29 April 2019

Weekly Market Review (29 April 2019) - What happened & What's next?

Market update

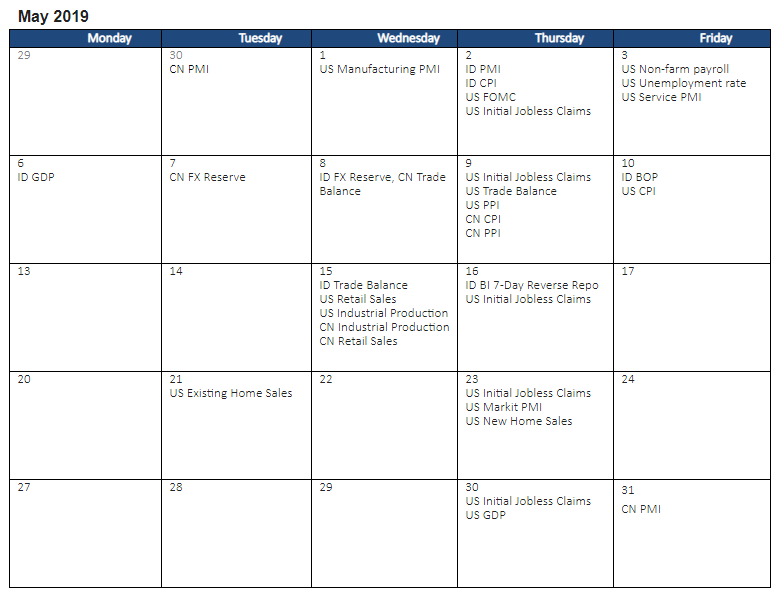

- Global indices ended the week with mixed performances: S&P500 +1.2% WoW, Hang Seng Index -1.2% WoW, Shanghai Composite Index -5.0% WoW, KOSPI -1.6% WoW, FTSE -0.42% WoW. A renewed strengthening of USD and market expectations that China may slow on monetary easing given the recent recovery in key activity indicators dragged Asian equities down this past week. On the other hand, US GDP numbers surprised on the upside, with better-than-expected Q1 GDP growth of 3.2% y-y driven mostly by an upside surprise on non-residential fixed investment. On the domestic side, JCI index closed the week lower -1.6% WoW, in-line with the regional trend. The most outperformed sector was Infrastructure (+0.9% WoW) on the back of noise on potential consolidation. Whereas Basic Industry was the main drag of JCI index, declined by -4.4% WoW due to fear on the poultry sector, while Agriculture also declined -4.2% WoW on weak 1Q19 result. Newsflows to be watched within this week include: China PMI; US PMI, FOMC meeting, non-farm payroll, unemployment rate, initial jobless claims; ID PMI and CPI.

- IDR weakened to IDR 14,199 (-1.1% WoW), roughly in-line with the emerging market currencies. DXY index strengthened by +0.6% WoW to 98.0.

- Negative sentiment came from concern on weaker IDR and higher auction issuance size at Rp 23.4Tn. This made IDR bond market yield weaker by 9-8 bps. 10 year yield increased the most.

- Foreign investor increased position by IDR 10.6 Trillion, mostly seen on 5 years series.

- Japan Credit Rating Agency Lifts Indonesia Outlook to Positive. JCR retains Indonesia’s sovereign foreign currency long-term issuer rating of BBB and BBB+ for local currency long-term issues. Ratings mainly reflect Indonesia’s solid economic growth underpinned by domestic consumption, restrained level of budget deficit and public debt, and resilience to external shocks stemming from flexible exchange rate policies and accumulation of foreign exchange reserves.

Global news

- US GDP grew 3.2% in 1Q19, above consensus expectation of 2.3%. The threat of a continuing trade war with China prompted American businesses to stockpile inventories at an accelerated rate—which boded well for GDP growth but also means that those goods and materials will have to be worked off in the coming quarters. That dynamic could result in offsetting negative implications in the second and third quarters of this year. The stronger-than-expected GDP number was also helped by the lower imports.

- Oil price fell 3 percent after President Donald Trump demanded OPEC to raise output to soften the impact of U.S. sanctions against Iran.

- Chinese President's speech hinted that they've accepted US terms on trade war. Xi Jinping said that China promises to have a reform regarding national subsidy system, protection of intellectual property, and driving foreign investments in various sectors. He added that he will eliminate inappropriate regulations which hinder the implementation of fair business competition and causing distortion in the market.

Domestic News

- BI kept 7-day reverse repo rate unchanged at 6%, in-line with market expectation.

- Price Monitoring Survey from Bank Indonesia showed inflation rate throughout Apr-2019 will reach 0.35% MoM or 2.74% YoY, mainly driven by increasing onion prices and air freight rates.

- Coordinating Minister for Economic Affairs Darmin Nasution projects economic growth in 1Q19 to reach 5.1%. Darmin said that one of the business sectors that would contribute to growth during the period was agriculture.

- Indonesia raised IDR23.4tn in bond auction. Value was above indicative target of IDR15tn according to the financing and risk management office at the finance ministry. The weighted average yields for some of the bonds sold on Tuesday were slightly lower than yields of comparable bonds at the previous auction. Total incoming bids were IDR41.77tn.