21 March 2022

Weekly Market Review (21 March 2022) - What happened and What's Next

Market update

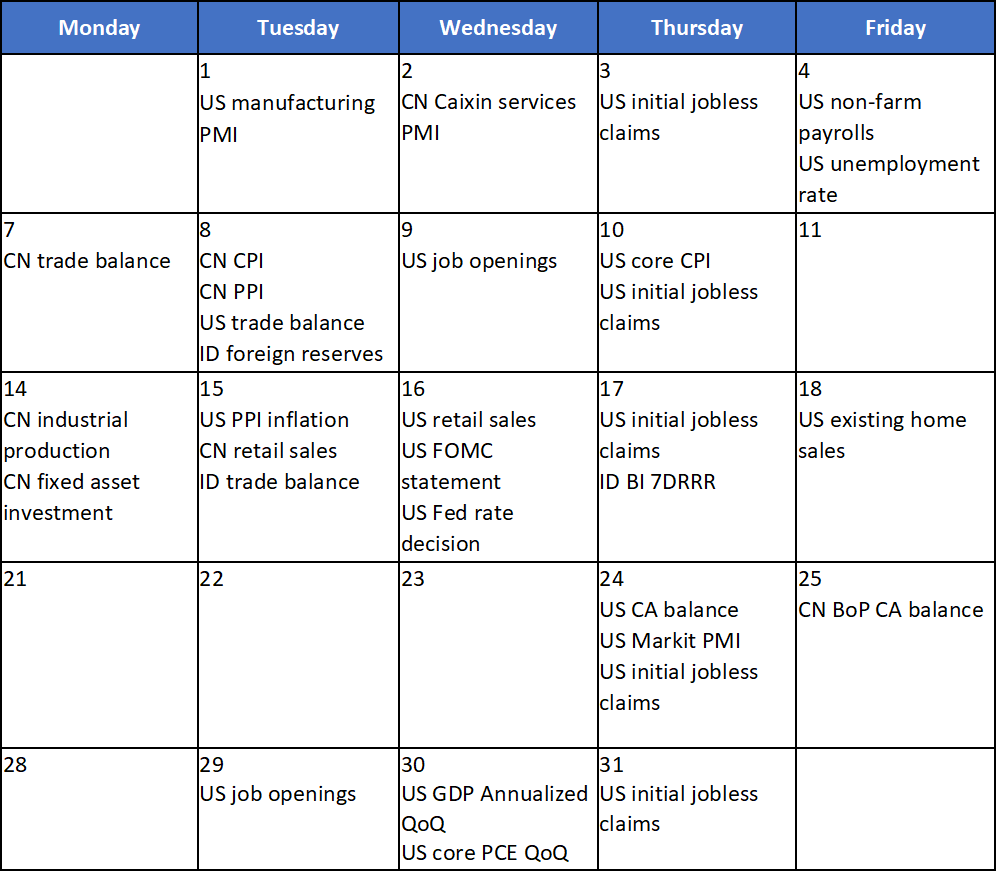

- Global indexes reversed and recorded a weekly gain with S&P 500, DJI, and MSCI ex Japan up by respectively +6.2%WoW, +5.5%WoW, 3.9%WoW. The Fed hiking cycle has been started, but historically struggle for equity market during the Fed’s hike preparation. Powell stated multiple times on “long cycle” indicating reluctance ahead of inflation. However, Powell mentioned a Quantitative Tightening may appear in the next meeting with the details expected in the upcoming Minutes. Quiet end to the week as Russia-Ukraine talks achieve common ground on Ukraine neutrality but disagreements remain there until another date of talk is set. On Biden/Xi meeting, although Xi said that he was against punitive sanctions on Russia and warned US on interfering with Taiwan, he stated that relations between nations should not resort to arms and international community should value peace indicating an acknowledgment China won’t support Russia in its war against Ukraine. On China covid, the country has largely kept covid at bay until last week the Omicron strain has broken its defence. More than 4,000 new infections were reported across China on Sunday (jump from prior hundreds) and the government imposed stay at home order in the country’s northeast. On the domestic JCI book a slight gain of +0.5%WoW. Sectors’ movement mixed with Financial sector and Basic Material sector were the most outperformers, up by +1.5%WoW and 1.1%WoW, respectively. In contrast, Property and Real Estate was the main drag, down by -3.7%WoW. News flows to be watched within this week: US Current Account balance, Markit PMI, Initial Jobless Claim; China Balance of Payment, Current Account Balance.

- Rupiah depreciated by 0.3% WoW to IDR 14,342, underperformed than average EM currencies' performance. Meanwhile, DXY also depreciated by 0.9% WoW to 98.1.

