04 April 2022

Weekly Market Review (4 April 2022) - What happened and What's Next

Market update

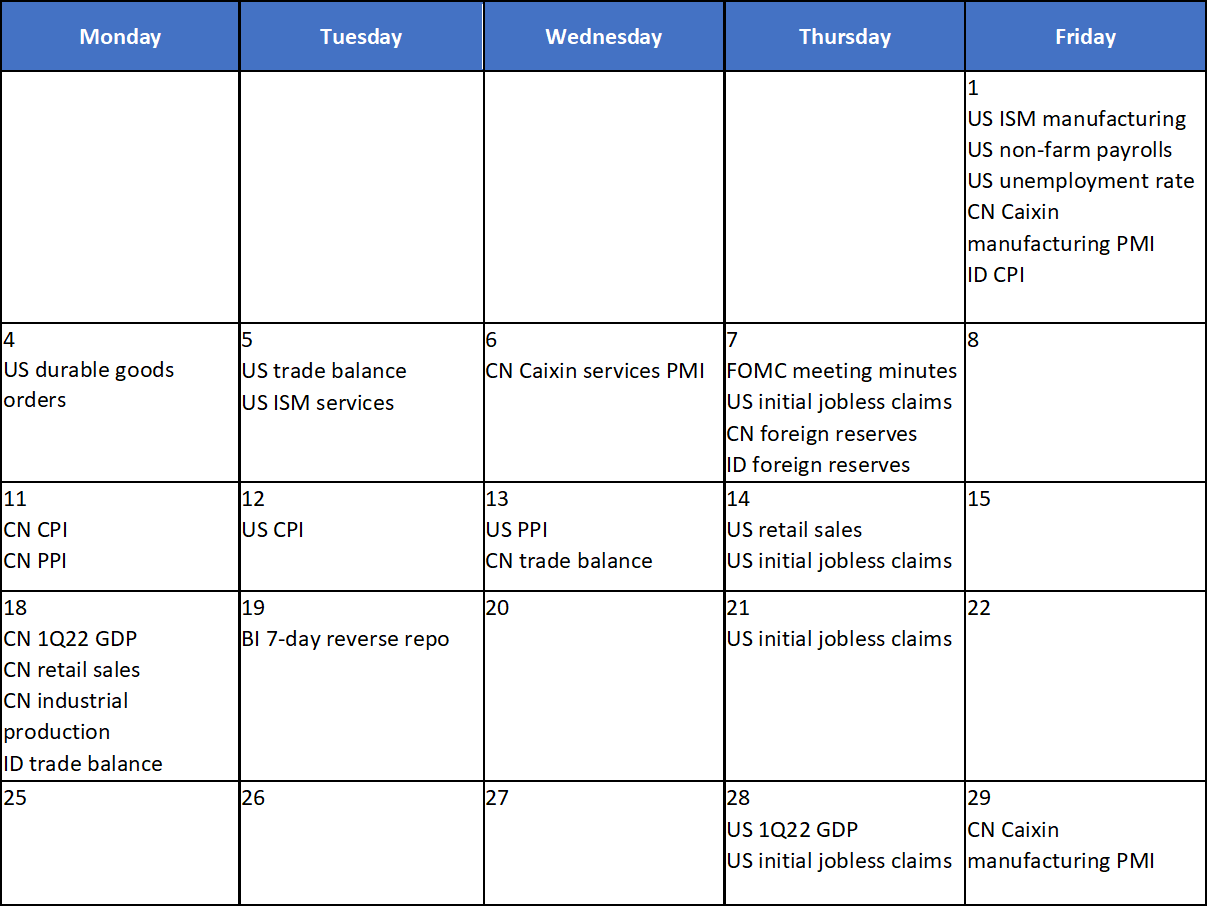

- Global indexes were closed mixed last week with S&P 500 up by +0.1% while MSCI Asia ex-Japan was up by +1.7%. While the COVID outbreak in China continues to weigh on consumption and supply chains, the resultant shortfall from the 5.5% growth may well lead to stronger policy support, which would be net positive. Fed’s hawkishness continued to be at a high level. The other big event of the week was the inversion in the widely-followed 2-10 portion of the US yield. Crude oil prices corrected on the back of US SPR release (1mbd per day) last week. That said, a reduction in SPR and low spare production capacity translates into a higher medium-term price for crude oil (USD80/bl) and an improved outlook. On the macro data, global manufacturing PMI declined to 53.0, dragged down by the war in Europe and COVID in China. China’s PMI prints were weak, with worsening new order component across manufacturing and services. On the domestic side, JCI booked a gain of +1.1% WoW. Technology sector was the main outperformer, booked a gain of +4.3% WoW. On the contrary, Transportation and Logistic sector was the main drag, down by -0.6% WoW. News flows to be watched within this week: US .

