25 January 2021

Weekly Market Review (25 Jan 2021) - What happened and What's Next?

Market update

- Global equities continued to power ahead with AeJ equities gaining another +3.4% WoW, outperforming S&P index (+1.9% WoW). Growth/tech stocks massively outperformed value/cyclicals both in AeJ and US market. US 4Q20 earnings beat expectations as 86% of S&P companies have reported positive EPS surprises. US data such as PMI and initial jobless claims also showed improvement. However, gains were reduced on Friday as investors weighed the outlook of USD 1.9tn Covid-19 relief packages. In addition, there are some concerns on vaccine rollout process that has been slower than expected. On the other hand, JCI index were closed lower -1% WoW, mainly dragged by mining and property sectors each down by -5.6% WoW and -4.8% WoW respectively. All sectors were in the red territory except for miscellaneous industry that still manages to grow by +0.8% WoW. Newsflows to be watched within this week: US FOMC rate decision, US 4Q20 GDP and US initial jobless claims.

- Rupiah slightly weakened by -0.1% WoW to IDR 14,035/USD, relatively underperformed compares to average EM currencies. Similarly, DXY index also declined by -0.6% WoW to 90.2.

- Indonesia government bonds traded lower following higher UST yield and dollar index. Yield increased by 9bps along the curves with yield on the long tenor bonds increased the most. 15yr and 20yr bond yield rose by 12bps and 13bps respectively over the week to 6.23% and 6.71%. Meanwhile, yield on the 10yr bond rose by 10bps to 6.26% by the end of the week.

- Bank Indonesia kept its policy rate on hold at 3.75%, in-line with market expectation. Despite of surging number of virus cases, the central bank maintained its 2021 growth and inflation forecast for 2021 at 4.8-5.8% and 2-4% respectively. BI also delivered a consistent message which is to keep monetary policy accommodative to support economy.

- Based on DMO data as of 21 Jan-21, foreign ownership reported at IDR 980.42tn or 24.78% of total outstanding.

- The incoming bids in the first conventional auction this year was reported at IDR 55.3tn, which was lower than the previous incoming bids of IDR 97.2tn. With the slowing demand, government only issued IDR 24.45tn, lower than initial target of IDR 35tn. Due to lower bond issuance, government implemented additional auction (GSO) and obtained IDR 15.55tn proceed with incoming bids reported at IDR 16.5tn

- US Treasury yield still traded above 1% on hope of economic rebound. Development of Covid-19 vaccines and expectation of more stimulus under the Democrat-led congress have prompted some investors to pursue riskier assets. Investors also worried about the possibility of an earlier than expected taper tantrum as this will cause yields to increase sharply. 10yr UST unchanged to 1.11% (+1bps WoW) by the end of the week

Global news

- IHS Markit data shows that US manufacturing PMI accelerated to 59.1 in the first half of this month from 57.1 in Dec-20. The number is better than consensus' expectation at 56.5.

- US initial jobless claims increased by 900k, slightly lower than consensus' expectation of 910k. The number has also went down from the previous week of 926k.

- Eurozone Markit's flash PMI dipped to a 2 month low in Jan-21 to 47.5 from 49.1 in the previous month.

- China's 4Q20 GDP jumped to +6.5% YoY from +4.9% in 3Q20. The number is also higher than consensus at +6.1% YoY.

Domestic News

- Ministry of Communication & Information decided to revoke 2.3Ghz frequency (5G) auction process. The key reasoning offered is the need for realignment of the selection process with laws and regulations for Non-Tax State Revenues within the ministry regulation. Consequently, the previously announced winners (Telkomsel, Smartfren, Hutch3) are annulled.

- Bank Indonesia (BI) decided to leave its policy rate unchanged at 3.75%. BI governor, Perry Warjiyo sees more room to cut rates and weighs further action.

- Jakarta government decided to extend PSBB until 8th Feb-20 and is planning to add 1.9k isolation beds and 260 icu beds. Operational hours for malls and restaurants were relaxed to 8pm instead of the original 7pm.

