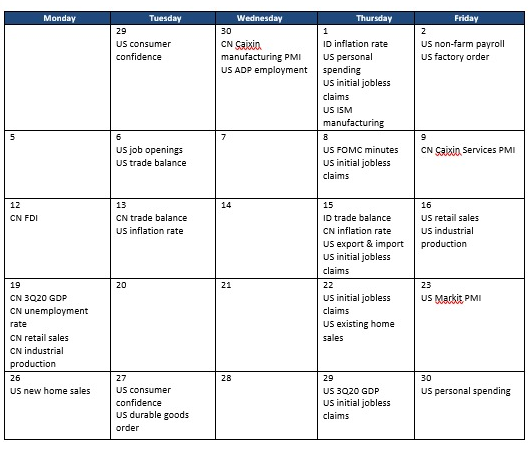

Calender

October 2020

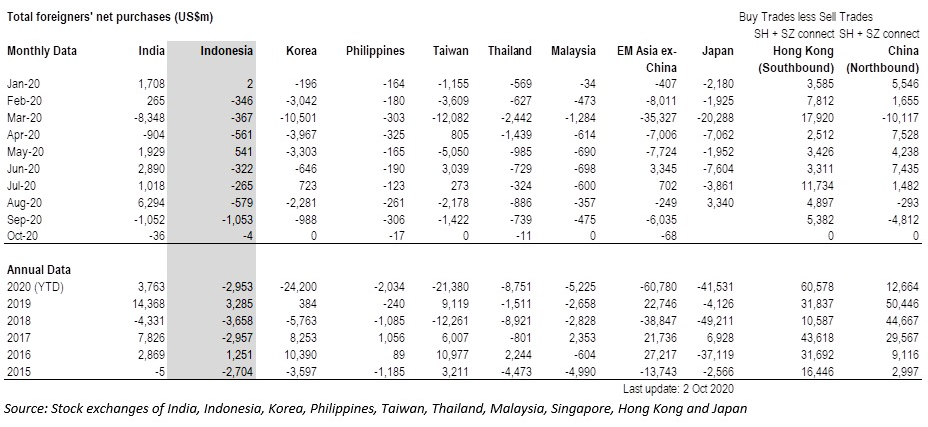

Foreign net purchases of Indonesia equities