26 July 2021

Weekly Market Review (26 July 2021) - What happened and What's Next?

Market update

- Global indexes were closed mixed where US equities touched new high (S&P 500 +2%WoW; DJI +1.1%WoW), meanwhile Asian stocks struggled (MSCI Asia ex-Japan down by -2.2%WoW). US stocks recorded gain along US long end bond yield stabilization and strong earning reports, reducing the concern on the spread of delta variant. Key focus in the coming week will be US core PCE and FOMC meeting whereby tapering discussions are likely to be intense and market will continue to monitor the Fed’s stance on inflation whether transitory or not. In other hand, Asian stocks slumped due to China stocks subdued along stricter regulation which might be imposed on China education sector (including turning tutoring companies to non-profit). Broader negative sentiment from the plunged of China’s Education stocks curb foreign investors’ confidence in China stocks on which area that become the next target of expanded state control. China’s stock market suffer will likely be a gain for some other parts of the Asian equity– as investors hunt for the next set of investment opportunities that benefit from long-term structural themes of digitalization/disruptive e-commerce/technology/fintech/payments/ed-tech, and others. India, Korea, and ASEAN (including forthcoming tech IPOs) appear to be beneficiaries. However, the spread of delta variant may hamper growth along the rolling of the social restriction. In the domestic side, JCI continued to record gain, up by +0.5%WoW, with sectors mixed movement. After becoming the worst performer in the past week, Technology sector then became the most outperformer, up by 3.1%WoW. In contrast, Consumer Non-Cyclical sector plunged by -2.5%WoW, underperformed others. News Flows to be watched within this week: US FOMC, PCE inflation, GDP annualized QoQ, Initial Jobless claims, new home sales; China manufacturing PMI.

- Rupiah was relatively flat at USD/IDR 14,493, in line with other EM peers. Meanwhile, DXY index slightly strengthened by 0.2%WoW to 92.91.

- Indonesia government bonds traded mix with yield on 5-10y tenor were down by 2-4bps while yield on the 15y increased by 5bps. On Thursday Bank Indonesia decided to keep key rate unchanged at 3.5% as market expected. BI decided to keep interest rate unchanged as they need to maintain Rupiah stability amid global uncertainty.

- Incoming bids on Tuesday’s auction increased significantly as market liquidity remained ample. The incoming bids were recorded at IDR95.55tn compared to the previous auction at IDR83.4tn. Demand mostly came from the new series FR91 (10y), FR90 (5y) and FR92 (20y) which accounts for 78% of the total incoming bid. At last, the government finally issued IDR34tn.

- Last week Government also successfully issued SBR10 at IDR7.5tn. This issuance breaks record for non-tradeable retail state security issuance in terms of number of investors and amount compared to the previously offered. In the same week, the government also issued dual currency global bonds USD1.65mn and EUR500mn.

- Based on DMO data, foreign ownership as of 21st Jul 2021 was reported at IDR962.77 tn or 22.73%.

- 10y UST still hovered around 1.3% after hit 1.19% on Tuesday. Fears of renewed lockdowns due to emergence delta variant and the Fed insistence that the inflation will remain within its 2% target have recently spurred a sharp decrease of treasury yields. By the end of the week, 10y UST was reported at 1.30% (+1bps WoW).

Global news

- US Manufacturing PMI hit record high of 63.1 in Jul-21, higher than consensus expectation of 62 and prior 62.1.

- US Initial Jobless Claims added +419k higher than consensus expectation of +350k and prior +360k. The stall in the improving trend coincides with greater concern about delta variant, although other factors might also influence.

- US Jun Existing Home Sales up by +1.4%MoM slightly lower than consensus expectation of +1.7%MoM, but higher than prior -0.9%MoM.

- The European Central Bank (ECB) revised its forward guidance on interest rates, expecting rate to remain stagnant until it sees inflation reaching 2% well ahead and durably of the end of its projection horizon. The ECB will continue asset purchase program until at least March 2022.

- PBOC (China Central Bank) left interest rates for corporate and household loans steady (3.85% for 1Y, 4.65% for 5Y), despite growing expectations for a cut.

Domestic News

- President Jokowi extended PPKM Level 4 restrictions to 2 Aug, with key changes: Traditional market (groceries) may open until 8pm, 50% capacity; Traditional market (non-groceries) may open until 3pm, 50% capacity; Small vendors, warong, barbershop, laundry, car wash, and other micro businesses may open until 9pm; Outdoor food stalls, hawker center may open until 8pm, dine-in max 20 min.

