30 August 2021

Weekly Market Review (30 August 2021) - What happened and What's Next?

Market update

- Global stocks rebounded with S&P 500 up by+ 1.5% WoW and MSCI Asia ex-Japan +4.1% WoW, from technically oversold conditions the week before, driven by somewhat cautious comments by Kaplan and softer US data the week before and PBOC’s assurance this past week to keep support for the economy. The much awaited Chair Powell’s Jackson Hole speech confirmed a potential Q4 tapering announcement, but as expected, did not provide any clues on exact timing, composition or pace of tapering. On the virus front, new cases of the delta variant showed moderation in growth in the US. Hospitals remain strained, with ICUs at maximum capacity in severely affected areas indicating deaths might continue to rise in the coming weeks. In Asia, case numbers continued to rise on a 7DMA basis: Japan (~22.7k, new highs), India new cases have picked up in the past few days (33.7k), Malaysia (remains elevated at ~21.6k), Philippines (~15.5k, new highs) and Vietnam (~12.4k new highs). However, new cases in Thailand declined WoW (~18K vs ~21K), and Indonesia continues to see a decline in fresh infections (~15.5k). On vaccines, the US FDA approved the use of the Pfizer-BioNTech jab for individuals 16 years of age and above, previously the vaccine was only administered under emergency use. On the domestic side, JCI underperformed the region up by +0.2% WoW. Technology sector was the main outperformer with +9.5% WoW, while Infrastructure sector was the main underperformer with -1.9% WoW. News flows to be watched within this week: China PMI and US initial jobless claims.

- Rupiah strengthened by 0.2% WoW to IDR 14,418/USD, underperformed compare to other EM currencies. DXY index declined by -0.9% WoW to 92.7.

- Indonesian government bonds yield down by 3-20bps along the curve with reduction in supply due to BI and MoF 3rd joint decree announced on Monday. The number of bond issuance will only left IDR 151tn and the reduction translated to the reduction on the biweekly auction target that down to IDR 20-24tn from IDR 30-35tn previously. BI also committed to purchase up to IDR 215tn worth of tradeable bonds in 2021 and IDR 224tn in 2022. By the end of the week, the 10yr was reported at 6.17% (-20bps WoW).

- Incoming bids on Tuesday’s sukuk auction was booked quite high with demand reached IDR 52.47tn compared to the previous bids of IDR 52.7tn. 5% of the incoming bids went to short tenors. The government issued IDR 9tn.

- Based on DMO data, the foreign ownership as of 26th Aug was reported at IDR 973.99tn or 22.29%.

- The Fed dovish remarks on the annual Jackson Hole indicates that the Fed will remain cautious in rising rates as it tries to nurse the economy to full employment. The Fed will also begin reducing its monthly purchases of US Treasuries and mortgage-backed securities. By the end of last week, 10y UST was reported at 1.31% (+5bps WoW).

Global news

- US core PCE inflation declined modestly to 0.34% MoM in July largely in line with market expectations.

- Markit flash services came in significantly below market expectations (55.2 for August vs Cons: 59.2) driven by the resurgence in cases which impacted service sector activity while manufacturing PMI declined by 2.4pp to 61.2 in August (Cons: 62.3) mainly due to manufacturers struggling with an uncertain supply chain outlook and slower growth momentum.

- PBoC and six ministries have pledged to increase financial support to rural areas via PBoC rediscounting, re-lending as well as cuts to RRR, as per the briefing released on 26 August.

- Bank of Korea raised its policy rate by 0.25% to 0.75%.

- China regulatory pressures continue with Dow Jones reported that China will seek to ban companies with rich consumer data from US IPOs. In addition, Chinese cyberspace regulator has asked website platforms to remove all ranking lists of celebrities and a crackdown on China’s online fan club.

- Bloomberg reported that Cyberspace Administration of China will take measures to rectify violations of instances where social media and commercial platforms are seen as ‘maliciously’ or falsely interpreting domestic policies and economic data.

