13 June 2022

Weekly Market Review (13 June 2022) - What happened and What's Next

Market update

- US equities had a risk-off session including after the hotter CPI print, whereby S&P and DJI plunged by -5.1%WoW and -4.6%WoW, respectively. Meanwhile MSCI Asia ex-Japan slightly gained by +0.5%WoW as MSCI China rose by +6.1%WoW, the only major market in Asia rising. As US peak inflation narrative is now postponed (after another CPI’s new record high), the Fed likely remain on the hawkish path until monthly inflation indicated a clear sign of slowing. Heading to FOMC meeting (with the focus on a hawkish dot plot and summary economic projection), market found hard to sustain an upside surprise. The debate on whether there is ‘hard landing’ or ‘soft landing’ is unlikely to be resolved soon. Although US survey data on consumer sentiment by UoM fell to 50.2 (consensus 58; prior 58.4), but other past data reading such as US NFP, retail sales, still show the economy remain resilient. In China, although it saw cross border net inflow, the volatility may persist as some recent news announced another lockdown in some Shanghai area. On the domestic side, JCI booked a loss, down by -1.3%WoW. Sectors were mostly in negative territory except Healthcare sector that had a slight gain by +0.1%WoW. The biggest loser was Transportation and Logistic sector, down by -8.1%WoW. News flows to be watched within this week: US FOMC meeting, retail sales, initial jobless claim, industrial production; China retail sales, industrial production; Indonesia trade balance

- Rupiah weakened by 0.8% WoW to IDR 14,550, as most EM currencies weakened. In contrast, DXY continue to strengthen by 2.0% WoW to 104.1.

- Yields along the curve rose by 6-24bps along the curve with yield on the belly of the curve underperformed. INDOGB rose on the back of higher UST that touched above 3% level. By the end of the week, yield on the 10yr was reported at 7.18% (+27bps WoW).

- Total incoming bids in Tuesday’s conventional auction rebounded reaching IDR43.54tn compared to previous incoming bids at IDR 39.14tn. Biggest demand still came for the 10yr tenor reaching IDR13.52tn. Despite the solid demand, government only issued IDR 17tn or lower than IDR20tn target.

- Based on DMO data, foreign ownership as of 9th June was reported at IDR806.78tn or 16.71%

- Treasury yields rose after the release of the hotter than expected inflation data raised concern over possible recession. The 2yr note jumped more than 24bps over the week as short-term rates have higher sensitivity to Fed rate hikes. By the end of the week, 10yr UST was reported at 3.15% (+19bps WoW).

Global news

- The World Bank revised down global growth in 2022 to 2.9%, compared to the 4.1% projection for 2022 in January (vs 2021 growth of 5.7%). OECD also revised global growth to 3.0%, or 150bps downgrade from the last December forecast. The revision driven by disrupted activity and trade due to geopolitical tension; the fading pent-up demand; and withdrawal of accommodative policies by the fiscal and monetary authorities.

- US CPI inflation reported rose by 8.6%YoY in May, seeing the biggest price increase since 1981 and surpassing economists' forecasts of peaking level at March-22. As a result, there are growing sentiment for the Fed to act more aggressively by raising interest rates to 75 bps this week.

- US initial jobless claims hit 229k, highest level since Jan-22, beating consensus estimates at 206k. However, the four-week moving average for continuing claims remained around its lowest level since 1970.

- US trade deficit came better at USD-87.1bn than consensus estimation of USD-89.5bn and prior figure at USD-109.8bn, as export jumped to record high, putting trade on course to contribute to economic growth this quarter.

- China’s exports grew by 16.9YoY in May, up from 3.9%YoY in April boosted by Shanghai reopening, but forward momentum is set to fade amid rising uncertainties. Meanwhile, import grew by 4.1%YoY up from unchanged reading in April.

Domestic News

- Indonesia’s FX reserves in May-22 reported stood at USD135.6bn, which relatively stable compared to April-22 figure at USD135.7bn as export receipt (c.USD2.2bn) somewhat equals debt payment (c.USD2.3bn). The reserve position is equivalent to 6.8 months of imports or 6.6 months of imports and external debt payments.

- Indonesia’s consumer confidence index (CCI) improved significantly to 128.9 in May from 113.1 previously. Improvement believed came as the result of easing mobility restriction and a more positive expectation for the economic recovery. Broad-based improvement in confidence seen across all spending, age, and education brackets.

- Retail Sales Survey conducted by Bank Indonesia illustrated that retailers expect positive sales performance in May-22, as index is up by+0.2%MoM or +5.4%YoY (Apr: 16.5%MoM, or 8.5%YoY). On a monthly basis, respondents expected gains in the Other Household Equipment group along solid demand; while annually, respondents cited Automotive Fuel; Food, Beverages and Tobacco to grow in the reporting period.

- The Ministry of Energy and Mineral Resources said to announce new electricity tariff, with indications that it will increase tariff for 3,000 VA class and above, as signalled earlier. The new price adjustment will be implemented since 1 July 2022.

