25 October 2021

Weekly Market Review (25 Oct 2021) - What happened and What's Next?

Market update

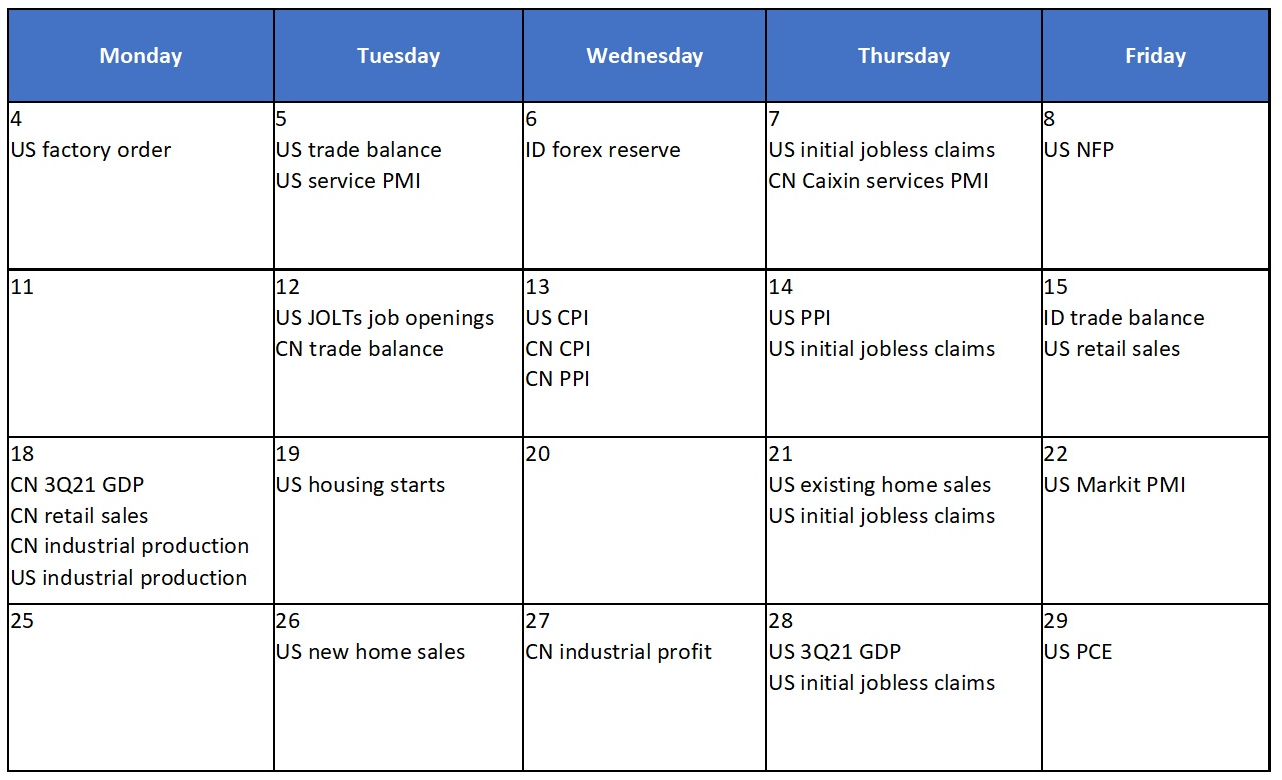

- Global equity indexes closed higher last week with S&P and Dow Jones up by + 1.6% and 1.1% WoW respectively even as technology share fell under pressure. Optimism came from upbeat 3Q21 earnings result in which 85% of US companies beat expectation. Although gains were evaporating on Friday on the back of Fed Chairman Powel's hawkish comments during the speech for Bank For International Settlement, equity markets still managed to end the week in a positive territory. Powell mentioned that US labor market might reach maximum employment next year, possibly paving the way for interest rate hikes. Meanwhile, JCI moved slightly higher, up +0.2% WoW driven by financial (+2.5%) and transportation & logistic (+2.1%) sectors. On the other hand, the major underperformer was energy sector, down -4.9% WoW. News flows to be watched within this week: US new home sales, US 3Q21 GDP, US initial jobless claims, US PCE and CN industrial profit.

