08 February 2021

Weekly Market Review (8 Feb 2021) - What happened and What's Next?

Market update

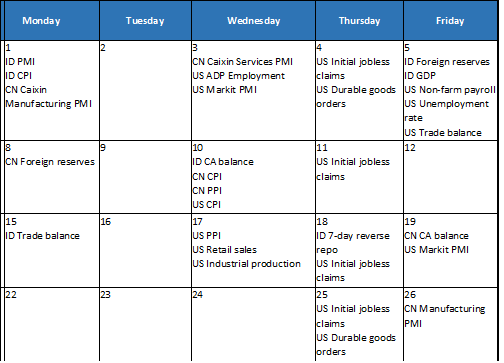

- Global equities showed a strong rebound across the board (SPX +4.6%WoW; DJI +3.9%WoW; MXASJ +5%WoW; MSCI EM +4.9%WoW) along increasing recovery expectation after USD1.9tn Covid Relief Package that has been passed by Senate, as well as fading fears of retail trading in some Reddit stocks. Janet Yellen also commented towards pushing the stimulus bill as well as an improvement in COVID-19 trends. The reflation trade hence reappeared, at least shown by US stocks which cyclical stock outperformed and US10Y yield rose by 10bps WoW. Besides that, vaccine rollout is speeding in the West which vaccination rate in the US 1.4mn doses per day (7DMA)—up from 400k at the beginning of the year, and the global rate is ~4.6mn doses/day vs 940k per day in early Jan. In China, POBC’s liquidity drain on Wednesday has raised a concern by investors, although China may have already peaked on credit and easy monetary policy. On the domestic side, JCI gained +4.9%WoW (foreign net inflow IDR4tn MTD or +IDR15ttn YTD). All sectors recorded positive with strong performance shown by Basic Industry up by +9.4%WoW. Miscellaneous industry was the main underperformer, only up by 1% WoW. News flows to be watched within this week: US initial jobless claim, CPI; China Foreign Reserve, CPI, PPI; Indonesia Current Account Balance

- Rupiah was flat last week at USD/IDR 14,030, as well as DXY index was flat at 91.

- Indonesia government bonds trade higher with yield decreased by 6bps along the curve. Yield on the mid to long tenor decreased by 2-10bps (WoW) with yield on the 15yr decreased the most by 10bps. Meanwhile yield on the 10yr tenor was reported at 6.13% (-6bps WoW) by the end of the week. Indonesia bond market remained supportive amid GDP data released that showed economy was contracted by -2.07% in 2020.

- Total incoming bids in Tuesday’s conventional auction rose to IDR83.3tn (+51%) compare to previous auction incoming bid of IDR53.3tn. Almost all series’ incoming bids rebounded from the previous auction as well, except the 15yr and 30yr tenor which lowered by 18% and 38% respectively. The biggest increases seen in the 5yr and 10yr which rose more than 172% and 106% from the previous auction. At last, government issued IDR35tn as targeted thus no GSO needed.

- Based on DMO data as of 4 Feb 2021, foreign ownership reported at IDR995.55tn or 24.85% of total outstanding.

- US treasury yields climbed for the week and yield curve remained steepened. The longer UST yield were higher as market positioned for a large pandemic relief package from Washington and a stabilizing US labor market. The 10y UST was reported at 1.19% (+8bps WoW) by the end of the week.

Global news

- The US Senate passed Presiden Joe Biden’s USD 1.9tn Covid relief package with Vice President Kamala Harris cast her first tiebreaking vote in the 50-50 Senate.

- US January ADP Employment Change added +174k, higher than consensus +70k and prior figure of -78k.

- US January Markit PMI Services was 58.3 higher than consensus 57.4 and prior 57.5.

- US January ISM Services Index was 58.7 higher than consensus 56.7 and prior 57.7.

- US Jan.30 Initial Jobless Claims recorded + 779k lower than consensus +830k and prior +812k.

- US Jan Unemployment Rate was 6.3% lower than consensus +6.7% and prior +6.7%.

- US Dec Durable Goods Orders up by +0.5%MoM higher than consensus +0.2%MoM, prior +0.2%MoM while Durable ex transportation up +1.1%MoM higher than consensus +0.7%MoM, prior +0.7%MoM

- US trade deficit surged to its highest level in 12 years in 2020, jumped by 17.7%YoY to USD678.7bn. Exports of goods and services tumbled by -15.7%YoY to their lowest level since 2010. Imports of goods and services dropped by -9.5%YoY to a four-year low.

- China’s Caixin Manufacturing PMI dropped to 51.5 in Jan and Caixin services PMI fell to 52.0 from 56.3 in Dec, much weaker than market consensus of 55.5.

Domestic News

- Indonesia GDP growth improved to -2.19% YoY in 4Q20 (-3.49% YoY in 3Q20), to make full year growth at -2.07% YoY (2019: 5.02%), roughly in line with consensus expectation of -2.10% YoY. Real GDP in 4Q20 is recorded at IDR2,709tn while nominal GDP is IDR3,929tn, bringing the full-year real GDP and nominal GDP to IDR10,722tn and IDR15,434tn, respectively.

- Bank Indonesia (BI) reported that the forex reserve increased to USD 138.0bn in Jan-2021 (vs. USD 135.9bn in Dec-2020), marking the all-time high position. Current position is equivalent to 10 months of imports and government external debt repayment.

- BPS announced the CPI only increased by 0.26% MoM in Jan-21, lower than the average January figure in the last 5 years at 0.51% MoM, respectively. Overall, this caused the annual inflation to further decelerate to 1.55% YoY (vs. 1.68%YoY in Dec-20). On the other hand, the core inflation continued to ease to 1.56%YoY from 1.60%YoY as demand remained subdue.

- PEN stimulus dynamic continued which at the latest update, the Ministry of Finance stated to have another increasing budget to IDR627.9trn, along rising new covid-19 active cases which need bigger budgets for health, social aid, sectoral, tax stimulus, and for MSMEs.

- Indonesia's purchasing managers index / PMI in January 2021 reached 52.2, up from the previous month's level of 51.3. This figure is the highest in 6.5 years.

- The government will set a 7.5% income tax rate for foreign taxpayers (PPh 26) as the partners of the Indonesian SWF (INA). The Ministry of Finance stated that this rate is lower than the rates in other countries and the rate in the prevailing regulation of 20%.

Calendar

Febuary 2021

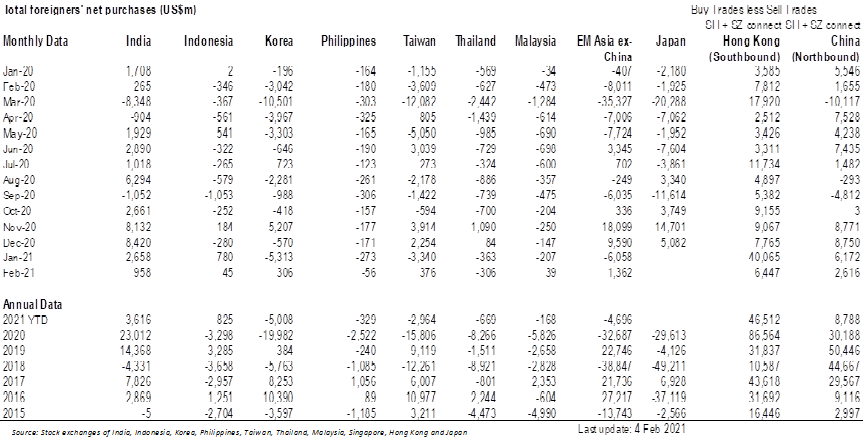

EM Equities net foreign flow