02 November 2020

Weekly Market Review (02 Nov 2020) - What happened and What's Next?

Market update

- Global indexes closed lower last Friday with S&P and Dow Jones down by -1.5% WoW and -3.0% WoW respectively. Investors waved off strong quarterly results from technology heavyweights and focused on the uncertain outlook amid a surge in Covid-19 cases in the US and Europe. Germany and France has re-entered lockdowns while cases in US continues to jump. In addition, nervousness over US election continues to hang over the market. Meanwhile, there is no certainty about the timing of any further US fiscal stimulus. On domestic side, JCI index ended the short trading week with a slight gain, up +0.3% WoW. The main outperformer was agriculture sector +3.7% WoW due to increase in CPO price as supply is expected to tighten. On the other hand, mining and consumer sector were the only ones that booked losses, each down by -1.2% and -1.1% WoW respectively. News flows to be watched this week: US manufacturing PMI, US factory orders, US trade balance, US ADP employment change, US initial jobless claims, US non-farm payrolls, CN Caixin manufacturing PMI, ID inflation rate and ID 3Q20 GDP.

- Rupiah was appreciated by +0.2% WoW to USD/IDR 14,625, performed better than most EM' currencies. DXY index also strengthened by +0.2% WoW to 92.9.

- Indonesian bond market traded quietly ahead of long weekend. Weekly movement of government bond yield were mixed, ranging between 1-6 bps along the curve. Whereas 10Y government bond yield fell 2bps to 6.58%.

- Total demand in sukuk auction slightly declined with total bids reported at IDR 25.9tn (vs IDR 26.1tn in the previous auction). Long tenor series 12Y and 26Y were the most attractive with demand reached IDR 8.1tn and IDR 7.2tn respectively. Although demand was weaker, government issued IDR 11.9tn (vs IDR 12tn in the previous auction).

- Based on DMO data, foreign ownership as of 26 Oct-20 was at IDR 955.83tn or 26.53% of total outstanding.

- Global market pressure increased along with higher Covid-19 cases in US and Europe. Optimism came up on Friday after the Fed unveiled new measures to support small businesses. The Fed lowered minimum loan size for its lending program from USD 250k to USD 100k. They will also ease debt restrictions for companies that participate in Paycheck Protection Program. UST 10Y yield climbed to 0.88% (+3bps WoW) by the end of last week.

Global news

- US new home sales fell unexpectedly by -3.5% MoM to a seasonally adjusted annual rate of 959k (vs expectation of +2.8% MoM increase). August's sales pace was revised down to 994k from the previously reported 1.011mn units.

- US durable goods order jumped by +1.9% MoM in Sep-20, following an increase of +0.4% MoM in the previous month (beating expectation of +0.5% MoM).

- US initial jobless claims down 40k to 751k last week, marking the lowest level since the week of 14-Mar-20 (vs consensus expectation of 778K ).

- China Caixin PMI came in at 53.6 in Oct-20, better than 53.0 forecast by consensus. The latest reading was the highest since Jan-11.

Domestic News

- Indonesia inflation rate was 0.07% MoM and 1.44% YoY in Oct-20, thus bringing Jan-Oct-20 inflation to 0.95% ytd.

- Covid-19 vaccination that initially was targeted to begin in Nov-20 was postponed to Jan-21. The postponement was due to Emergency Use Authorization has not been granted by BPOM.

- Ministry of Manpower instructed regional governors to keep local minimum wage unchanged for next year to support businesses. This was officially signed in circular letter no. M/11/HK.04/X/2020.

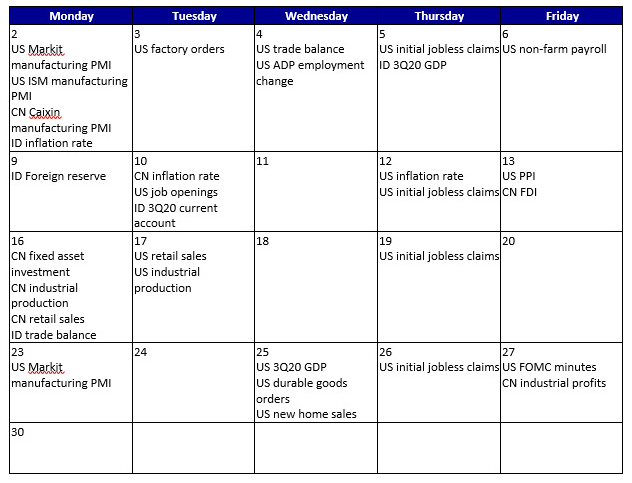

Calendar

November 2020

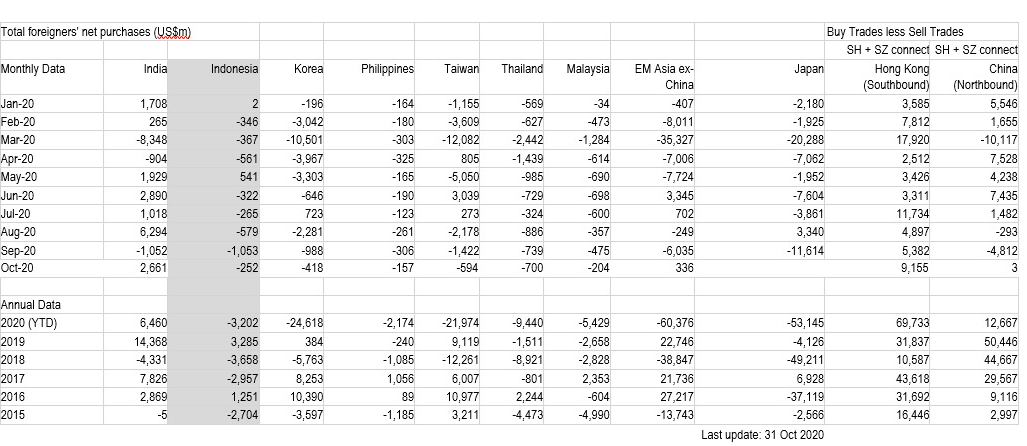

Foreign net purchases of Indonesia equities

Source: Stock exchanges of India, Indonesia, Korea, Philippines, Taiwan, Thailand, Malaysia, Singapore, Hong Kong and Japan