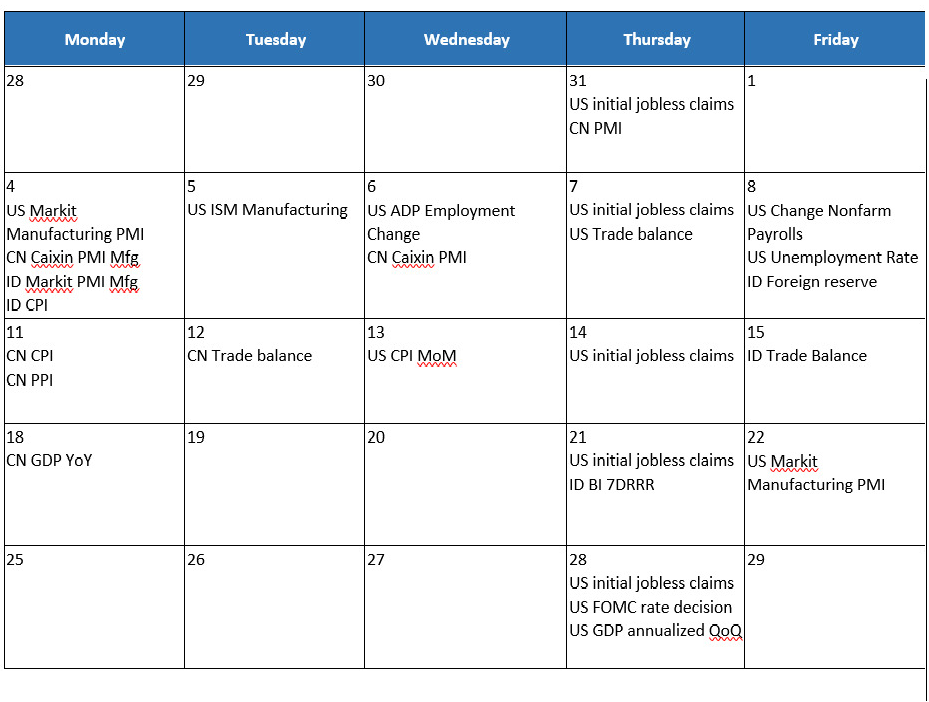

Calendar

January 2021

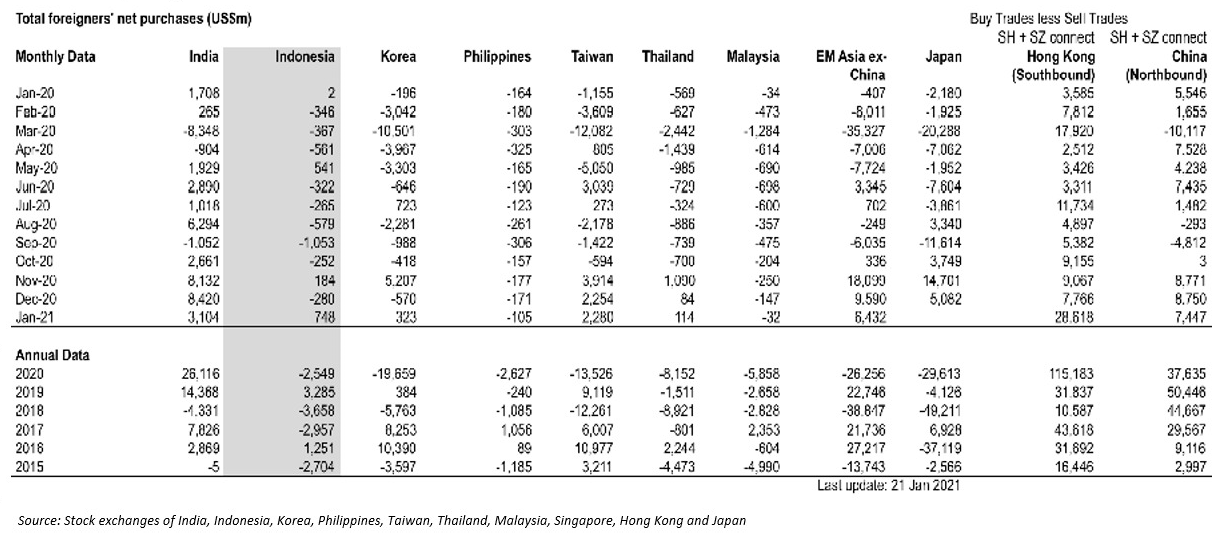

EM equities net foreign flow.