11 January 2021

Weekly Market Review (11 Jan 2021) - What happened and What's Next?

Market update

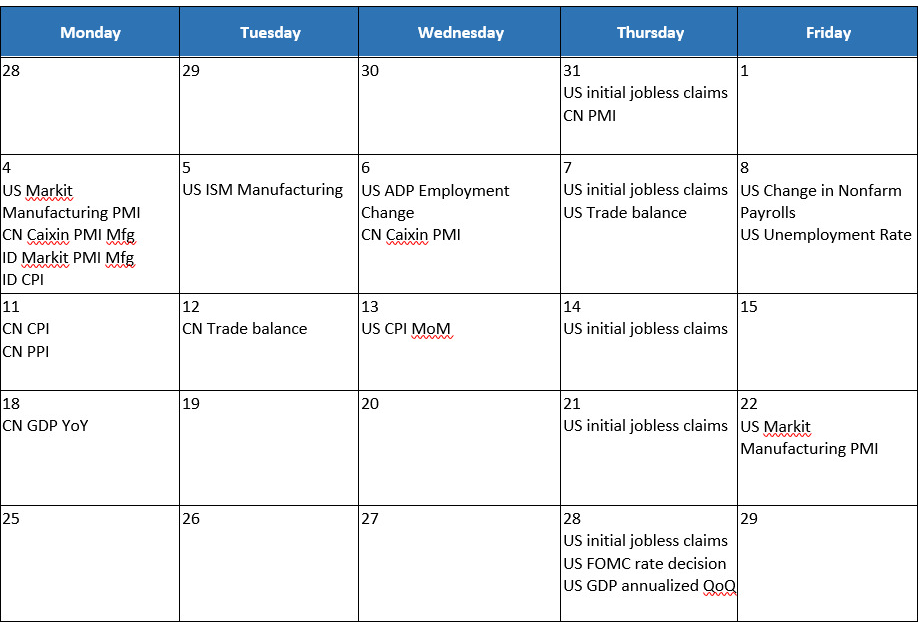

- Global equities booked gains last week as Democrats took control of the US Senate that could lead to higher stimulus packages, with MSCI Asia ex-Japan gaining +5.2% WoW and S&P 500 up by +1.8% WoW. Economic data also continue on the uptrend with US ISM services index in Dec. recording 57.2, suggesting a faster pace of expansion for the services sector, and ISM manufacturing PMI jumped to 60.7. Meanwhile in Asia, China’s Caixin manufacturing and services PMI dropped, missing estimates. On the Covid-19, the virus cases continued to surge across globe, with more cases of lockdowns/restrictions. Japan announced a state of emergency in Tokyo and adjacent areas until 7 February, UK announced a third lockdown to remain in effect, until at least 15 Feb, Germany officially extended the current lockdown until at least the end of January. On the other hand, JCI index closed positive as well +4.7% WoW. Mining was the main outperformer up by +10.7% WoW, while Consumer sector was the main underperformer up by +1.0% WoW. Newsflows to be watched within this week: China GDP; US initial jobless claims and Markit PMI.

- Rupiah strengthened to USD/IDR 14,020 (+0.2% WoW), in-line with EM currencies. Meanwhile, DXY index strengthened by +0.5% WoW to 90.1.

- Indonesia government bonds trade lower to open the first week of 2021, following the weaker rupiah that traded higher to above USD/IDR 14,000. Yields were up by average 7bps along the curve. Yield on 5y and 10y Indonesian government bond reported at 5.17% and 6.09% by the end of the week.

- Based on DMO data as of 6 Jan, foreign ownership reported at IDR 983.9tn or 25.15% of total outstanding.

- First bond auction of the year held successfully as government received a solid demand at IDR 97.2tn incoming bids and finally issued IDR 41tn. The government also set target issuance higher at IDR 35tn (vs. IDR 18.5tn last year average target per auction). Newly issued 15y benchmark (FR88) was the star of the auction, as 32.3% of total incoming bids went to FR88 and IDR 12.75tn able to be issued.

- On the same week, the government also issued their first foreign currency bond, which issued in multi tranches USD bonds of 10y, 30y, and 50y with total issuance of USD 3bn. While for the EUR, government will only issue 1 tranche of 12y with issuance of EUR 1bn.

- Global investors’ optimism surged, which can be spotted after the US Congress confirmed the election of Joe Biden as the US President and investors ignored the unrest in Washington. By the end of the week, 10y UST broke 1% to 1.13% (+20bps WoW).

Global news

- Saudi Arabia announced its unilateral plan to reduce the oil output by 1mbpd in Feb. and March, taking crude prices to a 10-month high of above USD50/bbl.

