21 December 2020

Weekly Market Review (21 Dec 2020) - What happened and What's Next?

Market update

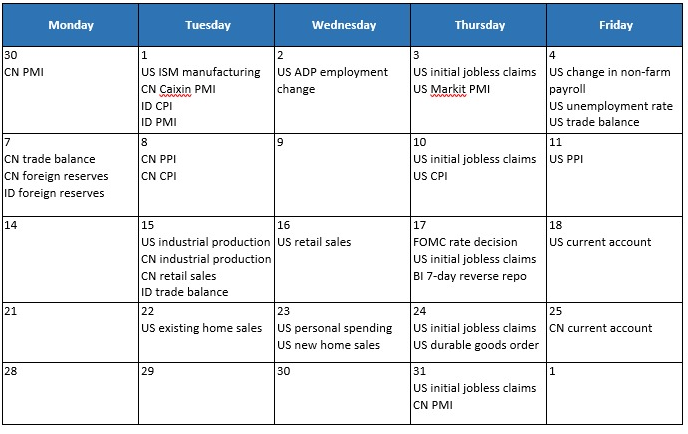

- Global equities continued its rally with S&P 500 +1.3% WoW, DJI +0.4% WoW, and MSCI Asia ex-Japan +0.5% WoW. Investors perceived positive on the US stimulus expectation that was finally settled at USD 900bn. This includes USD 600 direct payments to Americans, USD 300 in weekly supplemental unemployment insurance, USD 300bn in small business assistance, plus funding for vaccinations, schools, and additional economic relief to aid the recovery. On the other hand, European countries are banning travellers from the UK because of a more contagious strain of Covid-19 that is emerging in Britain. France, The Netherlands, Italy and Austria have all banned flights from the United Kingdom. The more transmissible strain of Covid-19 prompted U.K. Prime Minister Boris Johnson to order additional lockdown measures, putting in place a new stay-at-home order and dramatically limiting travel in and out of London and other parts of southeast England on Saturday. On the domestic, JCI index outperformed with a gain of +2.8% WoW. The most outperformed sectors were Miscellaneous and Mining, up by +7.6% WoW and 5.9% WoW, respectively. In contrast, Basic Industry was the main drag, down by -0.5% WoW. News flows to be watched this week: US existing and new home sales, personal spending, initial jobless claims, durable goods order; China current account.

- Rupiah slightly weakened to USD/IDR 14,110 (-0.2% WoW), contrast than other EM countries’ strengthening. Meanwhile, DXY index continued its weakening by -1.1% WoW to 90.0.

- Indonesia government bonds’ price rose with yield declined by average 7bps along the curve and inflows were still seen in the long tenor bonds. The 20y tenor yield declined the most by 16bps WoW. Yield on 10y bond fell to the lowest to 5.19% by the end of the week, as improving global market outlook fuelled demand for emerging market debt. Bank Indonesia on Thursday kept its policy rate unchanged at 3.75% as market expected. The central bank remains positive that economy is gradually improving and will keep an accommodative monetary policy stance.

- Based on DMO data as of 16 Dec, foreign ownership reported at IDR 973.57Tn or 25.21% of total outstanding.

- US Treasury yields climbed after the Fed pledged to maintain its bond-buying programs until the economy returns to full employment. On the same occasion, the Fed also kept its rate on hold near zero until an economic recovery is complete. Global market also continued to monitor progress on the stimulus talks as lawmakers in congress were closing in on USD 900bn covid19 aid bill. By the end of the week, 10y UST reported at 0.95% (+5bps WoW).

Global news

- US industrial production in November recorded +0.4% MoM, in-line with consensus expectation of +0.3% MoM, slowing down from previous month of +1.1% MoM.

- US retail sales in November recorded -1.1% MoM, below consensus expectation of -0.3% MoM and previous month of +0.3% MoM.

- Fed kept interest rate unchanged at 0-0.25%.

- US initial jobless claims climbed to 885k, worse than consensus expectation of 818k and previous week of 853k.

- US continuing claims declined to 5.5mn, better than consensus expectation of 5.7mn and previous week of 5.8mn.

- US 3Q current account balance recorded USD -179bn, better than consensus expectation of USD -187bn.

- China industrial production in November recorded +7% YoY, in-line with consensus expectation.

- China retail sales in November recorded +5% YoY, in-line with consensus expectation.

Domestic News

- Indonesia trade balance in November recorded USD 2.6bn, in-line with consensus expectation, with exports growing +9.5% YoY and imports declining 17.5% YoY.

- BI kept 7-day reverse repo rate unchanged at 3.75%, in-line with consensus expectation.

- The central gov't to intervene in the mechanism for regional taxes & retribution (PDRD) starting 2021, as stated in the gov't regulations draft (RPP), under the Job Creation Law. The central gov't will be authorized to adjust the rates or remove the types of PDRD.

- The gov’t has decided on the maximum tariff or price cap for the rapid antigen swab test of IDR 250k in Java and IDR 275k ex-Java. The determination of the price cap is meant as a response to public complaints due to price vary across hospitals.

- President Jokowi inaugurated the Patimban International Port operation. This inauguration was marked by the export of 140 cars to Brunei Darussalam. President Jokowi is optimistic that Patimban Port will play a strategic role as an export driver in the manufacturing, tourism and agricultural centers spread across West Java.

- The gov't have decided on a free corona vaccination program for all Indonesians. The President instructed all cabinet ministries and agencies and local governments to prioritize the corona vaccination program in the 2021 budget. The gov’t will reallocate the 2021 State Budget to meet the budget for free vaccines to 160mn people worth around Rp150tn.

- The gov’t revealed that the realization of the PEN program budget as of 14 December 2020 reached Rp481.6tn (69.3%) of the budget ceiling of Rp695.2tn.

Calendar

December 2020

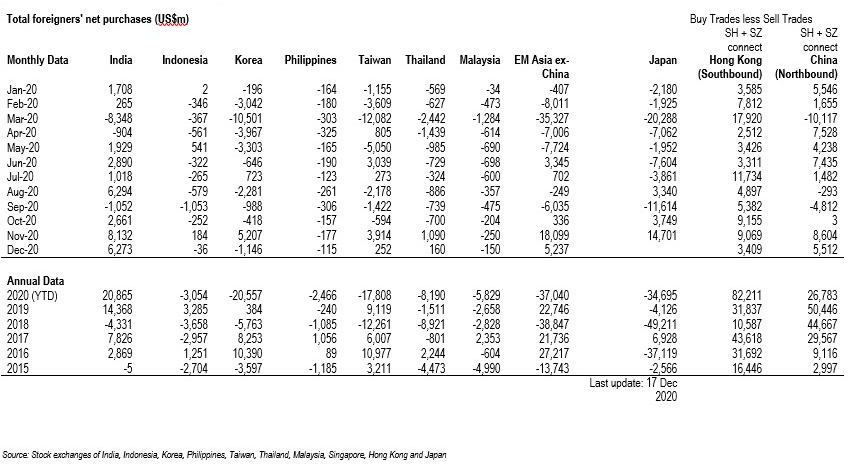

Foreign net purchases of Indonesia equities