23 May 2022

Weekly Market Review (23 May 2022) - What happened and What's Next

Market update

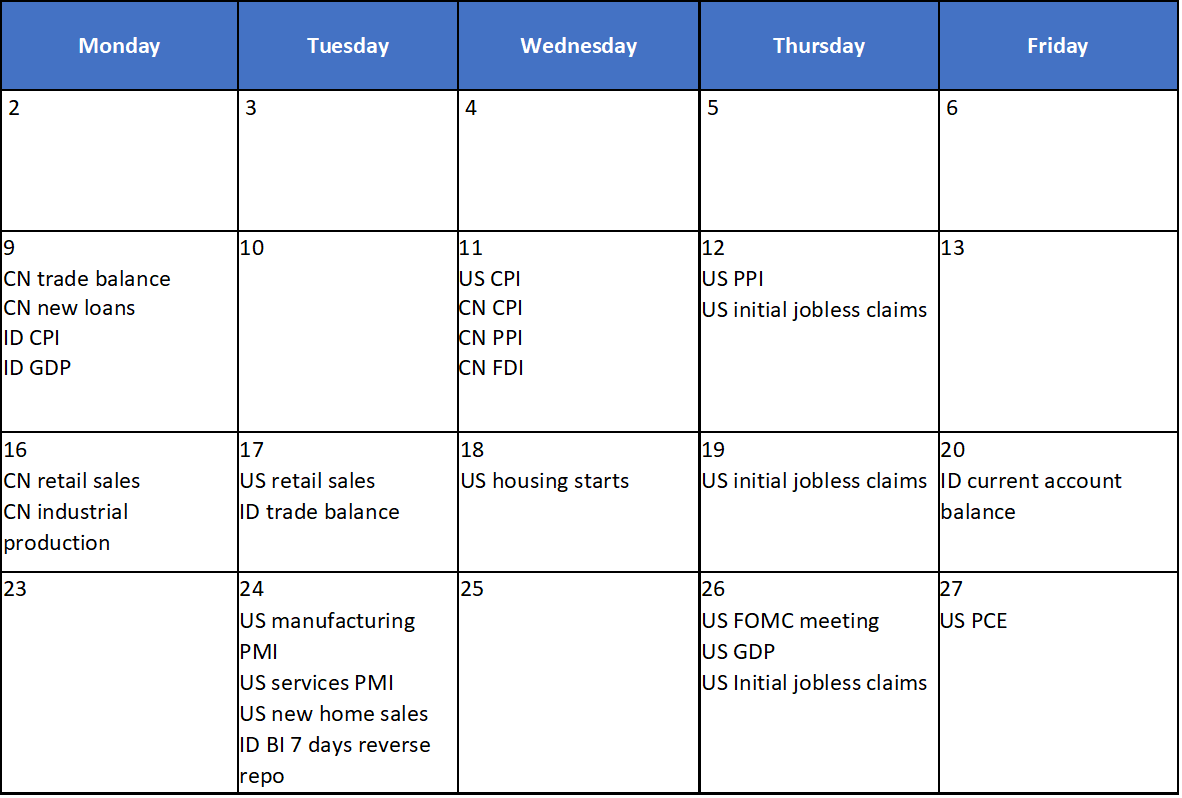

- Asian equities recorded a weekly gain with MSCI Asia ex-Japan up by +3.5%WoW, in contrast to US equities that pared losses with S&P and DJI down by respectively -3.0%WoW and -2.9%WoW. With this figure, the relative performance of Asia vs US equities posted the best weekly gain since March-2020. Rising investor interest in Asia as the region now trades at close to the largest discounts to the US and some sectors valuation look most attractive for relative performance. In the US, the Fed continue to commit to fight inflation by tightening financial condition further. US bearish sentiment weigh Goods-focused companies, both discretionary and staple, under pressure. In China, growth risk remains concerning, shown by poor April data readings, however, market already expected some incremental easing of restrictions in Shanghai such as back to office regulation. PBOC cut 5yr LPR more than expected, spurring equity inflows which could be front running of easing Covid restriction. On the domestic side, JCI rallied by +4.9%WoW, following the region. Gains were recorded almost all sectors, except Infrastructure sector which down by -2.8%WoW. Technology sector posted the most weekly gain, up by +11.7%WoW, followed by Energy sector by +3.8%WoW. News flows to be watched within this week: US FOMC meeting, GDP Annualized QoQ, PCE, Manufacturing PMI, Service PMI, Initial Jobless claim; Indonesia BI 7D Reverse Repo.

- Rupiah depreciated by -0.3% WoW to IDR 14,652, underperformed other EM currencies. Meanwhile, DXY weakened by -1.4% WoW to 103.2.