- US treasury department left Alibaba and Tencent off a blacklist, prohibiting Americans from investing in Chinese companies.

- US ISM manufacturing PMI in Dec 2020 recorded 60.7, above consensus estimate of 56.8 and previous month of 57.5.

- US ISM services PMI in Dec 2020 recorded 57.2, above consensus estimate of 54.5 and previous month of 55.9.

- US non-farm payroll in Dec 2020 declined by 140k, below consensus estimate of 50k and previous month of 245k.

- US unemployment rate in Dec 2020 recorded 6.7%, in-line with consensus estimate of 6.8% and previous month of 6.7%.

- US initial jobless claims recorded 787k, better than consensus estimate of 800k, similar to previous week of 787k.

- US trade balance in Nov 2020 recorded USD -68.1bn, higher deficit compared to consensus estimate of USD -67.3bn and previous month of USD -63.1bn.

- China Caixin manufacturing PMI in Dec 2020 recorded 53.0, below consensus estimate of 54.7 and previous month of 54.9.

- China Caixin services PMI in Dec 2020 recorded 56.3, below consensus estimate of 57.9 and previous month of 57.8.

- China foreign reserves in Dec 2020 recorded USD 3.2tn, in-line with consensus expectation.

Domestic News

- Government decided to implement Enforcement of Restrictions on Public Activities (PPKM) in Java and Bali on 11-25 January 2021

- Indonesia Markit manufacturing PMI in Dec 2020 recorded 51.3, up from previous month of 50.6.

- Indonesia CPI in Dec 2020 recorded +1.68% YoY, in-line with consensus estimate of +1.61% YoY.

- Indonesia foreign reserve in Dec 2020 recorded USD 135.9bn, up from previous month of USD 133.6bn.

- BI predicts inflation of 0.38% MoM in January 2021, or 1.68% YoY.

- Unspent funds (SILPA) reached IDR 234.7tn for 2020 fiscal year, which was the highest in the last 10 years. Average SILPA was at IDR 32tn in 2010 - 2019. High SILPA was also due to gov't placement of IDR 66.7tn funds in banks.

- Financial Services Authority (OJK) plans to change the tiering of banking classification in which minimum core capital is planned to increase for each category. That said, 3 conventional banks that currently under BUKU 4 category (core capital more than IDR 30tn) could be downgraded as the new tiering for require minimum capital of at least IDR 70tn for KBMI4 (bank group based on core capital).

Domestic New

January 2021

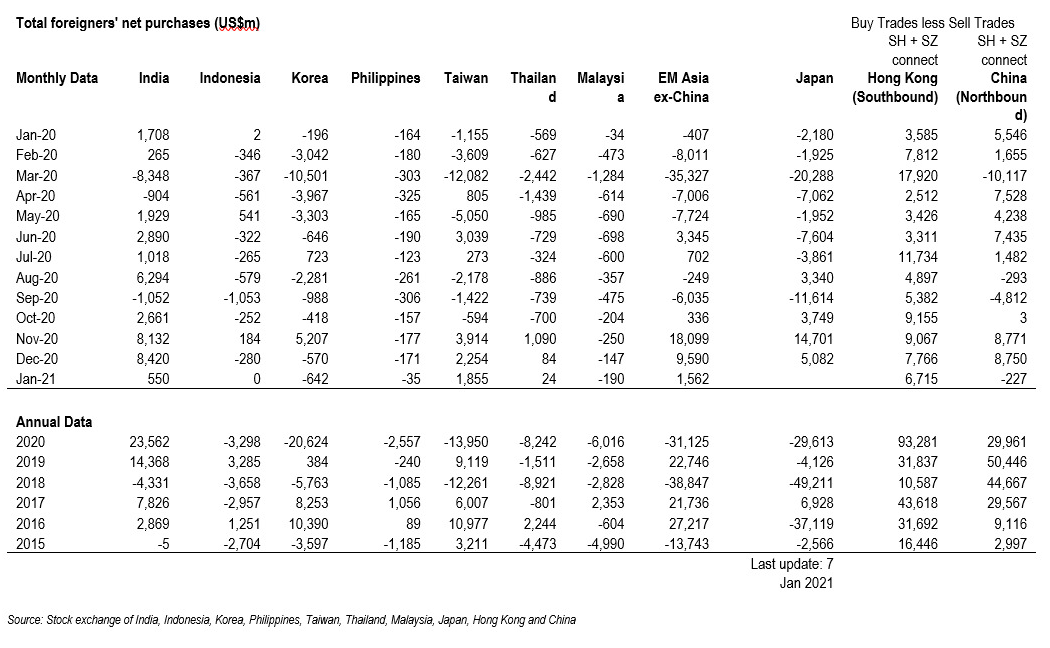

EM net foreign flow