04 October 2021

Weekly Market Review (04 Oct 2021) - What happened and What's Next?

Market update

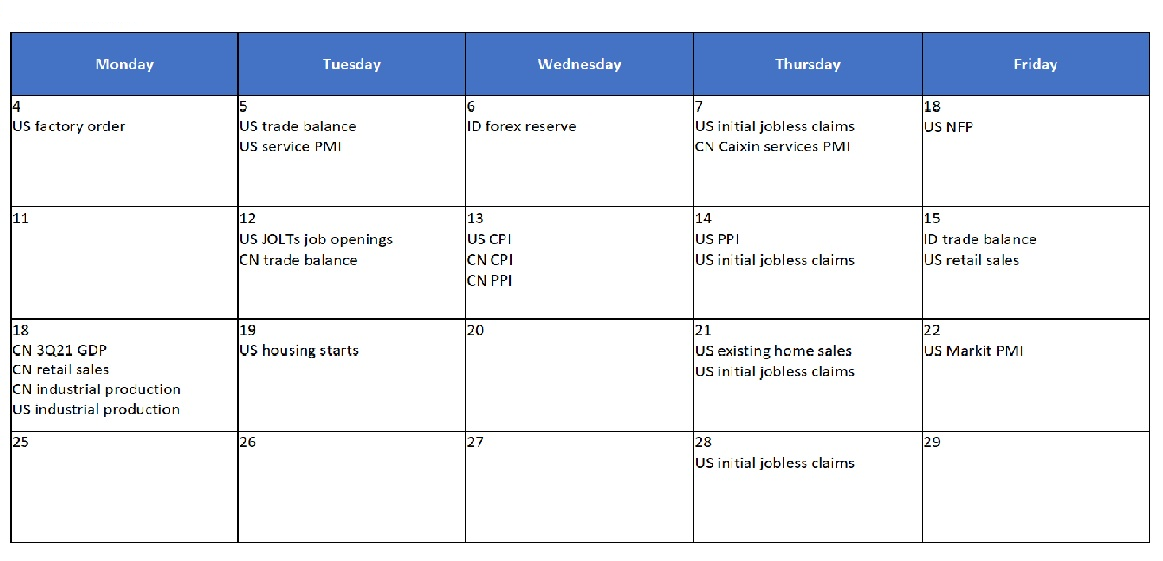

- Global equity indexes were closed lower last Friday with Dow Jones and S&P down by -1.4% and -2.2% WoW respectively. Investors were worried about China Evergrande and whether Congress can resolve battle over US spending plans. House Democrats postponed plans to vote on an approximately USD 1tn infrastructure bill on Thursday as they couldn't reach an agreement around a separate social policy and climate package. In addition, surging prices for natural gas in Europe and Asia have raised concerns that inflation might last longer than expected and could lead to stagflation. Meanwhile, JCI Index booked a gain of +1.4% WoW last week driven by energy sector. Power crunch in China has caused an increase in coal price, hence the rally in coal related stock prices. On the other hand, techology sector was the worst performing sector down by -6% WoW. News flows to be watched within this week: ID forex reserve, US factory order, trade balance, US service PMI, US initial jobless claims, US NFP and CN Caixin services PMI.

- Rupiah weakened by -0.4% WoW to IDR 14,308/USD, underperformed other EM currencies. Meanwhile, DXY index slightly strengthened by +0.8% WoW to 94.04.

- Indonesian government bonds yields were broadly higher, up by 3-10bps as higher UST. Yield on the 10yr was reported at 6.32% (+7bps WoW)

- Total incoming bids on Tuesday’s conventional bond auction was recorded lower than previous auction at IDR 58.83tn (prev. Rp 80.67tn). Most demand went to shorter tenors, where bid of 3-9mo SPN, 5yr, and 10y accounts for 72% of total incoming bid. The government finally issued IDR 12tn.

- Based on DMO data, the foreign ownership as of 30th Sept was reported at IDR 961.78tn or 21.56%.

- The 10y UST topped 1.55% earlier in the week, marked its highest point since June as market concerns about higher inflation and tighter monetary policy. Yields finally ease to 1.48% on Friday (+1bps WoW).

Global news

- US durable goods order were up by +1.8% MoM in Aug-21, exceeded expectation of +0.6% and prior month's figure of +0.5%.

- US initial jobles claimes added +362k, higher than expectation of 335k and prior week 351k.