- Yields along the curve was down by 10-15bps WoW. INDOGB have erased half of the sell off last week with 10yr back to 7.15% by the end of the week. Buying flows were came from the 1-15yr parts of the curve with yield on the belly have decreased the most.

- Total incoming bids on Tuesday Sukuk auction rebounded to IDR17tn compared to previous bid of IDR7.5tn. The significant increase came from the short end tenors (SPN) totalling IDR6tn from onshore banks due to restored liquidity after long holiday. At last, government issued IDR4.3tn and scheduled GSO auction the next day where they accepted all incoming bids totalling IDR3.3tn. So, including the regular auction, the government has issued IDR7.45tn or still lower than the IDR9tn initial target.

- Based on DMO data, foreign ownership as of 11th May was reported at IDR817.80tn or 16.83%

- US Treasury yields continued its trend of falling in the face of rising recessions fears. By the end of the week 10yr UST was reported at 2.78% (-15bps WoW).

Global news

- World’s second-largest wheat producer, India, announced export ban for wheat, allowing only exports backed by letter-of-credit (LCs) issued before May 13.

- US retail sales rose by 0.9%MoM, just below the 1.0% estimate, boosted by demand and inflation.

- US initial jobless claims recorded 218k, higher than consensus estimate of 200k and prior 197k. Although this reached a four-month high, the labor market remains tight as the report from the Labor Department.

- US industrial production rose by 1.1%, above consensus expectation of 0.5% and prior 0.9%. The increases were widespread across sector.

- China retail sales slumped to its lowest in two years, shrank by -11.1%YoY (lower than estimation of -6.6%YoY and prior -3.5%YoY). Chinese consumers remained cooped up at home or jittery over lingering restriction.

Domestic News

- Indonesia Balance of Payment 1Q22 recorded higher outflow of -USD1.8bn in 1Q22 (-USD0.8bn in 4Q21). Current Account continue to record a surplus of +USD0.2bn or +0.1% of GDP (+USD1.5bn in 4Q21), yet Financial Account recorded deficit of -USD1.7bn (vs -USD2.3bn in 4Q21 thanks to higher FDI at +USD4.5bn, +8.0%YoY)

- Indonesia’s trade balance reached all-time high position in April, at +USD7.56bn (higher than expectation of USD4.0bn and prior USD4.53bn). This was driven by surplus of +USD9.94bn from the non-Oil and Gas sector but reduced with deficit of -USD2.38bn from Oil and Gas sector.

- The government plans to revise State Budget (APBN 2022) by expecting a higher state revenue to IDR2,266tn (prior: IDR1,846tn) and cutting deficit forecast to 4.5% of GDP (vs prior 4.9% of GDP). Energy subsidies is revised from IDR134tn to IDR208.9tn as well compensation budget from IDR18.5tn to IDR293.5tn, for Pertamina and PLN.

- • Along pandemic improved situation, President Jokowi lift face mask mandate for general outdoor activities and in the area that not packed with people. However, the public, including older people (>54 years old), must still wear masks in closed spaces and busy public areas.

- President Jokowi lifted its ban on pam oil export starting on Moday, May 23. He revised of the suspension as domestic supply and price of cooking oil had improved since the ban came intro effective on April 28.

Calendar

May 2022

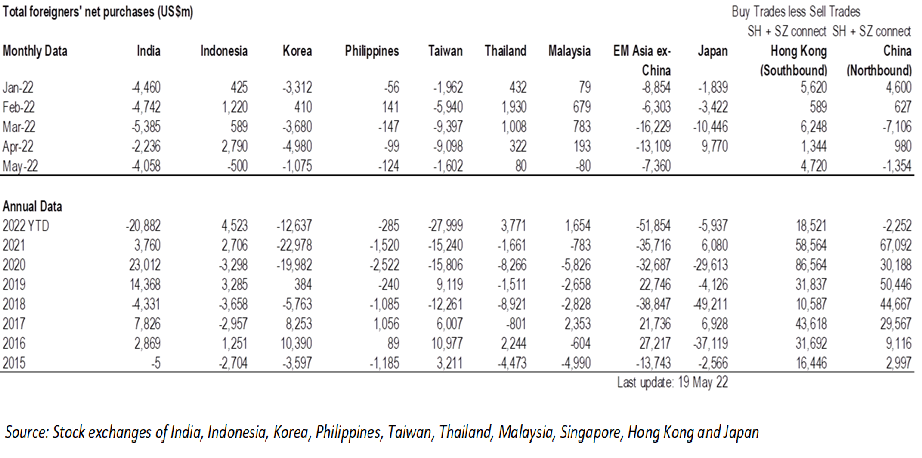

EM Equities Net Foreign Flow