21 June 2021

Weekly Market Review (21 June 2021) - What happened and What's Next?

Market update

- Global indices ended the week lower with S&P and MSCI Asia ex-Japan down by -1.9% WoW and -1.2% WoW, respectively, as Fed turned more hawkish during the FOMC meeting. In addition, Economic data generally on weaker side suggesting slowing momentum. US Core retail sales fell -0.7% MoM in May. Initial jobless claims also rose 37k to 412k for the week ending 12 June. Meanwhile in Asia, there are also signs that China’s growth is slowing down as China’s May activity data missed market expectations (IP growth 8.8% YoY, FAI 5.5% YoY and Retail sales 12.4% YoY) on fading pent-up demand, weakening exports, property-related tightening measures and surging raw materials prices, while fiscal revenue growth dropped to 18.7% YoY in May, led by a slump in non-tax revenue growth. On the Covid-19, cases continued to surge in parts of Asia with Indonesia and Philippines seeing a spike in COVID-19 cases, while caseloads remain high in Malaysia and Thailand. In India, new cases have receded but there remains a risk of a ‘third wave’ as the economy gradually opens. According to the National Health Commission (NHC), China has administered over 990mn total number of doses as of Friday. Meanwhile in the US, the steady pace of vaccination (65% received at least one shot), along with the decelerating growth in new cases/deaths, has led to further removal of restrictions. Japan decided to lift the state of emergency for 9 out of 10 prefectures on 20 Jun and EU recommended lifting travel restrictions from a number of countries, including the US. On the domestic side, JCI index was also down by -1.4%. The most outperformed sector was Technology, up by +33.9% WoW then followed by Basic Materials sector, up by +0.1% WoW. Transportation and Consumer sectors were the main underperformers, down by -5.6% WoW and -4.8% WoW, respectively. News Flows to be watched within this week: US existing and new homes sales, manufacturing PMI, initial jobless claims, PCE inflation.

- Rupiah weakened by 1.3% WoW to USD/IDR 14,375, in-line with other EM peers. Meanwhile, DXY index strengthened slightly to 92.2 (+1.8% WoW).

- Indonesia government bonds’ yield rose by 3-19bps along the curve. Yield on the long tenor increase the most as US treasuries rally. Yield curve continued to steeper as the Fed officials signalled monetary policy tightening could start sooner than previous thought. By the end of last week, yield on the 10yr INDOGB was reported at 6.52% (+19bps WoW).

- The total incoming bids in Tuesday’s sukuk bond auction continued to increase following the previous conventional bond auction with incoming bids reached IDR 46.7tn. These incoming bids were higher than the previous auction’s bids of IDR 44.6tn. Bids were higher for all series except the longest 25.3yr which lowered by IDR 1.8tn compared to the previous auction. The biggest increase was seen in the short tenor 2yr. The government finally issued IDR 10tn as its initial target.

- Based on DMO data, foreign ownership as of 17th June 2021 was reported at IDR 981.21tn or 23.07%.

- US Treasury yields moved higher to 1.57% on Wednesday after The Fed released its policy statement and economic projections, showing increased inflation estimates. The Fed changed its headline inflation estimate to 3.4% for the year. Fed dot plot also showed The Fed expect rate hikes in 2023, a year ahead of prior estimates. By the end of last week, 10y UST yield eased and closed at 1.45% (-2bps WoW).

Global news

- US retails sales in May declined by -0.7% MoM, lower than consensus expectation of +0.4% MoM.

- US PPI in May rose by 0.8% MoM, higher than consensus expectation of +0.5% MoM.

- US industrial production in May rose by +0.8% MoM, in-line with consensus expectation of +0.7% MoM.

- US initial jobless claims recorded 412k, higher than consensus expectation of 360k.

- China retail sales in May recorded +12.4% YoY, below consensus expectation of +14% YoY.

- China industrial production in May recorded +8.8% YoY, below consensus expectation of +9.2% YoY.

Domestic News

- Indonesia recorded trade balance of USD2.4bn in May, in-line with consensus expectation, with export up by 58.7% YoY and import up by 68.7% YoY.

- Bank Indonesia kept 7-day reverse repo rate unchanged at 3.5%.

