11 April 2022

Weekly Market Review (11 April 2022) - What happened and What's Next

Market update

- Major global indexes were closed lower last Friday with S&P and Dow Jones each down by -1.3% and -0.3% WoW respectively as investors continued to digest expectations of the Fed becoming more aggressive in combating high inflation. Earlier last week, Fed Gov. Brainard indicated that the central bank’s monetary tightening may include interest rates hikes as well as a rapid pace of balance sheet reductions that could begin as soon as May. FOMC minutes which was released on Wednesday set the stage for a likely $95bn reduction per month in the central bank’s balance sheet while reaffirming prospects of multiple, half-point increases in interest rates in future meetings. Meanwhile, Russia-Ukraine war still weighing on investor sentiment. On the other hand, domestic side continued to book a gain of +1.9% WoW, buoyed by energy (+7.9% WoW) and basic material sector (+6.7% WoW). Whereas the major underperformer is properties & real estate sector, down by -0.1% WoW. News flows to be watched within this week: US CPI, US PPI, US retail sales, US initial jobless claim, CN CPI, CN PPI and CN trade balance.

- Rupiah slightly appreciated +0.04% WoW to IDR 14,362, outperforming other EM currencies' performance. Meanwhile, DXY also strengthened by +1.2% WoW to 99,8.

- INDOGBs were mixed with 10yr yield was reported 6bps higher to 6.80% in response to the release of Fed minutes for March. Meanwhile yield on the 20yr lowered by 7bps to 7.14%. IndoGB market had sluggish week with a slight offerish tone as market players were on a cautious mood ahead of next week US CPI.

- Total incoming bids Tuesday’s Sukuk auction rebounded to IDR 18.1tn from the IDR 13.8tn on the previous auction. The 6mo SPNS had the biggest demand reaching IDR 8.2tn. The government issued IDR 8.2tn still lower than IDR 9tn target but no Greenshoe option was announced on the following day.

- Based on DMO data, foreign ownership as of 7th Apr was reported at IDR 857.23tn or 17.73%

- Minutes from the March FOMC showed that many Fed members would have preferred a 50bps hike instead of 25bps hike. On balance sheet reduction, Fed agreed to unwind a USD 60bn monthly cap of treasury securities and USD 35bn of mortgage-backed securities. 10yr UST hit its highest level since March 2019 as market continued to digest Fed tightening policy. By the end of the week, 10yr was reported at 2.72% (+28bps WoW).

Global news

- US ISM services index in Mar-22 was at 58,3%, slightly higher than consensus number of 58% and prior's month figure of 56,5%.

- US initial jobless claims recorded 166k last week vs consensus number at 200k and prior's week figure at 171k.

- CN Caixin services PMI slumped unexpectedly to 42 in Mar-22 from 50.2 in the previous month and lower than expectation of 53.

- CN forex reserves fell by USD 25.8bn to USD 3.2tn in Mar-22.

Domestic News

- The Deputy Governor of Bank Indonesia mentioned that BI has created a projection of 2%-4% YoY. But with the continuous increase in prices, BI has recalculated and revised the projected inflation rate for this year to reach upper tier of the target, or at 4% YoY.

- The six schemes prepared by the government, said to be included in the government regulation draft on IKN, which is planned to be completed on April 15th, 2022. The first financing scheme planned is through APBN via budget allocation & finance; second scheme is through cooperation between government and business entity (KPBU); third, participation of SOEs; fourth, private schemes; fifth, international finance; and six, creative financing as of crowd funding from the philanthropic funds.

- Bank Indonesia reported Mar-22 foreign reserves of USD 139.1bn or down USD 2.3bn vs Feb-22 figure of USD 141.4bn. This was the lowest level since Jul-21 and translated to 7.2 months of imports or 7.0 months of imports and government's external debt service.

