01 March 2021

Weekly Market Review (01 March 2021) - What happened and What's Next?

Market update

- Global equities showed a pull back (DJIA -1.8%WoW; S&P -2.4%WoW), particularly on Asia equities (MXASJ -6.2%WoW), as rising US yields which rattled investor sentiment. The reflation trade might be a dominant topic that highly put pressure on stretched equity valuation. The direction of US bond market might influence the equity direction in the near term with volatility is expected. However, both US and global monetary policy will likely remain in place – for now – to continue supportive on economic recovery. The US House also passed, Biden’s USD1.9trn relief package, moving forward on Senate debate and vote. The next focus will remain on The Fed speakers to have opportunity to forward guidance and AIT framework, US fiscal packages as the focus moves towards Senate negotiation, and OPEC+ meeting where oil producers might discuss the modest easing of oil supply curbs, give recovery in prices. On the domestic side, JCI recorded a slight gain by +0.2%WoW to 6,242 (with foreign recorded net inflow of IDR3.6tnMTD or +IDR14.6tnYTD). Sectors were mixed whereby Infrastructure sector was the main outperformer, up by 5.4%WoW. In contrast, Miscellaneous sector was the main underperformer, down by -4.1% WoW. News flows to be watched within this week: US ISM manufacturing, ADP Employment, Markit PMI, Initial Jobless Claim, Non-Farm payroll, Unemployment rate, Trade Balance; China Caixin PMI, Trade Balance; Indonesia CPI.

- Rupiah weakened by 1.2% WoW to USD/IDR 14,235, in line with other EM currencies’ weakening. On the other hand, DXY index strengthened by 0.6% WoW to 90.9.

- Indonesian government bonds continued to trade lower with yield rose by 8bps along the curve, tracking the 10y UST which hit 1.5% level. Yield on the 5y and 10y tenor was reported at 5.64% (+4bps WoW) and 6.56% (+3bps WoW) by the end of the week. In the press conference of APBN this month, MoF mentioned that it could reduce its bond issuance by tapping the left-over funds from previous year which amount to around IDR80-100tn.

- Incoming bids in Tuesday’s Sukuk bond remained solid with total bids reached IDR24.2tn compared to previous incoming bids of IDR26.1tn. Demand on was more in the shorter tenor with 5yr tenor reached IDR13.1tn or 54% of the total incoming bids. Government only issued IDR5tn vs. IDR12tn initial target and opened additional bond auction on Wednesday and accepted IDR7tn.

- Based on DMO data foreign ownership as of 25 Feb reported at IDR976.39 tn or 23.93% of total outstanding.

- The 10y Treasury benchmark surged to highest against market expectation on how soon the Fed will be forced to tighten policy. As for now, officials are stressing that the Fed has no plans to raise rates given the lingering weakness in the labor market. Meanwhile, The House of Representatives passed President Joe Biden’s USD1.9 trillion stimulus package early Saturday, which includes extensions to programs designed to assist millions of unemployed Americans and provides financial support for state and local governments. By the end of the week, 10y UST was reported at 1.44% (+10bps WoW)

Global news

- President Biden’s USD1.9trn “American Rescue Plan” has been passed by The US House Representative, as widely expected. Therefore, the progress will continue to a Senate debate and vote as early as next week.

- US initial jobless claims recorded 730k, lower than consensus expectation of 825k and prior week of 861k.

- US GPD Annualized QoQ was 4.1%, lower than consensus expectation of 4.2% but higher prior result of 4.0%.

- US Durable Goods order was 1.2%, higher than consensus expectation of 1.1% and prior result of 0.5%

- China PMI Manufacturinng was 50.6, lower than consensus expectation of 51 and prior 51.3.

