30 November 2020

Weekly Market Review (30 Nov 2020) - What happened and What's Next?

Market update

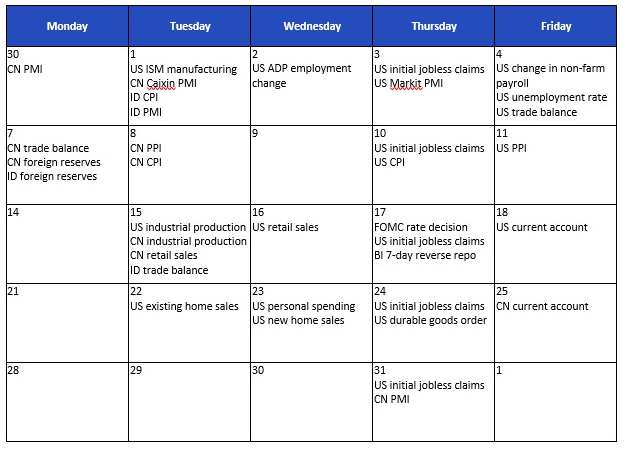

- Global equities ended the week higher with S&P 500 +2.3% WoW and MSCI Asia ex-Japan +1.5% WoW. In the US, durable goods orders showed a healthy gain of +1.3% MoM in October and personal spending data came better than expected, rising +0.5% MoM in October, suggesting continued resilience for consumers, while flash manufacturing PMI was stronger than expected at 56.7. However, the decline in continuing claims slowed further in mid-November, suggesting some softening in labour market conditions. In Europe, Euro area flash composite PMI fell to around 45 in November. German Ifo survey showed a small decline in the current assessment component, while expectations fell to 91.5 from 94.7. Meanwhile in Asia, key data was better-than-expected. China’s industrial profit growth surged to +28.2% YoY in October from +10.1% in September, with the YTD growth turning positive at +0.7% YoY in October. On the other hand, the virus cases continued to surge across the US and Europe, with some US states reporting nationwide record for new daily cases, as did death rates that climbed to record highs with increasing strain on hospitalization capacity in some regions/cities. UK announced that the national lockdown will end on 2-Dec, followed by a three-tier system of restrictions, while Germany extended the ongoing restrictions till 20th Dec. On the domestic, JCI index booked +3.8% WoW gain following other Asian indexes. The most outperformed sectors were mining and property, both were up by +7.3% WoW. On the other hand, miscellaneous sector was the main drag, down -1.1% WoW. News flow to be watched this week: US ISM manufacturing, ADP employment change, Markit PMI, initial jobless claims, change in non-farm payroll, unemployment rate, trade balance; China PMI; Indonesia CPI and PMI.

- Rupiah strengthened to USD/IDR 14,090, in-line with other EM currencies. DXY index declined by -0.7% WoW to 91.8.

- Indonesia government bonds’ price advanced with yield declined by average 8bps along the curve. Inflows were still seen in the belly curve. By the end of the week, yield on 5yr and 10y tenor were reported at 6.17% and 5.05% respectively. The government also announced to do the last conventional bond auction this year on Tuesday (1 Dec).

- Demand in Sukuk auction rebounded to IDR 24.9tn compare to previous auction, which incoming bid reported at IDR 22.6tn. The increased demand was seen in the longest tenor (25.9yr) which reported incoming bids of IDR 13.1tn and the government rejected all bids for the short tenor paper 6mo paper and 2.5yr tenor. At last, government issued IDR 10tn the same with the initial target.

- Based on DMO data as of 26 Nov, foreign ownership reported at IDR 968.24tn or 25.96% of total outstanding.

- Global market optimism increased following positive news on vaccine development and update on Joe Biden’s pick for his incoming Cabinet. More vaccine progress as AstraZeneca reported a 70% and 90?ficacy rates which boosted risk appetite. President elect Joe Biden plans to nominate former Fed chairwoman Janet Yellen to become the next Treasury Secretary. Investors see Yellen’s appointment as market-friendly and would deliver more economic stimulus. Global risk sentiments also supported by the US Senate Majority Leader Mitch McConnell that agreed to restart talks with Democrats over a new Covid-19 bill. 10yr UST reported at 0.84% (+1 bps Wow) by the end of the week.

Global news

- US Markit Manufacturing PMI in Nov recorded 56.7, above consensus expectation of 53.0 and previous month of 53.4.

- US Markit Services PMI in Nov recorded 57.7, above consensus expectation of 55.0 and previous month of 56.9.

- US initial jobless claims recorded 778k, higher than consensus expectation of 730k and previous week of 742k.

- US personal spending increased by 0.5% YoY, in-line with consensus expectation of +0.4% YoY, lower than previous month of +1.4% YoY.

- US New home sales in October recorded 999k, above consensus expectation of 975k and previous month of 959k.

- China Manufacturing PMI in November recorded 52.1, higher than consensus expectation of 51.5 and previous month of 51.4.

- China Non-manufacturing PMI in November recorded 56.4, higher than consensus expectation of 56.0 and previous month of 56.2.

Domestic News

- Ministry of Finance (MoF) stated that the realization of national economic recovery (PEN) disbursement reached IDR 408.61tn as of 18Nov or equivalent to 58.8% of the total budget. The highest realization was from social safety net disbursement with IDR 193.07tn (82.4% of budget).

- Gov’t accelerates the gov’t spending and has reached IDR 2,041.8tn as of Oct2020 (+13.6% YoY) to support the economic recovery, this realization was at 74.5% of the state budget allocation. As of October 2020, tax revenues reached IDR 826.94tn or 68.98% of the 2020 target of IDR 1,198.8tn.

- Bank Indonesia forecasts inflation of 0.25% MoM in November 2020, higher compared to the inflation of 0.07% in October 2020.

- Ministry of National Development Planning targets to have 2.3mn-2.9mn new employment in 2021, following target of 4.5%-5.5% GDP growth.

- Transportation Ministry to review the maximum airlines passenger capacity from currently at 70?pacity. According to the Minister there is a possibility to relax the maximum capacity up to 85% of capacity to support airlines recovery.

- Investment in Indonesian start-ups is projected to reach US$4-5bn in 2021 from this year's estimated investment of around US$2.5bn.

- Gov’t and House of Representatives (DPR) agreed that 36 regulation (UU) drafts to be discussed as a priority (Prolegnas) in 2021 including the reforms to develop and strengthen the financial sector, protection of personal data, prohibition of alcoholic beverages, and draft on capital city.

Calendar

December 2020

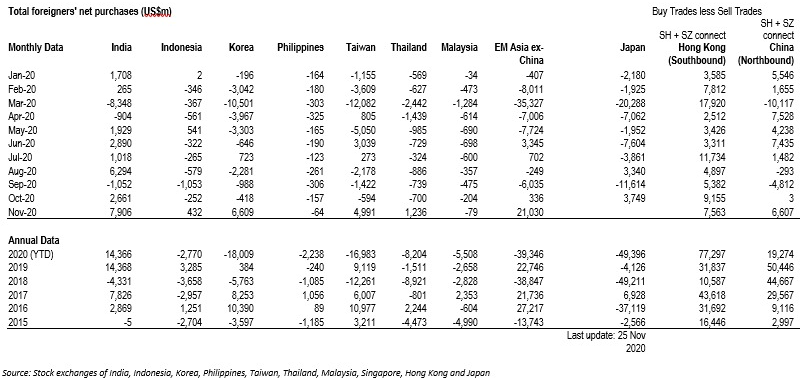

Foreign net purchases of Indonesia equities