Domestic News

- The Indonesia Stock Exchange (IDX) together with the Financial Services Authority (OJK) launched a simulus for listed companies and prospective listed companies. IDX provides a 50% discount on share listing fees. The new stimulus will take effect from August 30, 2021, to December 30, 2021.

- Financial Services Authority (OJK) noted that banks had disbursed loans of IDR 1,439tn up to July 2021. Statistically, bank credit in July 2021 grew by 0.5% YoY.

- State revenue dropped to IDR 144.61tn in Jul-21 (-10% MoM), due to the drop in both tax revenue and non-tax revenue. 7M21 realisation was at IDR 1,743.6tn (+11.8% YoY), which forms 59% of the budget and outlook.

- Ministry of Finance expects that the budget deficit in 2021 will reach IDR 961.5tn (5.82% of GDP).

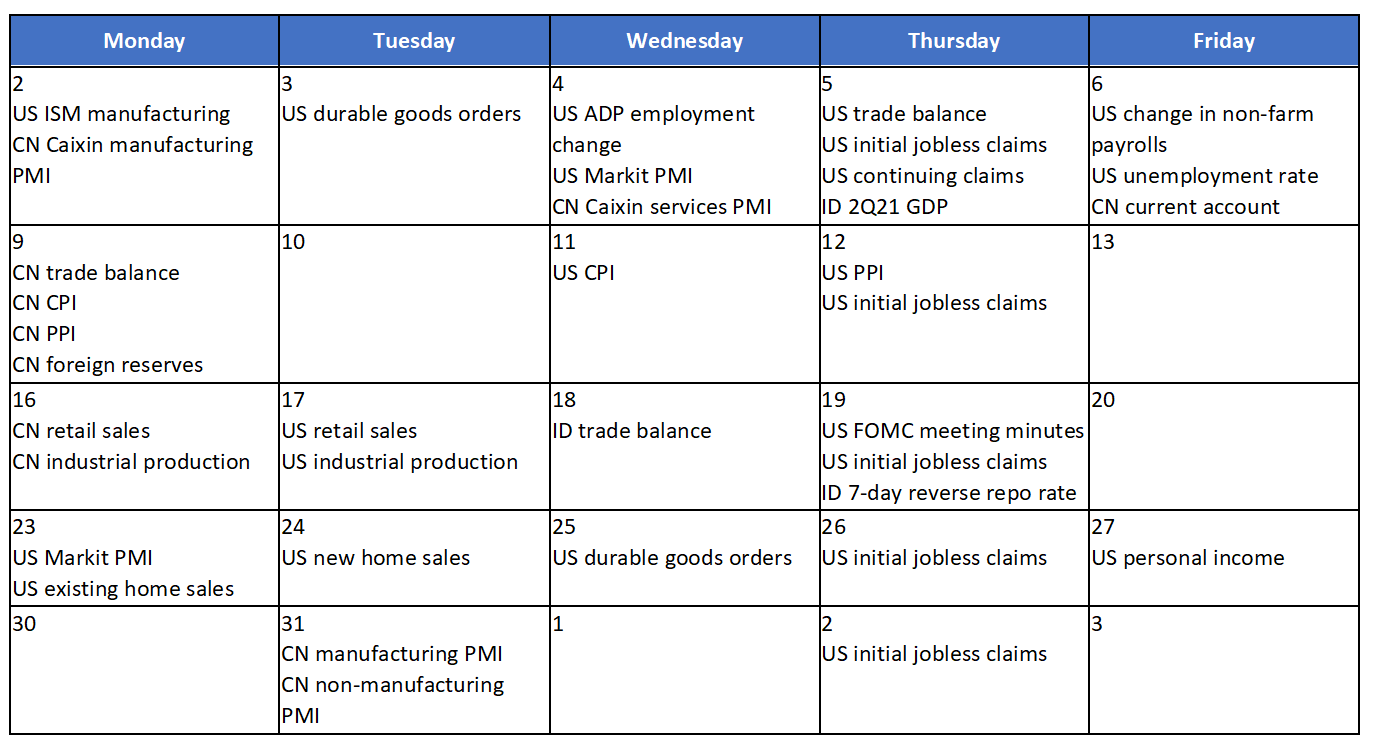

Calendar

August 2021

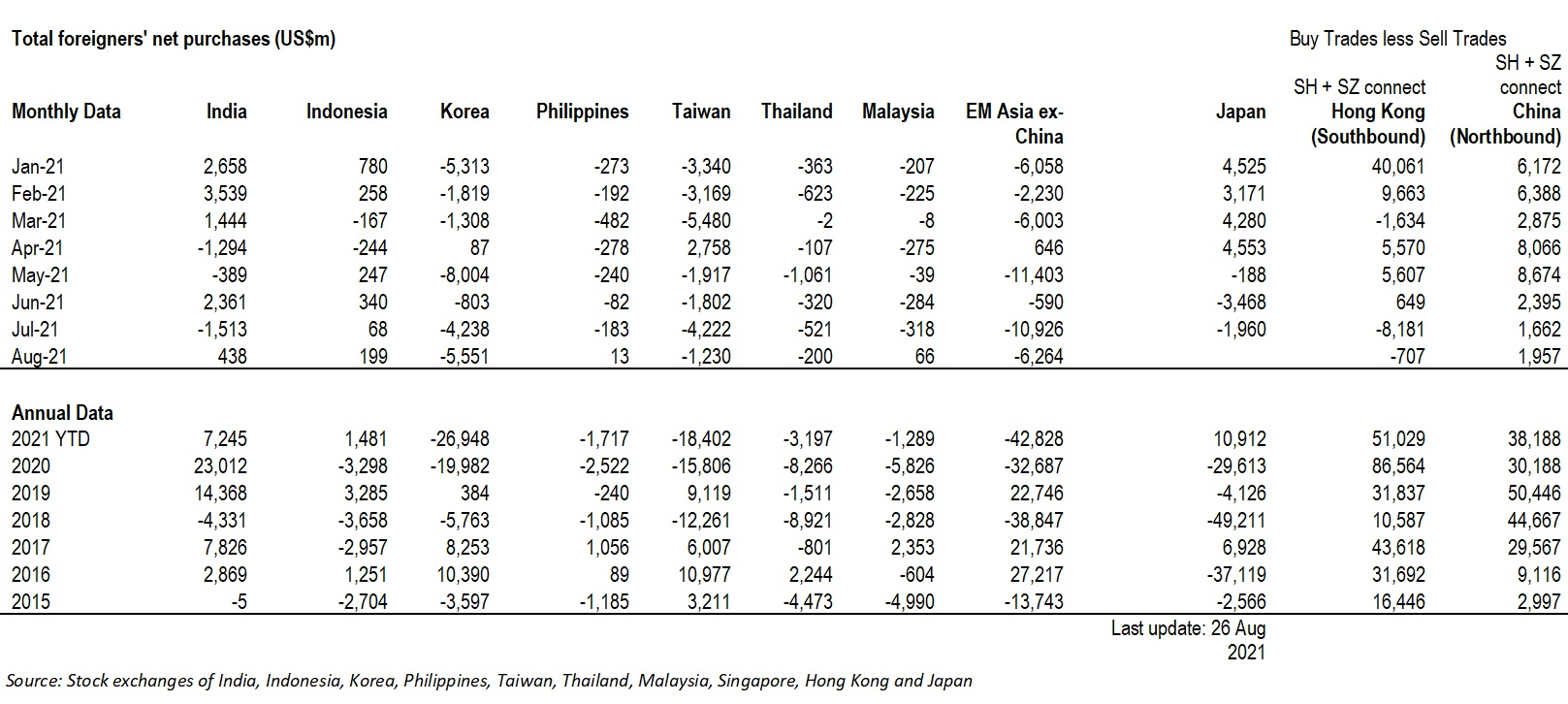

EM Equities net foreign flow

EM Equities net foreign flow