19 April 2021

Weekly Market Review (19 April 2021) - What happened and What's Next?

Market update

- US indexes were closed higher last week, S&P and Dow Jones gained +1.4% WoW and +1.2% WoW respectively as yields continued to stabilize. US Treasury yields dived to one-month lows on Thursday as a possible safe haven bid related to increase geopolitical risks, along with Japanese buying and technical factors helped overshadow better-than-expected economic data. Imposition of broad sanctions by US government to Russia as punishment for alleged misdeeds, including interfering in the 2020 US election has caused international risk to grow. Whereas US-China tension remains elevated over Taiwan. Meanwhile, market concerns on vaccine rollout (pause in J&J vaccine), difficult path of US' next fiscal/infrastructure package and Fed continuing to downplay inflation concerns. In AeJ, movement was mixed with North Asia outperformed whilst India/Thailand equities declined due to the resurgence of Covid-19 cases. On domestic side, JCI moved slightly higher +0.3% WoW. Agriculture sector was the main outperformer, up by +6.5% WoW. On the other hand, property declined the most -3.8% WoW. News flows to be watched within this week: ID 7 days reverse repo rate, US initial jobless claims, US home sales and US Markit PMI.

- Rupiah was stable at USD/IDR 14,565, one of the most underperformers in EM as majority strengthened. Meanwhile, DXY index continued to weaken to 91.6 (-0.7% WoW).

- Indonesian government bonds traded higher with yield along the curve increased by 3-13bps. Yield of 30y tenor increased the most by 13 bps whereas yield of 5yr and 10yr were reported at 5.68% and 6.47% respectively by the end of last week.

- Incoming bids in the latest conventional bond auction rebounded to IDR 42.97tn from IDR 33.95tn in the previous auction. Demand for short to medium tenor improved with biggest rebound experienced by the 10yr tenor as its incoming bids rose by IDR 6.3tn (+84.2%) to IDR 13.9tn. In contrast, the biggest drop was seen in the 20yr tenor, fell by IDR 0.8tn (-7.6%) to IDR 9.2tn. Overall, government issued IDR 24.2tn or 4 times higher than the previous issuance. Yet, the number is still lower than initial target of IDR 30tn. On top of that, government also held additional auction on Wednesday and issued IDR 5.8tn bond.

- Based on DMO data, foreign bond ownership as of 14 Apr 2021 was reported at IDR 953.76tn or 22.87%.

- The 10yr US Treasury yield dropped on the back of stronger than expected retail sales and employment data. By the end of the week, the yield was reported at 1.59% (-8bps WoW). Meanwhile, Fed members seemed to be divided about the outlook of inflation according to the March meeting minutes that was released on Wednesday.

Global news

- US retail sales rose by +9.8% MoM in Mar-21 from -2.7% MoM in the prior month, beat expectation of +6.1% MoM.

- US Initial jobless claims drop to 576k, the lowest level since pandemic. Beating consensus' forecast at 710k and declined from previous week number at 769k.

- US core CPI increased to 0.3% MoM in Mar-21 from 0.1% MoM in the previous month and beat expectation of 0.2% MoM.

- China's aggregate financing missed market expectation by only rising to RMB 3.34tn (+12.3% YoY) vs consensus' at RMB 3.7tn.

- China's real GDP growth rose to 18.3% YoY in 1Q21 (slightly below consensus' expectation of 19%) on a low base from 6.5% YoY in 4Q20.

- China's retail sales in Mar-21 jumped +34.2% YoY, outpacing forecast of +27.6% YoY and improved from prior month of +33.8% YoY.

- China's industrial production increased +14.1% YoY in Mar-21, easing from a record 35.1% jump in Jan-Feb and missing market consensus of 17.2% YoY.

- China's export soared +30.6% YoY in Mar-21, slowing from +154.95 YoY in Feb-21 and missing market expectation of a +35.5% growth.

Domestic News

- Mar-21 exports reached US$18.4bn (+20.3% MoM/30.5% YoY). The figure was the highest since Aug-2011 exports value of US$18.6bn. Meanwhile, imports reached US$16.8bn (+26.6% MoM/+25.7% YoY), bringing trade balance to reached surplus of US$1.6bn (-21% MoM/+119% YoY).

- Bank Indonesia's consumer confidence index reached 93.4 in Mar21 (Feb21: 85.8), the highest reading since the 96.5 print in Dec-20. The outlook of consumers across all spending classes also improved in March amid expectations of better economic conditions, as well as improved job availability and income prospects over the next six months.

- Indonesia government targets to invest USD 40.2bn in 2022 for the energy sector, up by +15.52% vs 2021 target of USD 34.8bn. within the sectors, USD 22.6bn will go to oil & gas, USD 7.6bn to coal sector, USD 5.6bn to electricity and the rest to renewable energy.

- The average COVID-19 vaccinations in the past two weeks have slowed down by -8% to 329k doses/day vs 358k doses/day in the middle of Mar-21, mostly due to limited vaccine supply.

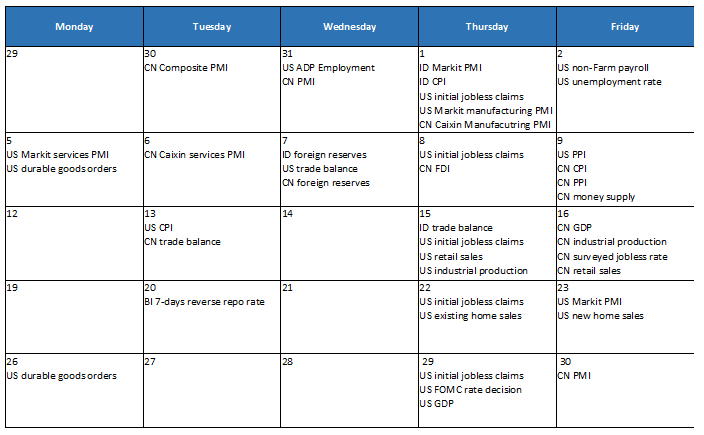

Calendar

April 2021

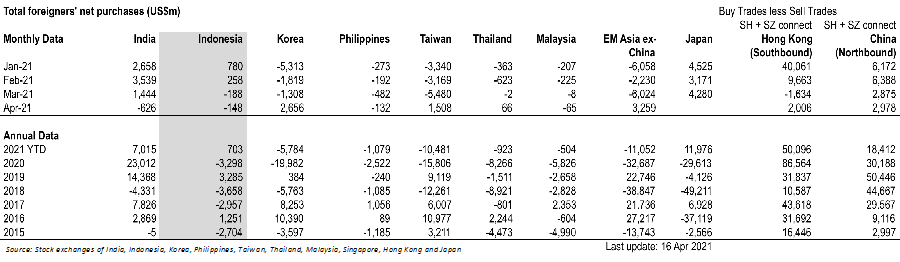

EM Equities net foreign flow