18 June 2019

Weekly Market Review (17 June 2019) - What happened & What's next?

Market update

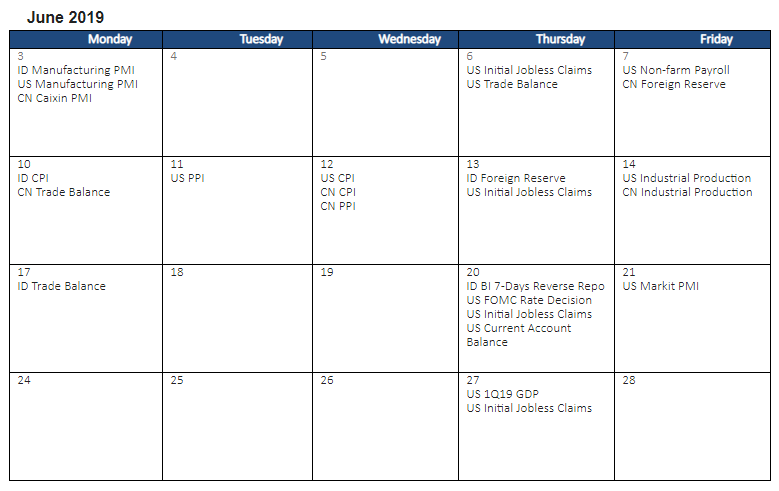

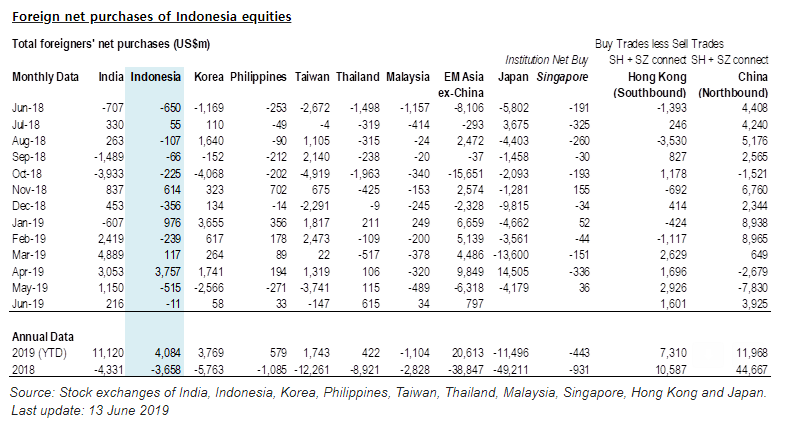

- Asian equities started the past week on strong footing from the afterglow of supportive Central Bank (CB) policies, but gave away some gains later in the week as Chinese data disappointed expectations. On Monday, while China’s export growth came out above expectations in May, supported by possible front loading of US-bound exports, it is likely to tumble in Q3 when the threatened tariffs are imposed. On the same day, China also announced measures to boost infrastructure investment, as Beijing issued a new order to allow local governments to use local government special bonds (LGSBs) as equity capital to borrow more from markets for infrastructure investment projects. Afterward, China’s money and credit data for May were slightly below market expectations. Then on Friday, it was announced that growth in China’s industrial production, fixed asset investment, property investment and new home sales (by volume) slowed in May from April, on a YoY basis. On domestic side, JCI gained +0.7%WoW to IDR6,250.3 by the end of the week, despite a foreign outflow of USD15m. Mining sector was the worst performer with -4.4%WoW given uncertainties in global trade and economy. Meanwhile, Property sector was the best performer (+2.8%WoW) last week, due to expectation of BI rate cut and a stronger than expected monthly marketing data. News flows to be watched within this week include Indonesia Trade Balance and BI 7-Day Reverse Repo; US FOMC meeting, Current Account Balance, PMI and initial jobless claim.

- IDR fell to IDR14,325 (-0.4%WoW), worse than average emerging markets (+0.8%WoW). On the other hand, DXY fell to 97.6 (-0.6%WoW).

- Expectation on more dovish statement on Fed meeting this week made bond market yield decreased by 5-11 bps. 20 years series decreased the most.

- Foreign investor reported net inflow of IDR 2.87trn over the week, mostly on 20 years series.

- 10 years US treasury yield unchanged over the week. Market seems to wait for Fed policy meeting this week, while investor pricing in a more than 80% chance of a rate cut in July and 70% probability of reduction in September.

Global news

- US Initial Jobless Claims unexpectedly increased 3,000 to a seasonally adjusted 222,000 in the week ended June 8. Market had expected claims decreasing to 215,000.

- U.S. industrial production rose a seasonally adjusted +0.4%MoM in May’19, better than Economists’ estimate of +0.1% increase. Utility production rose +2.1%MoM in May, bouncing back from a sharp decline in April.

- China’s trade surplus widened sharply to USD41.65bn in May’19 from the USD13.84bn surplus recorded in April’19. China’s Imports fell -8.5%YoY in May, after rising 4.0% in April, sharper than economists’ expectations. On the other hand, Exports rose +1.1%YoY, after dropping -2.7%YoY in April.

- China’s industrial output growth slowed to +5%YoY in 5M19, below market’s expectation and the weakest since 1992. Whereas, Fixed-asset investment, up +5.6% in 5M19. Both increases were slower than prior-month.

Domestic News

- May’19 CPI accelerated by +0.68%mom (vs.0.44% in Apr’19), higher than economists’ estimate due to elevated food prices amid fasting season. This increased YoY inflation to 3.32% from 2.83% in Apr’19, due to last year’s base effect (fasting period). Core inflation increased to 3.12% in May’19 (vs 3.05% in Apr’19).

- FX reserve declined to USD120.3bn in May’19 from USD124.3bn in the previous month despite the Samurai Bond issuance amounting USD1.6bn in the corresponding period. It was potentially due to the previous acquisition activity of a Japanese bank on Indonesia’s bank. All in all, the FX reserve position remains solid as it is equivalent with 6.9 months of imports above the minimum threshold of 3 months of imports.