13 September 2021

Weekly Market Review (13 Sept 2021) - What happened and What's Next?

Market update

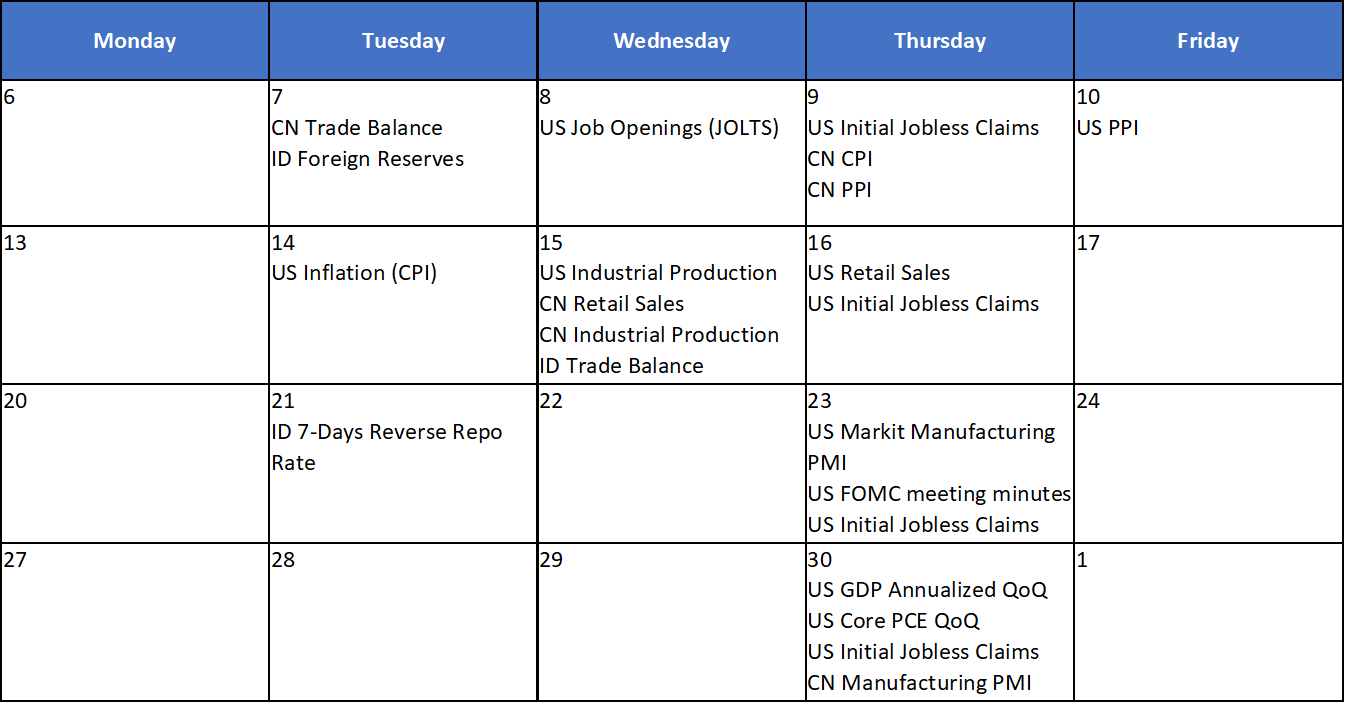

- US equities closed lower with S&P 500 and Dow Jones down by -1.7% and -2.2% WoW respectively meanwhile, China's stock market rebounded after weeks of losses due to regulatory crackdown. Investors were concerned over the spread of Delta variant in US with daily cases averaging just under 150k cases. Markets are also watching the Federal Reserve for an indication of when it might taper its bond-buying purchases. Investors will have to wait until Sept. 21-22 for the next Federal Open Market Committee meeting. On the domestic side, JCI experienced a correction of -0.5% WoW. The main drag is technology sector, down -3.3% WoW whereas the most outperformed sectors were healthcare and industrial, each up by +1% and 0.9% WoW respectively. News flows to be watched within this week: US CPI, US industrial production, US retail sales, US initial jobless claims, CN retail sales, CN industrial production and ID trade balance.

- Rupiah slightly strengthened by +0.4% WoW to IDR 14,203/USD, the best performing EM currencies. Meanwhile, DXY index strengthened by +0.6% WoW to 92.6.

- Indonesian government bonds yields were broadly higher by 1-4bps with yield on the 10y tenor rose by 4bps over the week. By the end of last week, 10y was reported at 6.12%.

- Total incoming bids in Tuesday’s sukuk auction remained strong at Rp 56.61tn compared to Rp 52.5tn on previous auction. Longer tenor 12.5yr (PBS29) attracted the biggest demand reaching Rp 15.6tn. Despite relatively high incoming demand, the government only issued Rp 10tn as target.

- Based on DMO data, the foreign ownership as of 9th Sept was reported at Rp 989.87tn or 22.51%.

- US Treasury yields rose as Producer Price Index showed that parts of the US economy are still contending with inflation. By the end of last week, 10y UST was reported at 1.35% (+2bps WoW).

Global news

- US Initial Jobless Claims added +310k slightly lower than consensus +335k and prior +340kk.

- US job openings in Jul-21 was at 10.9mn, higher than consensus expectation of 10.1mn and previous month at 10.2mn.

- US PPI in Aug-21 was up +0.7% MoM, slightly higher than consensus +0.6% but lower than prior month of 1.0%.

- China's trade balance for Aug-21 in Yuan terms, came in at CNY376.3 billion lower than consensus' expectation of CNY495.51 billion but higher than CNY362.67 billion prior figure.

Domestic News

- Bank Indonesia sees September CPI at +1.65% YoY (+0.01% MoM) as of second week. Rising prices of chicken, cooking oil, and some vegetables are behind the CPI increase.

- As of 12 September, Ministry of Health reported 4,167,511 confirmed cases (+3,779; lowest since 16 May) with 138,889 death (3.3%) and 3,918,753 recovered (94.0%) out of 23,078,739 testing. % new daily positive/ daily new tests reached 3%/124,016 vs last 7D average of 4%/138,074, respectively. On vaccine, 1st vaccination/ 2nd vaccination realization reached 72,766,195/41,734,734, or up by 517,475/200,394 vs last 7D average addition of 842,150/500,527, respectively.

- Indonesia FX reserves rose by US$7.5bn to US$144.8bn (all time high) from US$137.3bn in Jul-21. The increase in FX reserves was coming largely from IMF special drawing rights (SDR) amounted US$6.31bn. In sum, the current FX reserves level is adequate to finance up to 8.7 months of combined imports and government’s external debt servicing (higher than international standard 3 months).