- INDOGBs yields were higher by 2-5bps where the longer 10-20yr series traded weaker. Yield on the 10yr was reported at 6.71% (+3bps WoW). BI kept policy rate unchanged despite the 25bps hike by the Fed. BI also delivered a dovish tone on guidance, supported by still low inflation and IDR stability.

- Total incoming bids in Tuesday’s bond auction continued lower than the previous auction, reaching IDR49.2tn. Demand during the auction was still came from SPNs series, totalling IDR25.9tn or almost 53% of total incoming bids. The government finally issued only IDR17.3tn or lower than its initial target of IDR20tn due to high government excess cash.

- The government has set a yield range for the new sukuk series dedicated for taxpayers who joined the second tax amnesty program wherein to place their declared funds. The new series PBS35 has maturity of 20yr, and the range yield is set at 6.58-6.75%. The transaction will be on 25 Mar 2022 and no target size for this private placement.

- Based on DMO data, foreign ownership as of 17th Mar was reported at IDR867.9tn or 18.13%

- 10y UST was traded above 2% for the whole week, topped 2.2%. Yields rose as market digested the Fed decision to hike rates for the first time in more than three years. By the end of last week, 10y UST was reported at 2.14% (+14bps WoW).

Global news

- The Fed decided to increase the Fed Fund Rate (FFR) by 25bps to 0.25-0.50%, well expected the market. The Fed officials also updated dot plot, where it indicates that The Fed will increase the FFR at each of the six remaining meetings this year, three more hikes in 2023, then, none in 2024. The Fed officials also expects to begin the shrinking of its balance sheet consisted of Treasuries and MBS in the next meeting.

- US Feb PPI was 10%YoY in line with consensus estimation and higher prior figure of 9.7%YoY driven by another surge in energy price.

- US Feb retail sales grew by 0.3%MoM but slowed from Jan retail sales unusual strong 4.9%MoM increase, as Americans faced higher prices and the economic fallout from geopolitical tension.

- US Initial Jobless Claims added +214k lower than consensus’ estimation of +220k and prior +229k.

- China reported Feb YTD retail sales grew by 6.7%YoY, topping consensus expectation of 3%YoY with Petroleum products and gold, silver and jewellery saw the greatest increases.

Domestic News

- Indonesia trade balance recorded a thick surplus of USD3.8bn, higher than consensus estimation of USD1.75bn and prior figure of USD0.93bn. The surplus was gained on the back of continued strong exports growth by +34%YoY (+6.73%MoM), with a big push from commodity exports. Meanwhile, the imports growth decelerated to +25%YoY (-8.64% MoM), with non-oil and gas import slowing the most.

- On the latest RDG (Board of Governors meeting), Bank Indonesia (BI) decide to hold its 7DRRR at 3.5% and maintain deposit facility at 2.75%, and lending facility at 4.25%. The decision is consistent with the need to maintain exchange rate stability and control inflation, coupled with efforts to revive economic growth despite a build-up of external pressure, particularly the geopolitical tensions between Russia and Ukraine.

- BI stated that the first stage of increasing the rupiah reserve requirement, coupled with the Reserve Requirement (RR) incentive since 1st March 2022, has absorbed approximately IDR55 trillion of liquidity in the banking industry. BI added that the absorption has not reduced the banking industry's ability to disburse loans/financing to the corporate sector or participate in SBN purchases.

- Indonesia has raised its palm oil export levy and the maximum rate has been set at USD375 a tonne when the reference price for the edible oil hits USD1,500 a tonne, up from USD175 previously. Indonesian exporters are required to pay an export tax and logistic cost on palm oil shipments on top of the export levy. The maximum export tax and logistic cost are currently USD200 and USD30 per tonne, respectively.

Calendar

March 2022

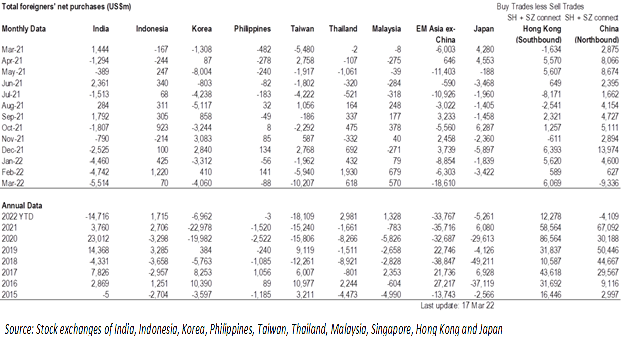

EM Equities Net Foreign Flow