12 July 2021

Weekly Market Review (12 July 2021) - What happened and What's Next?

Market update

- Global indexes were closed mixed, US equities booked gains while Asian equities slumped further. Asian indexes were weighed down by China stocks due to China's regulatory crackdown on tech company Didi Chuxing along with surge in Covid-19 cases and restriction in some countries. On the other hand, US stocks (Nasdaq and S&P) ended the week at new highs amid declining US bond yields. Concern on Delta variant, peak on US growth and technical UST supply factors have sent long-term yields down to its lowest level since February. Lower than expected US ISM services data as well as higher than expected initial jobless claims indicating slower growth as peak re-opening phase fades away. On domestic side, JCI was closed relatively flat +0.3% WoW. The best performing sector was technology +4.7% WoW while the worst performer was industrial -2.1% WoW. News Flows to be watched within this week: ID trade balance, US inflation rate, US initial jobless claims, US industrial production, US retail sales, CN trade balance, CN GDP and CN retail sales.

- Rupiah was relatively flat at USD/IDR 14,528, in line with other EM peers. Meanwhile, DXY index weakened by -0.1% WoW to 92.13.

- Indonesia government bonds’ yields were down by 2-10bps along the curve with yield on the 10yr stood at 6.52% (-5bps WoW).

- Incoming bids on Tuesday’s auction rebounded to IDR 83.4tn compared to previously at IDR 69.95tn. The solid demand came from the medium tenors with biggest rebound coming from the new 10yr series of FR91 as its bid reached IDR 34tn or 41% of the total incoming bids. The government finally issued IDR 34tn or slightly higher than the initial target of IDR 33tn.

- Based on DMO data, foreign ownership as of 7th Jul-21 was reported at IDR 972.65 Tn or 22.67%.

- UST yields were lower for the week with spread of the more transmissible delta covid-19 variant dampening sentiment. From data front, the Labor Department’s weekly jobless claims data showed an unexpected jump. 10yr UST yield was at 1.37% (-7bps WoW) by the end of the week.

Global news

- US ISM services index in Jun-21 declined from 64% in the previous month to 60.1%. The number came lower than expectation of 63.3%.

- US job openings in May-21 is in-line with previous month at 9.2mn but lower than consensus' number of 9.3mn.

- US initial jobless claims slightly inched up from 371k in the previous week to 373k, higher than consensus expectation at 350k.

- China's CPI inflation was up 1.1% YoY in Jun-21, slowing from previous month and consensus' expectation at 1.3% YoY.

Domestic News

- Indonesia's government announced PPKM Darurat to be implemented in 15 cities outside Java-Bali region as BOR has exceeded 65%, starting from 12th Jul-21. The activity restriction is similar to the one implemented in Java-Bali area.

- Kimia Farma to start selling vaccines to public on 12th Jul-21 in several cities including Jakarta, Bandung, Surabaya and Bali (first stage). The company has prepared 5k doses for each clinic, with a total vaccination capacity of around 1,700 people/day. The price of Sinopharm vaccine being sold is estimated at IDR 879,140 for two complete doses. In addition, Indonesia received 4mn doses of Moderna vaccine grant from US which partly will be used as a third booster for medical people. The vaccine will come in batches and first batch of 500k doses has arrived on Sunday.

- Governor Perry Warjiyo mentioned Bank Indonesia (BI) could begin tightening monetary policy next year, including potential moves on interest rates if economic recovery remains on track and policy makers see signs of inflation.

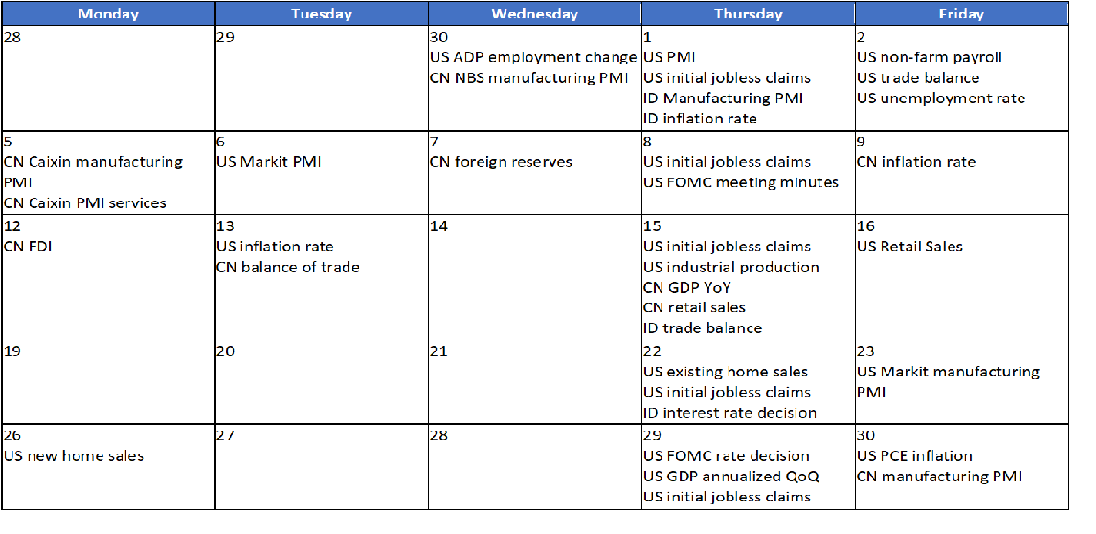

Calendar

July 2021

EM Equities net foreign flow

EM Equities net foreign flow