18 April 2022

Weekly Market Review (18 April 2022) - What happened and What's Next

Market update

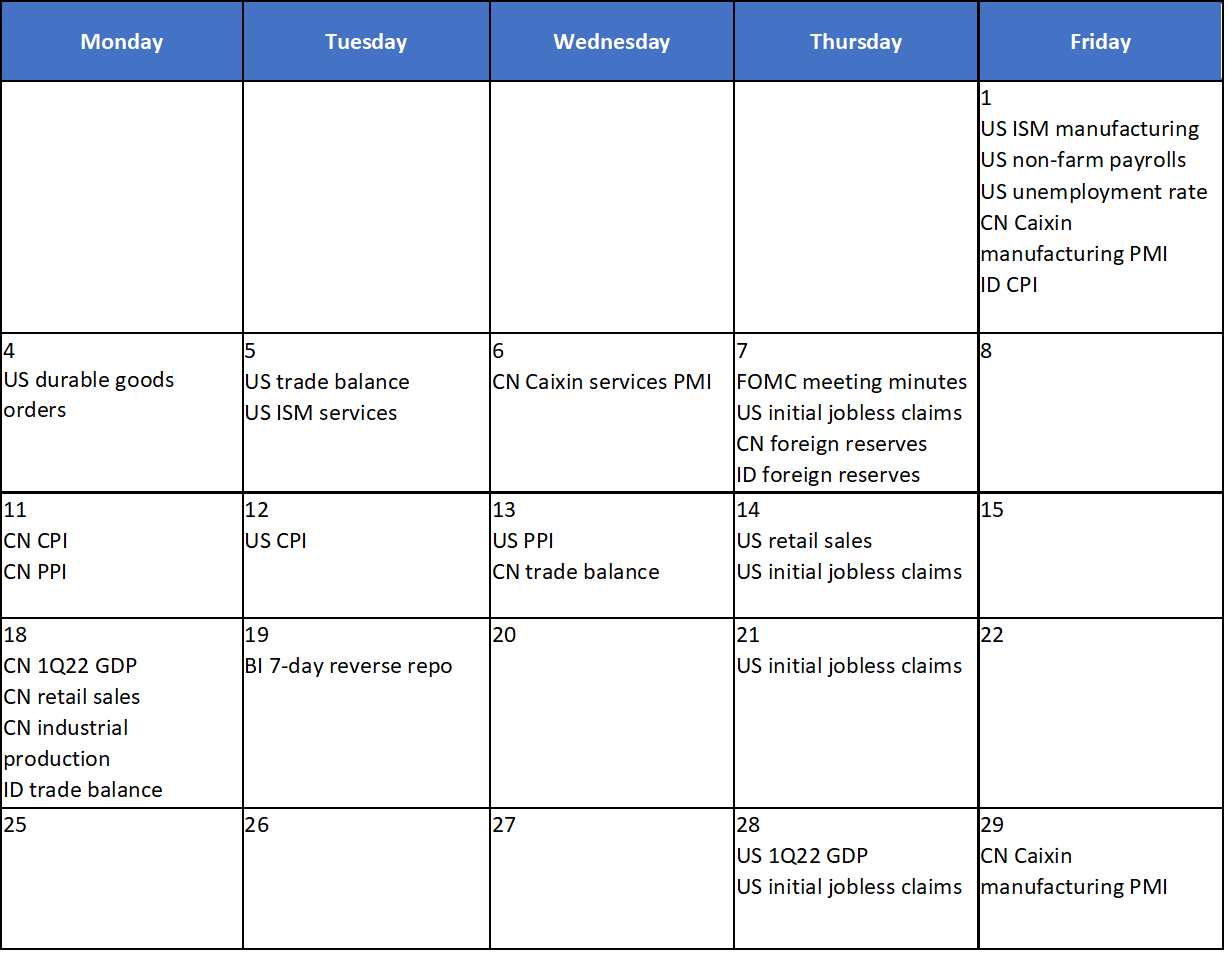

- Major global indexes were closed lower last Thursday with S&P 500 down by -2.4% WoW and MSCI Asia ex-Japan -0.9% WoW as investors continued to focus on inflation with core goods PPI exceeded consensus expectation. On other economic data, US industrial production data came in stronger than expected together with pick up in spending in services. On the covid front, Shanghai recorded daily new cases of more than 27k. Govt highlighted plans to stop the spread of Covid-19 outside quarantined areas, which would allow the city to further ease its lockdown and start returning to normal life as public frustrations grow. To stimulate the Chinese economy, PBoC has unveiled 25bp RRR cut, smaller than what the market has been anticipating a 50bp RRR cut. On the other hand, domestic side continued to book a gain of +1.5% WoW, buoyed by Transportation and Logistics sector (+6.4% WoW) and Healthcare sector (+4.9% WoW). Whereas the major underperformer is Property sector, down by -1.4% WoW. News flows to be watched within this week: China GDP, retail sales, industrial production; Indonesia trade balance, BI 7-day reverse repo; US initial jobless claims.

- Rupiah slightly appreciated +0.1% WoW to IDR 14,344, outperforming other EM currencies' performance. Meanwhile, DXY also strengthened by +0.6% WoW to 100.3.

- INDOGB yields were higher by 3-15bps along the curve with 5-15yr underperformed. Yield on the 5, 10 and 15yr rose by 15, 11 and 12bps, respectively. INDOGBs were under pressure amid global uncertainty. Indonesian Finance Minister said that the government will reduce debt issuance through SBN and chose to optimize SAL to finance APBN.