- Rupiah depreciated by -0.3%% WoW to USD/IDR 14,123, one of the worst performing EM currencies. Similarly, DXY index also weakened to 93.6 (-0.3%WoW).

- Indonesian government bonds yields declined by 3-7bps despite the 10y UST reached 1.70% due to inflation fear. INDOGBs were supported by the low issuance auction target coupled with strong bids from local banks and financial institutions. By the end of last week, 10y INDOGB was reported at 6.16% (-3bps WoW).

- Total incoming bids on Tuesday’s sukuk bond auction remained solid at IDR 53.42tn, higher than the previous auction bids at IDR 46.1tn. Long tenor bonds attracted higher demand in the auction with 12yr and 25yr had incoming bids of IDR 14.47tn and IDR 11.96tn respectively or almost 50% incoming bids. The government finally issued IDR 5tn as targeted.

- Based on DMO data, foreign ownership as of 21st Oct-21 was reported at IDR 959.16tn or 21.60%.

- The 10-year U.S. Treasury yield hit 1.68% on Friday, after the latest weekly jobless claims report came in lower than expected. Yields have been climbing over the past week as markets bet that inflation would remain elevated as economy reopening could result in supply-chain bottlenecks and labor shortages. By the end of last week, 10y UST was reported at 1.66%

Global news

- US initial joless claims recorded an additional of 290k, lower than consensus estimation of 300k and prior figure 293k.

- U.S. existing home sales were at 6.29mn in Sep-21, beat consensus estimation of 6.1mn and prior figure 5.88mn.

- US Markit manufacturing PMI was at 59.2 in Oct-21, lower than consensus estimation of 60.5mn and prior figure 60.7.

Domestic News

- Govt and House of Representatives have agreed to tax sweetened beverages starting next year. Packaged tea, soda, coffee, energizer, and concentrated drinks would be the tax subjects. So far, the suggested tariff is IDR 1,500/lt for packaged tea, and IDR 2,500/lt for soda and other beverages. Govt will potentially receive IDR 6.25tr additional annual tax revenue from the implementation.

- As of Oct-21, the government had has disbursed IDR 75.15tr of capital injection (PMN). The figure is equal to 55.6% of this year allocation. SOE companies that had received the PMN are PT Hutama Karya (IDR 6.2tr), PT PAL Indonesia (IDr 1.28tr), PT PLN (IDR 5tr), PT Sarana Multigriya Finansial (IDR 2.25tr), PT Pelindo III (IDR 1.2tr), and PT Kawasan Industri Wijaykusuma (IDR 0.97tr).

- Bank Indonesia (BI) has decided to extend credit card payment relaxation by 2 years, effective until 30 Jun 2022. The relaxation includes the extension of the 5% minimum credit payment period and late fee reduction to 1% of outstanding credit (max. IDR 100,000).

Calendar

October 2021

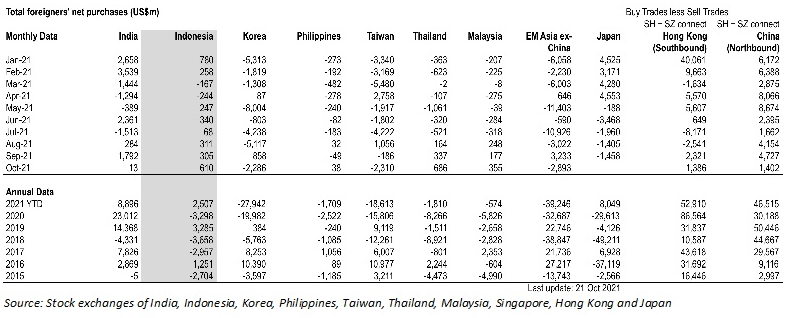

EM Equities net foreign flow

EM Equities net foreign flow