- Rupiah slightly depreciated by 0.2% WoW to IDR 14,368, underperforming other EM currencies' performance. Meanwhile, DXY was lower by 0.2% WoW to 98.6.

- INDOGBs were sold off by 2-11bps along the curve with yield on the 10yr was reported at 6.74% (+6bps WoW). Bond traded heavy on the back of US rates move and supply from the auction on Tuesday.

- Total incoming bids Tuesday’s bond auction was lower than the previous auction, reaching IDR 41.6tn compared to IDR 49.2tn bids in the previous auction. Demand was mostly coming from 10yr tenor totalling IDR 14.6tn or 35% of total incoming bids. The government issued only IDR 17tn or lower than the initial target of IDR 20tn. GSO was held on the following day and the government accepted IDR 2.95tn from total incoming of IDR 3.98tn. Added to the regular auction, government issued Rp 20tn in this auction.

- Based on DMO data, foreign ownership as of 31st Mar was reported at IDR 848.29tn or 17.57%

- 2yr treasury yield topped the 10yr for the first time since 2019. The pair was closely watched by market and typically given the most credence that the economy might heading for a downturn when it inverts. By the end of the week, 2yr and 10yr yield were reported at 2.44% (+14bps WoW) and 2.38% (-10bps WoW) respectively.

Global news

- US ADP employment change in March recorded 455k, in-line with consensus expectation of 450k.

- US initial jobless claims recorded 202k, above consensus expectation of 196k.

- US change in non-farm payroll in March recorded 431k, below consensus expectation of 490k.

- US unemployment rate in March recorded 3.6%, better than consensus expectation of 3.7%.

- US ISM manufacturing in March recorded 57.1, below consensus expectation of 59.

- China Caixin manufacturing PMI in March recorded 48.1, below consensus expectation of 49.9.

- China non-manufacturing PMI in March recorded 48.4, below consensus expectation of 50.3.

Domestic News

- Indonesia CPI in March recorded +2.64% YoY, above consensus expectation of +2.55% YoY.

- Gov’t has not completed the roadmap and the implementing regulation for the carbon tax, thus delaying the carbon tax policy to 1 July 2022 from initially planned on 1 April. Currently, gov’t is still arranging the regulation which include tariff, calculation method, collection & payment method and the roadmap.

- Gov’t raised Pertamax (Ron 92) retail fuel price in 16 provinces effective 1 Apr 2022 to IDR 12,500/litre from IDR 9,000 (Note: Java-Bali price). Gov’t has previously mentioned that economical price should be IDR 16k. Pertalite remains subsidized as per planned.

- Gov't debt reached IDR 7tn up to Feb-22. Debt to GDP increases to 40.17%, which is increasingly slightly from Jan-22 figure of 39.63%. 87.9% of the debt is from bonds and 12.12% from loan.

- Ministry of ESDM noted that consumption of subsidized solar and Pertalite has exceeded the quota as of February 2022. Pertalite distribution has reached 18.5% of this year’s quota of 23.1mn kiloliter.

- State budget surplus is at IDR 19.7tn (0.11% of GDP) in Feb-22. This fell from the surplus booked in Jan-22 of IDR 28.9tn, while Feb-21 it was at deficit of IDR 63.3tn (0.37% GDP). In Feb-22, the state revenue reached IDR 302.4tn (+37.7% YoY) while state expenditure at IDR 282.7tn (-0.1% YoY).

- Tax revenue realisation reached IDR 199.4tn as of February 2022 which grew by 36.5% YoY and equal to 15.8% of the target in the 2022 state budget.