28 June 2021

Weekly Market Review (28 June 2021) - What happened and What's Next?

Market update

- Global indices ended the week higher with S&P and MSCI Asia ex-Japan up by +2.7% WoW and +1.2% WoW, respectively, as Fed Chair Powell in his testimony tried to tone down the hawkish turn from the FOMC. He re-emphasized the Fed’s outcome-based approach and ruled out pre-emptive hikes. But he also acknowledged some uncertainty around the current view of inflation being transitory. Overall, market pricing of rate hikes continue to rise, with almost one full hike now priced for 2022. On the fiscal front, US President Biden secured Republican support for USD 580bn of spending in his infrastructure bill, but a desire to attach this to other spending priorities means passage is unlikely. Infra spend, thus, may only come through the Reconciliation progress, and the overall size may undershoot the proposed USD 2.3tn. On the economic data, June flash PMIs softened a bit with the DM composite PMI declining by 1.7pts to 59.6. The prints came off their elevated levels in all major regions except the Euro area, where the improvement was mainly due to a gain in the services component. On Covid-19, global infections’ curve is still trending downwards, but there is rising concern about the impact of the Delta variant, and some countries including Indonesia have seen a recent spike in cases. On the domestic side, JCI index was up by +0.3%. The most outperformed sector was Healthcare, up by +5.5% WoW. Transportation and Infrastructure sectors were the main underperformers, down by -1.3% WoW and -1.2% WoW, respectively. News Flows to be watched within this week: US PMI, payroll data, initial jobless claims; China PMI; and OPEC meeting.

- Rupiah weakened by 0.3% WoW to USD/IDR 14,425, slightly weaker than other EM peers. Meanwhile, DXY index weakened to 91.9 (-0.4% WoW).

- Indonesia government bonds’ yield rose by 1-8bps along the curve. New wave of Covid-19 infection set the tone for the week as bonds’ price slid. However, the selling pressure was brief. By the end of last week, yield on the 10yr INDOGB 6.53% (+1bps WoW).

- Incoming bids on Tuesday bond auction lowered but remained solid at IDR 69.95tn compared to IDR 78.46tn in the previous auction. Demand still supported by the medium tenors, with the biggest coming from the 4.8yr as incoming bids reaching IDR 24.3tn. The government finally issued IDR 30tn or as initial target.

- Based on DMO data, foreign ownership as of 24th June 2021 was reported at IDR 970.76tn or 22.67%.

- US Treasuries rose slightly after the release of key data indicator on inflation and after U.S. President Biden sealed a USD 579 billion bipartisan infrastructure deal with legislators. By the end of last week, 10y UST yield closed at 1.54% (+9bps WoW).

Global news

- US existing home sales in May recorded 5.8mn, higher than consensus estimates of 5.73mn.

- US new home sales in May recorded 769k, lower than consensus estimates of 865k.

- US initial jobless claims for the week recorded 411k, worse than consensus estimates of 380k.

- US personal income in May recorded -2% MoM, better than consensus estimates of -2.5% MoM.

Domestic News

- Govt is allowing all adults get Covid-19 vaccination without having to present a proof of residence in a bid to speed up inoculation process and achieve president’s target of 1mn doses a day by Jul 21 and 2 million doses by Aug21. On 26 Jun, the government managed to administer 1.3mn doses in a single day after deploying military and police to help with the effort.

- State Budget (APBN) data shows that realisation of VAT receipts from coal reached IDR 439.5bn in 5M21, which implies around IDR 87.9bn per month, almost double the realisation in Nov-20 of IDR 48.3bn.

- Gov’t expects that GDP growth in 2Q21 to still grew by 7%. Previously Gov’t expects it to reach 7.1% - 8.3%, however the rising Covid-19 cases makes the upper range target not achievable.

- PEN budget realisation reached IDR 226.6tn as of 18 June 2021, which is equal to 32.4% of budget. Acceleration has been seen in the budget for priority programs, which rises by IDR 16.3tn to IDR 38.1tn, from 11 May 2021.

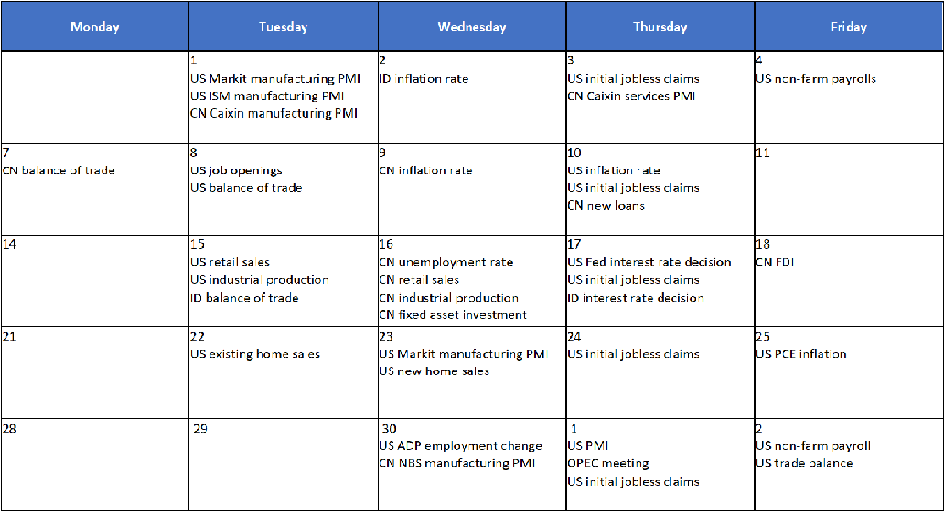

Calendar

June 2021

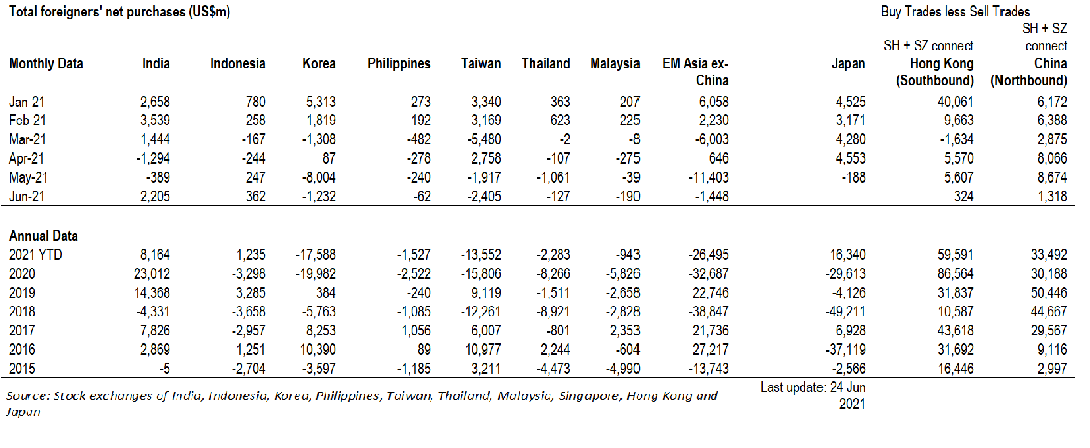

EM Equities net foreign flow