Domestic News

- Indonesia Consumer Price Index (CPI) to record an inflation of 0.10% MoM in Feb-2021, in line with consensus expectation (prior 0.26%MoM in Jan-21). Overall, the annual inflation was 1.38% YoY (vs 1.55% in Jan-2021), slight lower than consensus expectation of 1.4%. Core CPI was 1.53%, in line with consensus expectation (vs 1.56% in Jan-2021)

- Jan21 state expenditure realization reached IDR145.8tn (+4.2% YoY), 5.3% of FY21E. On the revenue front, Jan21 state revenue realisation reached IDR100tn (-4.8% YoY), 5.7% of FY21E. This resulted to budget deficit realization of IDR45.7tn (+31.5% YoY), or 0.26% of GDP.

- Bank Indonesia reported a balance of payments surplus of USD2.6bn in 2020, with a slight deficit of USD0.2bn in 4Q20. There was a continued surplus in the current account of USD0.8bn (0.3% of GDP) and moderate capital and financial account deficits.

- The Government shared details on the 49 implementing laws (45 Ministerial Decree and 4 Presidential Decree) of the Omnibus Law. The implementing regulations shared more details such as in the labor laws, severance package, foreign property ownership and many more.

- The Ministry of Finance raised PEN budget to IDR699.4tn from IDR688tn (7th time budget announced to increase). This time, the rise is mainly driven by higher allocation in healthcare program to IDR176.3tn, up 178% from 2020 realization of IDR63.5tn.

- The government officially issued sales tax on luxury goods (PPnBM) incentives for vehicles under 1,500 cc with minimum local purchase (TKDN) of 70% stipulated in Finance Ministry Regulation (PMK) No. 20/PMK.010/2021. According to Article 5b PMK No. 20/2021, 100% of the PPnBM would be borne by the govt from Mar-May, 50% from Jun-Aug, and 25% from Sep-Dec.

- The government has extended the micro-based social restrictions (PPKM Mikro) in Java-Bali for two weeks until 8 March 2021.

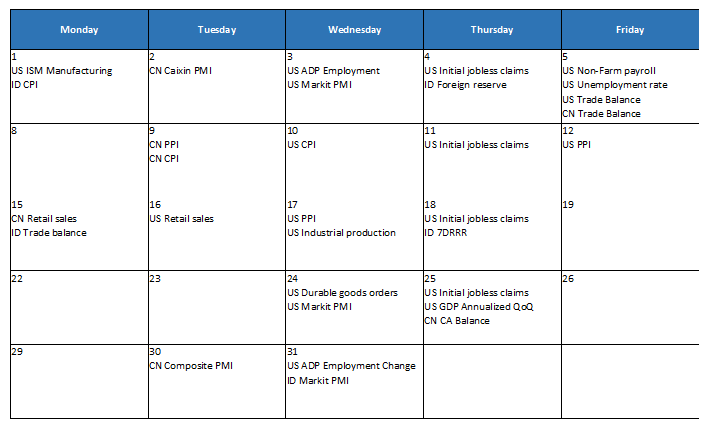

Calendar

March 2021

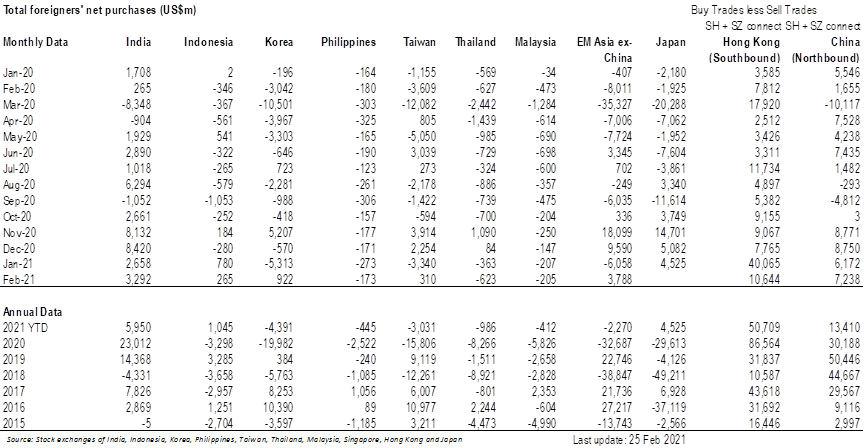

EM Equities net foreign flow