16 April 2019

Weekly Market Review (15 April 2019) - What happened & What's next?

Market update

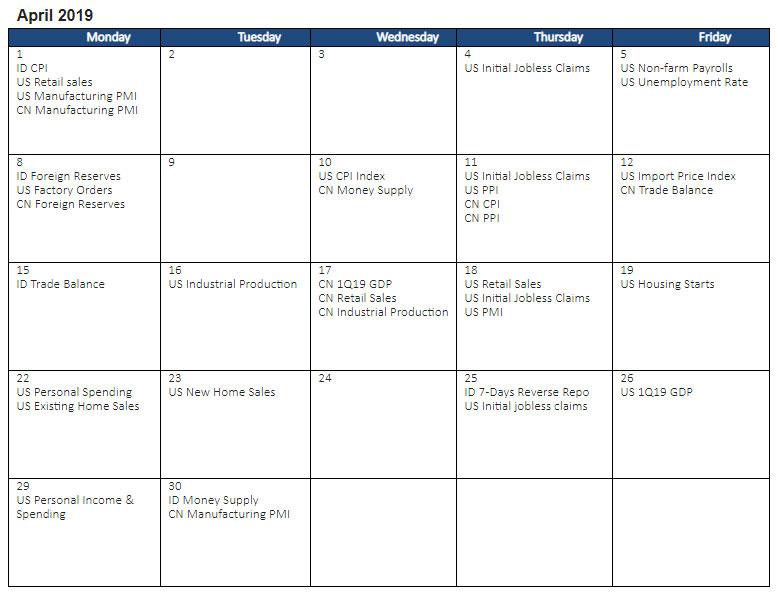

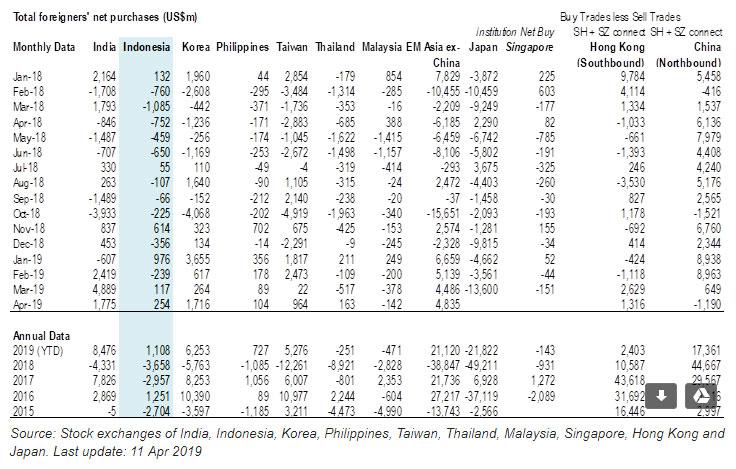

- Despite onshore Chinese equities taking a breather (-1.8%WoW), Asia equities were modestly up +0.3%WoW with Taiwan, Thailand and Philippines outperforming, while Malaysia, HK and Indonesia underperformed (MSCI, USD basis). FOMC minutes were modestly dovish, although key balance sheet questions were unanswered. The ECB meeting, too, turned out to be a non-event, as it did not provide markets with any further details on TLTROs as well as left rates and guidance unchanged. On Brexit events, the EU and Britain agreed to an extension to 31’Oct to decide on the Withdrawal Agreement. On domestic side, despite foreign inflow of USD90m inflow, JCI plummeted to IDR6,405.9 (-1.1%WoW) by the end of the week. Basic Industry sector was the worst performer with -2.6%WoW. Meanwhile, Financial sector was relatively better than other sectors by -0.1%WoW. Newsflows to be watched within this week include Indonesia Trade Balance and Election; China Retail Sales, Industrial Production and GDP; US Retail Sales, PMI, Industrial Production and initial jobless claim.

- IDR was flat at IDR14,120 (+0.1%WoW), relatively worse than average emerging markets (+0.4%WoW). On the other hand, DXY fell to 97 (-0.4%WoW).

- Ahead of election, bond market yield increased by 10-14 bps. Selling pressure came from onshore bank, while offshore real money increased position on Indo GB. 10 years series increased the most.

- Foreign investor increased position by IDR1.41trn, mostly seen on 10 and 20 years series.

- 10 year US Treasury yield increase from 2.5% to 2.56% as FOMC released minutes from its March meeting, which the Fed adjusted its forecast to no rate hikes this year. The minutes reflected a central bank that will watch data closely this year, with some members leaving open the chance of a rate hike if conditions continue to improve.

Global news

- US Initial Jobless Claims dropped 8,000 to a seasonally adjusted 196,000 for the week ended April 6, the lowest level since early October 1969. It was better than economists’ expectation of 211,000.

- US’s CPI rose 0.4% boosted by increases in the costs of food, gasoline and rents. It was better than the street expectation of +0.2%. The core CPI rose 0.1% in March.

- China’s CPI in March’19 rose 2.3%YoY, the quickest pace since Oct’2018. It was lower than the +2.4%YoY forecast by economists, but higher than February’s 1.5 percent increase. China’s PPI rose 0.4% YoY in Mar’19, in line with expectations of analysts.

- China’s FX reserves grew for the fifth straight month in March to a seven-month high of USD3.099trn (an increase of USD8.58bn MoM).

Domestic News

- Mar’19 FX reserve increased by USD1.2bn to USD 124.5bn (Feb19: USD 123.3bn), equivalent to 6.8 months of imports. The increase was partly due to BI’s FX term deposit and swap instrument, which rose by around USD3bn-4bn, according to our calculation. Thus, excluding the FX instruments, the amount actually relatively flat compare to Feb19.

- According to Senior Deputy Governor of Bank Indonesia, Trade balance seen in surplus in March’19, in line with improving current account deficit.

- Domestic cement sales declined by -1.1%YoY in Mar’19 to 5.1m tonnes, bringing 3M19 cement sales to 15.7m tonnes, -0.4%YoY. Decline in domestic sales volume was driven by Sumatra at -9.2%YoY, in line with the slowdown in commodities and construction sector, and Java at -4.1%YoY due to lack of new infrastructure projects.