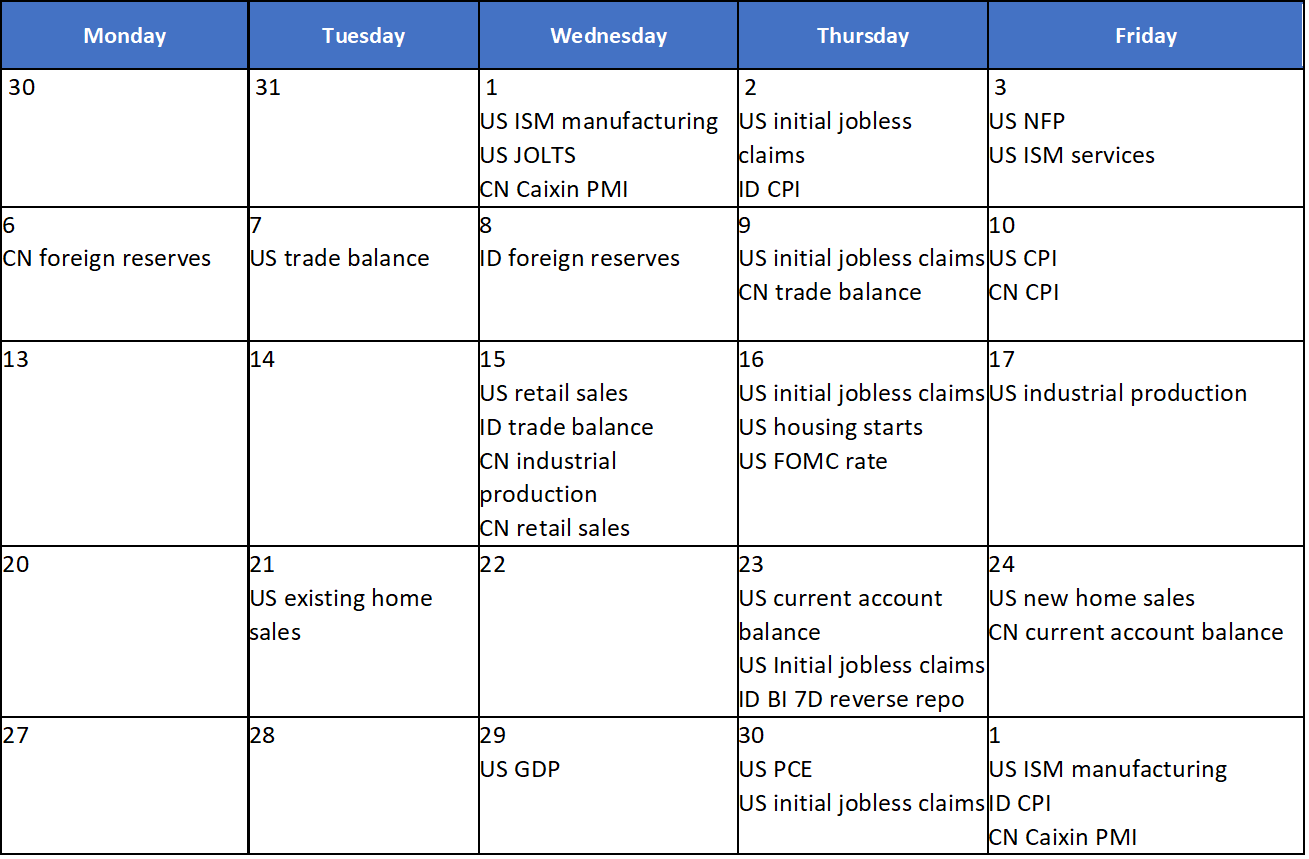

Calendar

June 2022

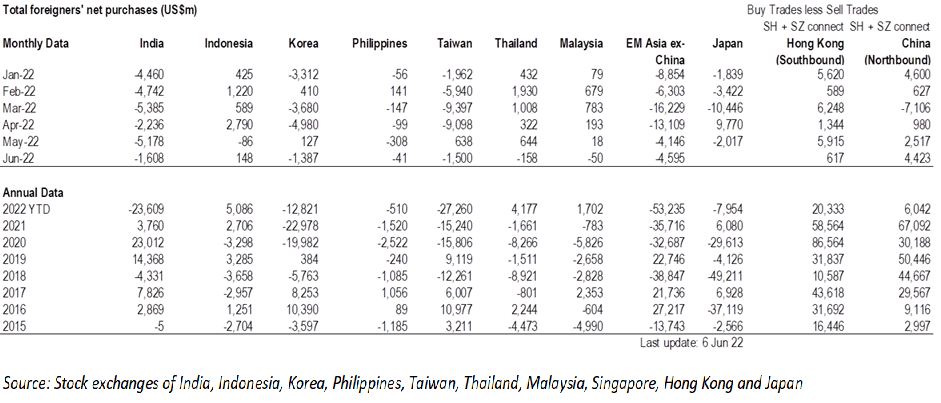

EM Equities Net Foreign Flow