- Bank Indonesia (BI) decided to hold BI 7-Day Reverse Repo Rate at 3.50%, while also maintaining the Deposit Facility (DF) rates at 2.75% and Lending Facility (LF) rates at 4.25%. In addition, BI has revised down its national economic growth projection for 2021 to 3.5-4.3% from 4.1-5.1% previously, given the emergence of delta variant.

- BI’s governor, Perry Warjiyo, reported loan growth of 0.59% yoy as of Jun. Going into 3Q21, BI projects 3Q loan growth to be lower than he initially expected due to the mobility restriction during emergency PPKM. For the 2021, BI projects loan growth to be at 4-6%.

- The government is currently preparing to launch wage subsidy program (BSU) again this year, after previously discontinued earlier this year. BSU program to be targeted towards workers in non-critical sectors affected by level 4 PPKM; each worker will receive IDR1mn.

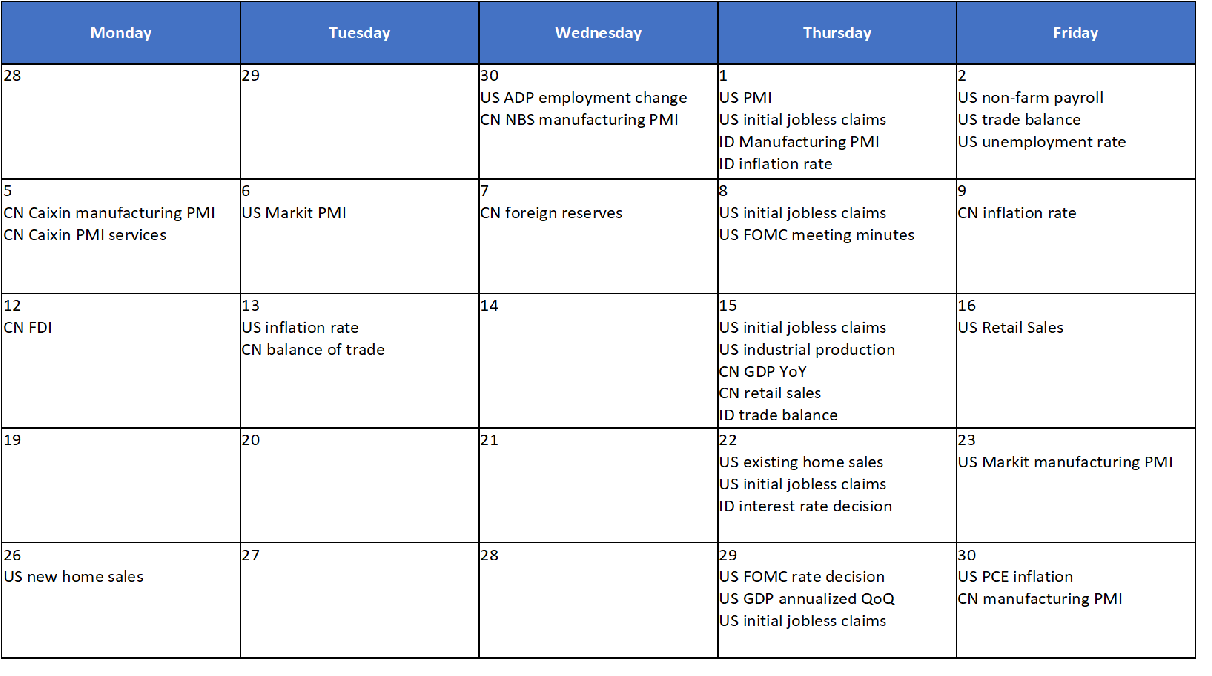

Calendar

July 2021

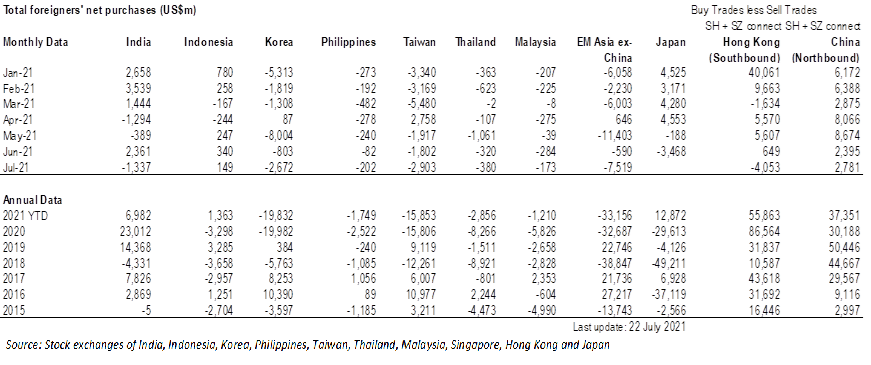

EM Equities net foreign flow

EM Equities net foreign flow