- Indonesia announced tighter measures PPKM until 5 July with public facilities in red zones to be closed while 75% capacity in non-red zones, shopping malls closing hours shortened to 8pm with 25% capacity, dine in 25% capacity until 8pm, offices in red zone to implement 75% WFH.

- IDX still implement the minimum free float requirements of 7.5% for the IPO of unicorn and decacorn companies. Share ownership owned by non-controlling shareholder is according to its equity, which is min. 20% for equity below IDR 500bn, min 15% for IDR 500bn to IDR 2tn, and 10% for above IDR 2tn.

- Minister of Finance noted that not all staple goods will be taxed. The VAT will only be imposed on premium staple goods.

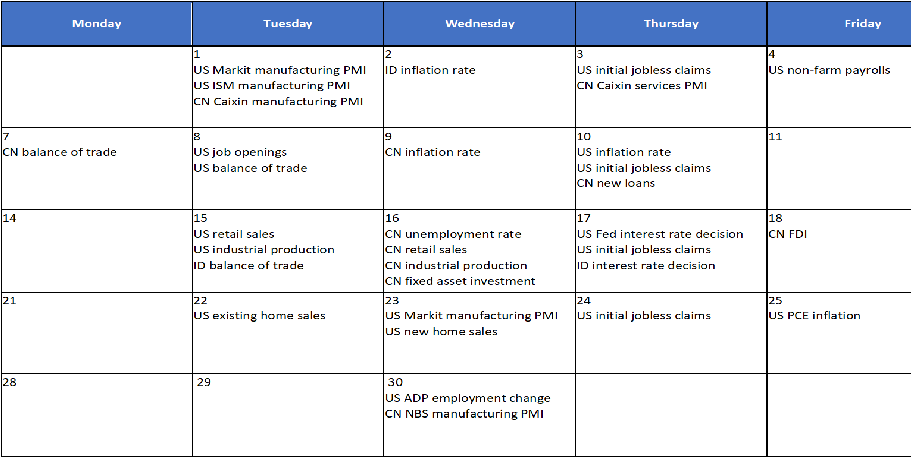

Calendar

June 2021

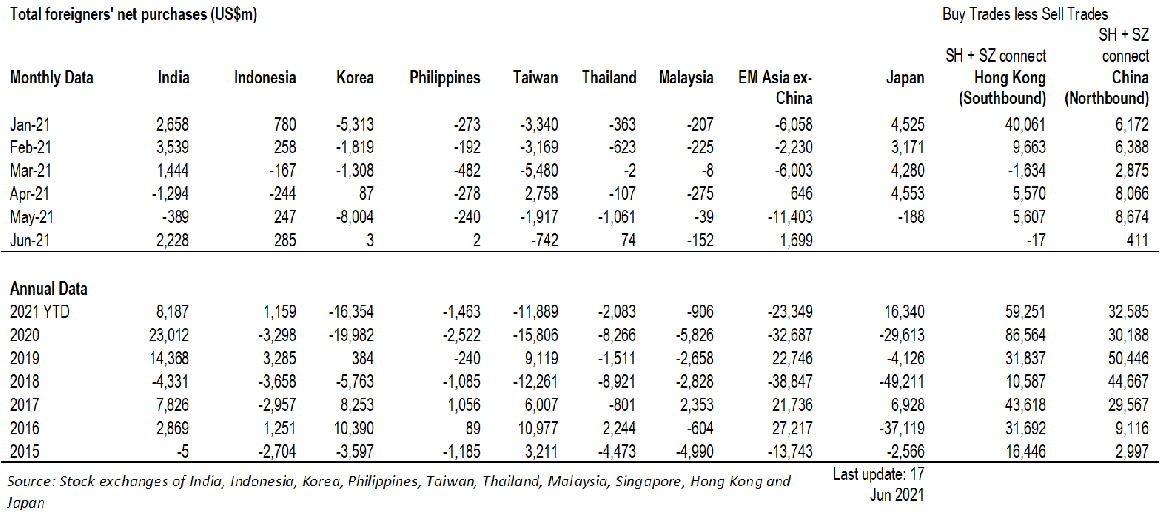

EM Equities net foreign flow