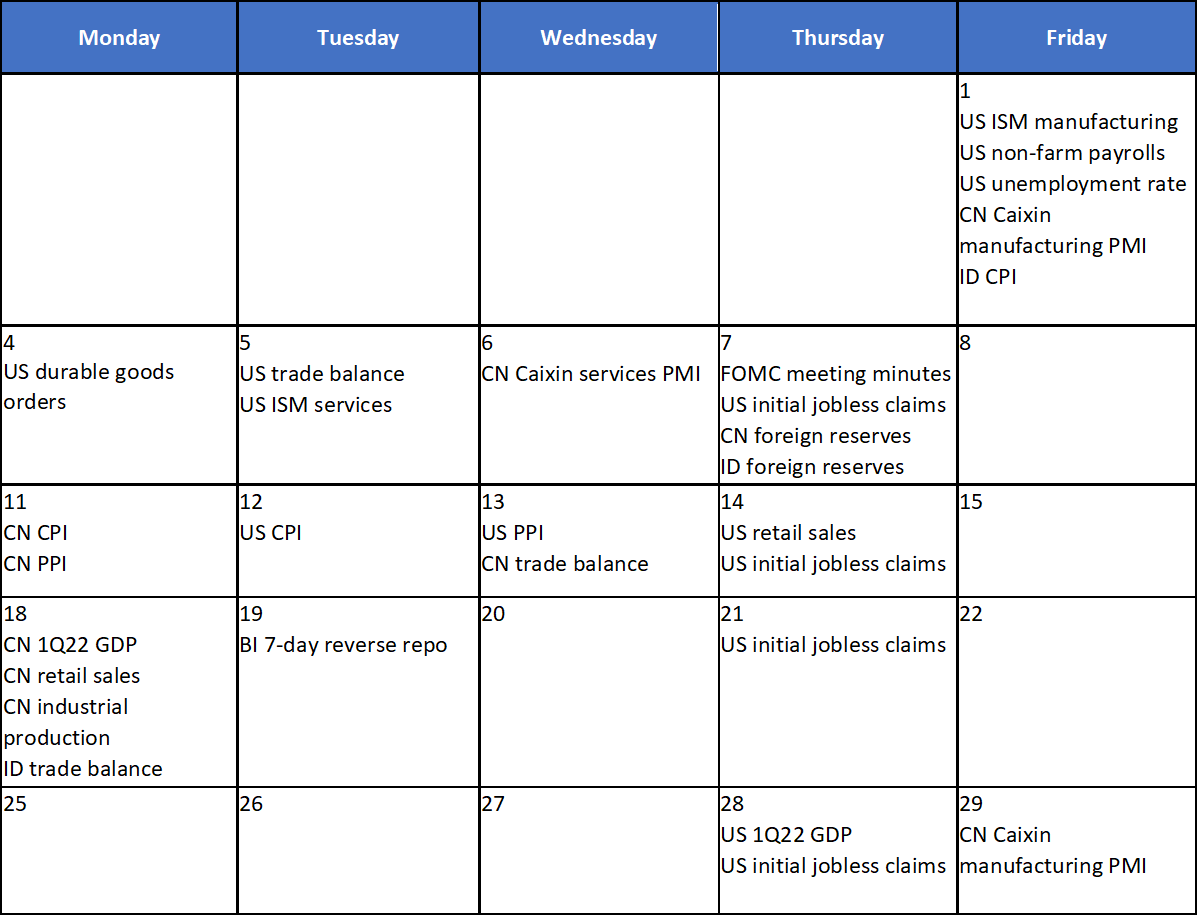

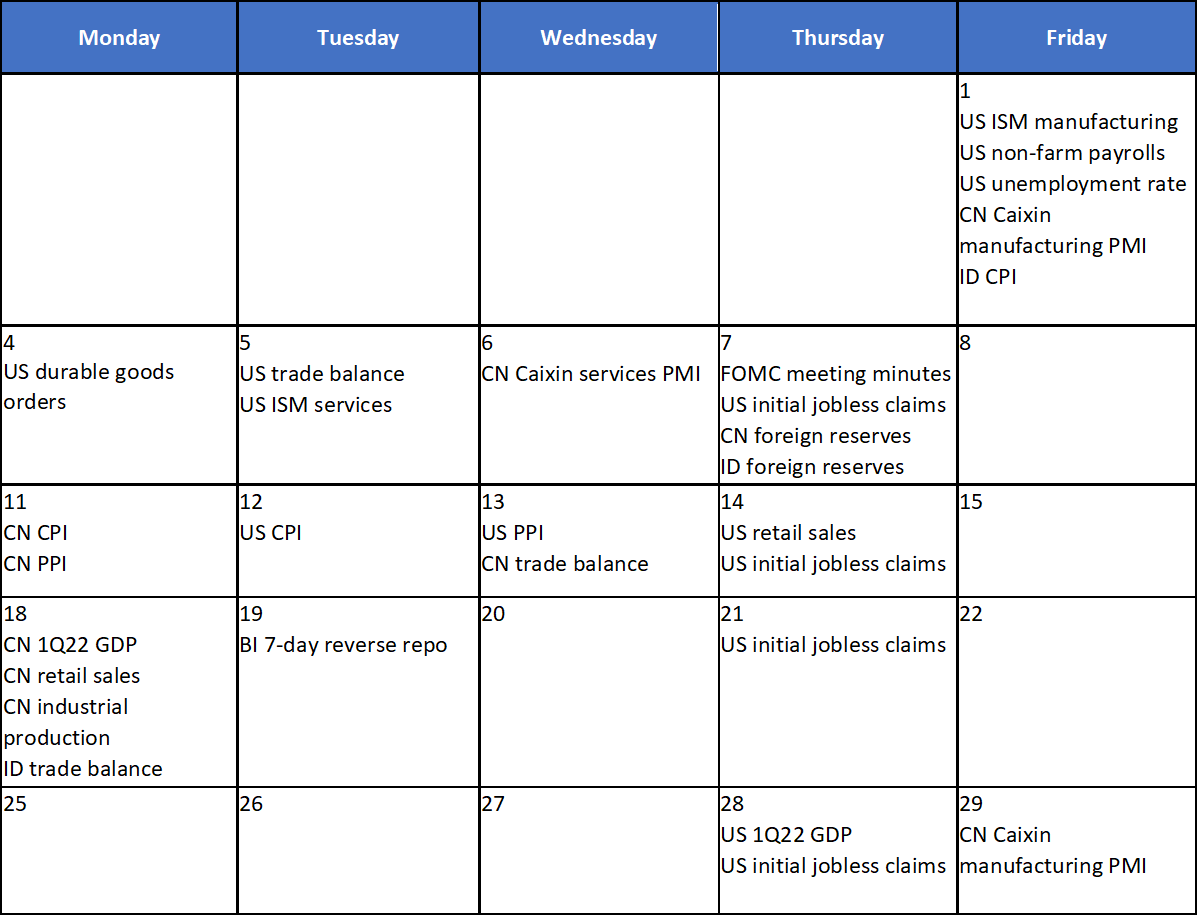

Calendar

April 2022

