06 May 2019

Weekly Market Review (6 May 2019) - What happened & What's next?

Market update

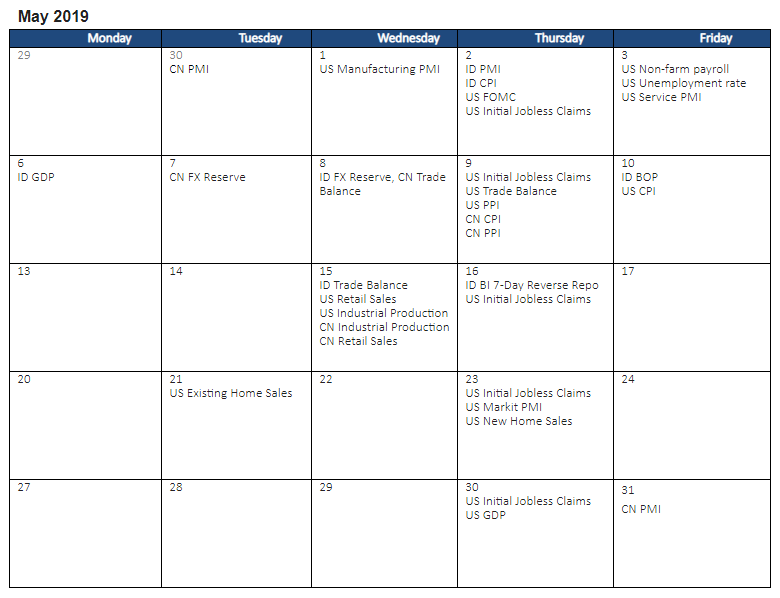

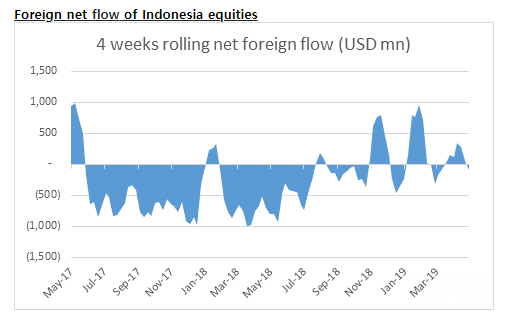

- Global stock indices were mixed but mostly lower for the week (Dow Jones -0.1% WoW, S&P +0.2% WoW, Hang Seng +1.6% WoW, Shanghai Composite -0.3% WoW). Investors were disappointed by Federal Reserve Chairman, Jerome Powell’s remarks last Wednesday. Powell offered no indication the central bank was eager to move rates either direction although investors were hoping for a rate cut indication. On the other hand, US job report is stronger than expected, added 263,000 new jobs in April. On the domestic side, JCI index closed the week lower -1.3% WoW along with net foreign sell of –USD 65mn . The most outperformed sectors were Agriculture +0.9% WoW and Trading +0.3% WoW. Whereas the other sectors booked losses for the week. Newsflows to be watched within this week include: Indonesia FX reserve, Indonesia BOP, US initial jobless claims, US trade balance, US PPI, China FX reserve, China trade balance, China CPI and China PPI.

- IDR weakened again to IDR 14,266 (-0.5% WoW), one of the worst performing currencies in emerging market. DXY also weakened by -0.5% WoW to 97.5.

- Negative sentiment came from concern on weaker IDR and strong US jobs data. This made IDR bond market yield weaker by 12-27 bps. 5 years yield increased the most.

- Foreign investor increased position by IDR 2.6tn, mostly seen on 5 years series.

- After strong jobs data released, 10 years US treasury yield increased from 2.51% to 2.54%. US NFP increased by 263,000 vs consensus of 180,000. In addition, unemployment rate was also better than expected at 3.6% vs consensus’ estimate of 3.8%.

Global news

- US ISM manufacturing index slipped to 52.8% in Apr-19 from 55.3% in the previous month. The number is disappointing, below consensus’ estimate of 54.7%. New orders declined partly due to sluggish demand for exports as trade tensions between US-China remains unresolved.

- The Fed left its benchmark interest rate unchanged in a range of 2.25-2.5%. FOMC is comfortable with their current policy stance. Powell downplayed the possibility of near-term rate cut.

- US economy creates 263,000 jobs in Apr-19 as unemployment falls to 49-year low. The increase in new jobs is better than economists’ forecast of 213,000. While average hourly wage increased by 0.2%.

- The Caixin PMI declined to 50.2 in Apr-19 from 50.8 in Mar-19. However, number above 50 still indicates expansion.

Domestic News

- Indonesia posted a growth of 5.15% in 1Q19, slightly lower than 5.2% in the previous quarter. Slower growth reflects smaller contribution from investment although offset by positive net exports. Meanwhile, contributions from private and government consumption remained resilient.

- Headline inflation accelerated to four month high of +2.8% YoY in Apr-19, primarily driven by food price. Prices of food commodities started to increase in the second half of Apr-19, ahead of the fasting month.

- FDI continued its declining trend in 1Q19, down by -11.5% YoY. It was driven by the primary sector as well as the secondary sector. Yet, investment trend is expected to improve post-election, supported by potential investment incentives such as the revision of negative investment list, reverse Tobin tax as well as wider sector coverage for tax holiday regulation.