- Total incoming bids in Tuesday’s bond auction remained solid although still in declining trend, reaching IDR 40.3tn compared to IDR 41.6tn bids in the previous auction. Demand during the auction was mostly came from SPN Series, totalling IDR 20.9tn or 52% of total incoming bids. The government finally issued only IDR 11.05tn or lower than the initial target of IDR 20tn. GSO was scheduled on the following day with IDR 8.46tn bids were accepted. Added to the regular auction, the total issuance was IDR 19.51tn.

- Based on DMO data, foreign ownership as of 13th Apr was reported at IDR 850.02tn or 17.58%

- 10yr UST rose back to its highest level in more than three years as market continued to assess the rising inflation data. Yield on the 10yr was closed at 2.83% (+11bps WoW). Meanwhile the 2yr yield stayed at 2.47-2.50% level for the week.

Global news

- US CPI in March 2022 recorded +8.5% YoY, above consensus expectation of +8.4% YoY.

- US PPI in March 2022 recorded +11.2% YoY, above consensus expectation of +10.6% YoY.

- US retail sales in March 2022 recorded +0.5% MoM, below consensus expectation of +0.6% MoM.

- US initial jobless claims recorded 185k, worse than consensus expectation of 170k.

- US industrial production in March 2022 recorded +0.9% MoM, above consensus expectation of +0.4% MoM.

- China PPI in March 2022 recorded +8.3% YoY, above consensus expectation of +8.1% YoY.

- China CPI in March 2022 recorded +1.5% YoY, above consensus expectation of +1.4% YoY.

- China trade balance in March 2022 recorded USD 47.4bn, above consensus expectation of USD 21.7bn.

- China industrial production in March 2022 recorded +5% YoY, above consensus expectation of +4% YoY.

- China retail sales in March 2022 recorded -3.5% YoY, below consensus expectation of -3.0% YoY.

- China 1Q22 GDP recorded +4.8% YoY, above consensus expectation of +4.2% YoY.

- China surveyed jobless rate in March 2022 recorded 5.8%, worse than market expectation of 5.5%.

Domestic News

- Indonesia trade balance in March 2022 recorded USD 4.5bn, above market expectation of USD 3bn.

- The Ministry of Finance has set an indicative ceiling for the 2023 infrastructure budget of around IDR 367-402tn, an increase from 2022 and 2019 levels as infrastructure becomes the focus of the govt. Meanwhile, the indicative budget ceiling for social protection will decrease to IDR 332-349tn, from IDR 431tn in 2022.

- Ministry of Finance expects that economy growth in 1Q22 may reach 4.5% - 5.2% YoY.

- The realisation for PEN budget reached IDR 29.31tn, which is only 6.4% from this year budget. The MoF noted that one of the reasons of slow realization was due to the claims of Covid-19 has not been fully paid yet.

- Jakarta Bandung High Speed train project has reached 80.3% completion, with gov’t targeting the first trial run to be done by end of this year.

Calendar

April 2022

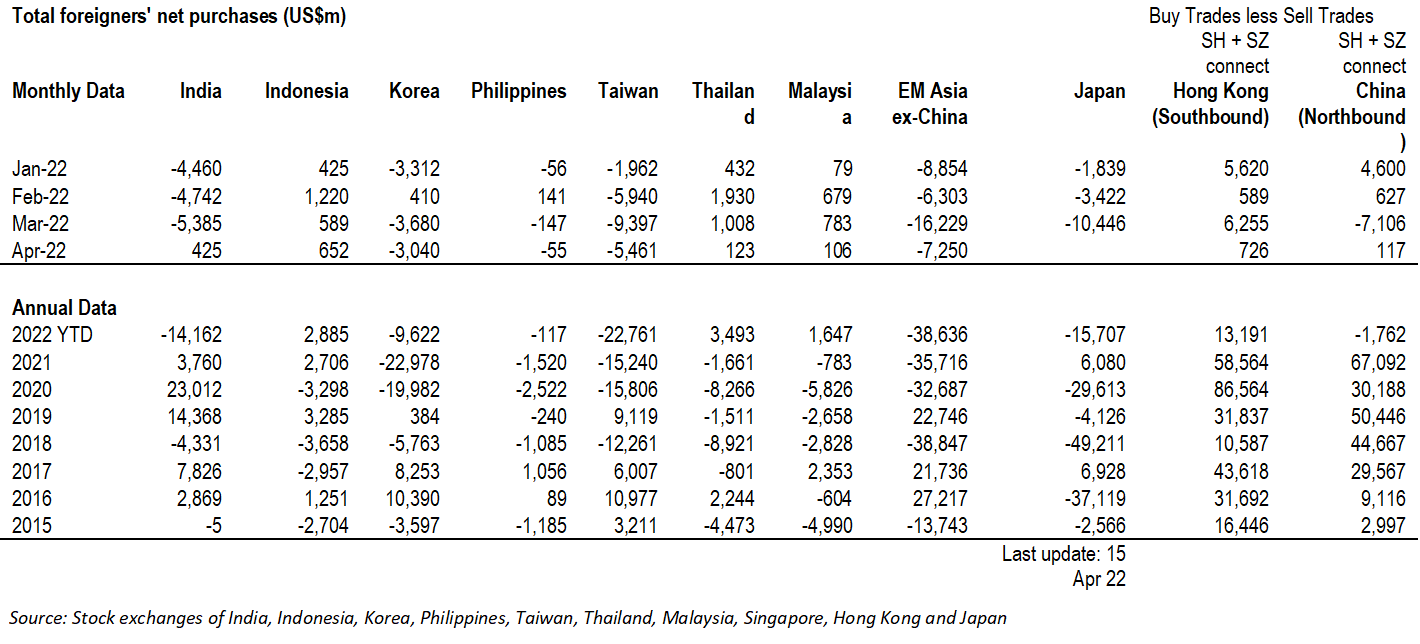

EM Equities Net Foreign Flow