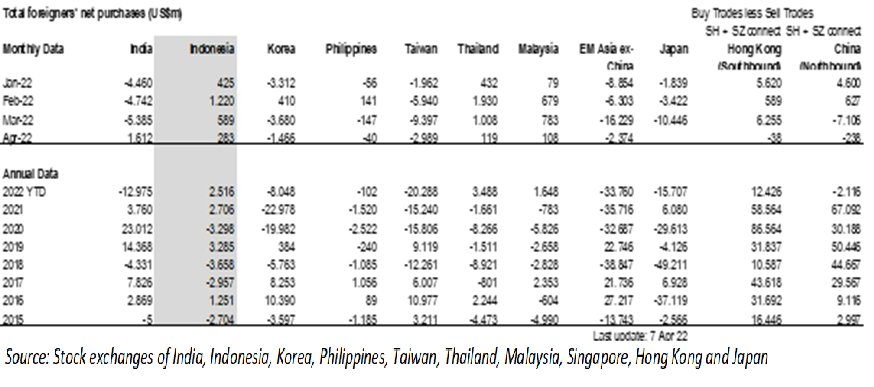

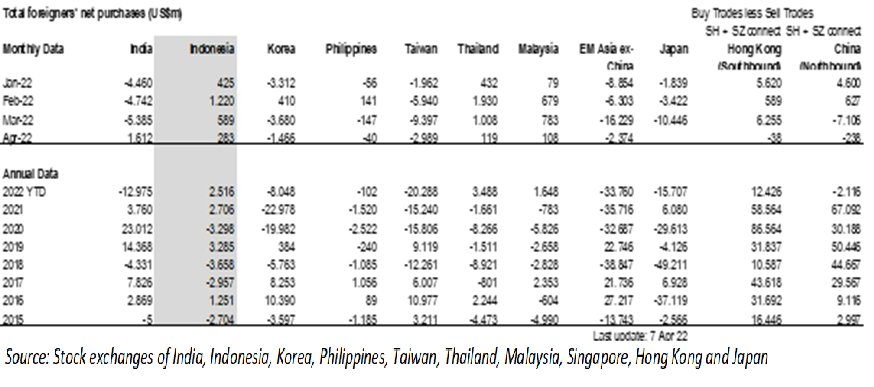

EM Equities Net Foreign Flow