- PCE index in Aug-21 increased by +0.3% MoM, equals to prior month but slightly higher than consensus' at 0.2% MoM.

- US Markit PMI was at 60.7 in Aug-21, pretty much inline with consensus and prior month's number of 60.5.

- The official manufacturing Purchasing Manager’s Index (PMI) was at 49.6 in Sep-21 vs 50.1 in Aug-21. The number is lower than expectation of 50.1.

Domestic News

- Sep-21 inflation reached +1.6% YoY (-0.04% MoM), with core inflation reached +1.3% YoY, food, drinks and tobacco reached +3.2% YoY, and health reached +2.1% YoY.

- The government and Parliament agreed to cut corporate income tax rate (PPh Badan) from 25% to 22% next year, stipulated in the Regulation Plan (RUU) of Tax Regulations Harmonization (RUU HPP). This is different from previously stipulated tax rate cut to 20% in Regulation (UU) No.2/2020 about Public Finance Policy and Financial System Stability to mitigate Covid-19 pandemic. Yet for those corporations with free float minimum of 40% will be subject to additional cut 3%, which in turn the tax rate will be effectively 19%.

- Government plans to impose carbon tax for coal-based power plant in 2022. In the draft regulation on Harmonization of Tax, the government plans to implement carbon tax for coal-based power plant company worth of IDR30 per kg CO2e in 2022. The carbon tax is lowered as compared to previous draft proposed by the government of IDR75 per kg CO2e.

- The Parliament approved the 2022 State Budget yesterday. In general, there was no change in macro assumption, except for GDP growth, which is now targeted at a pinpoint number of 5.2% from the range of 5.0–5.5% in the draft budget. The fiscal deficit target also remained the same at -4.9% of GDP. Meanwhile, the parliament and government agreed to slightly revise up the revenue and spending, each by IDR 5.5tn.

Calendar

September 2021

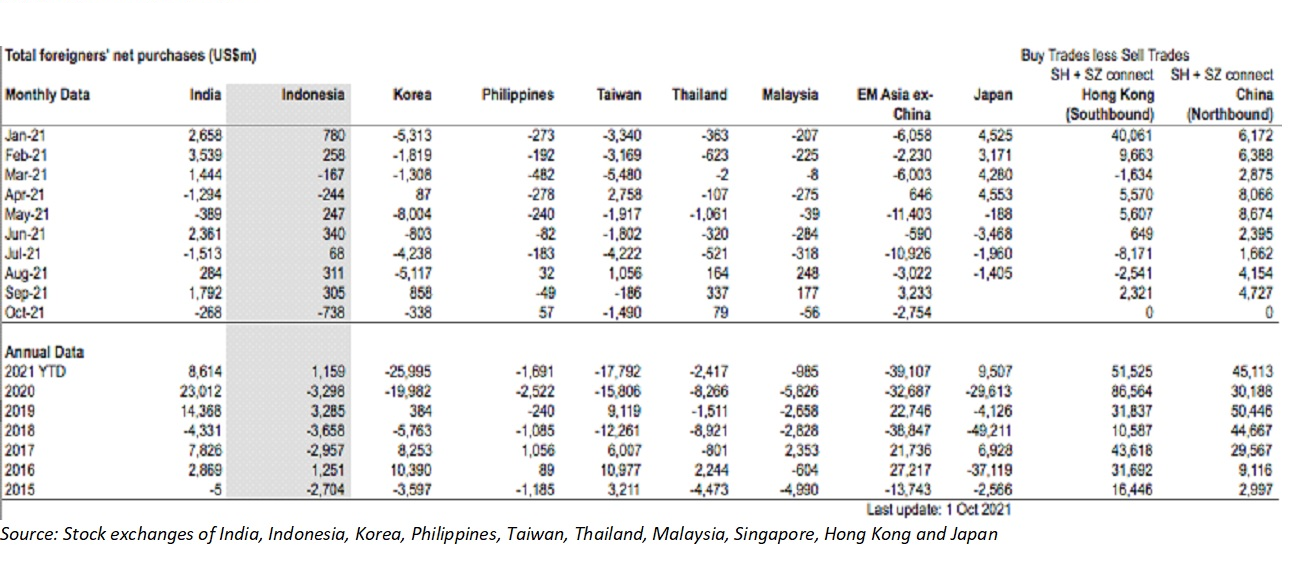

EM Equities net foreign flow