20 June 2022

Weekly Market Review (20 June 2022) - What happened and What's Next

Market update

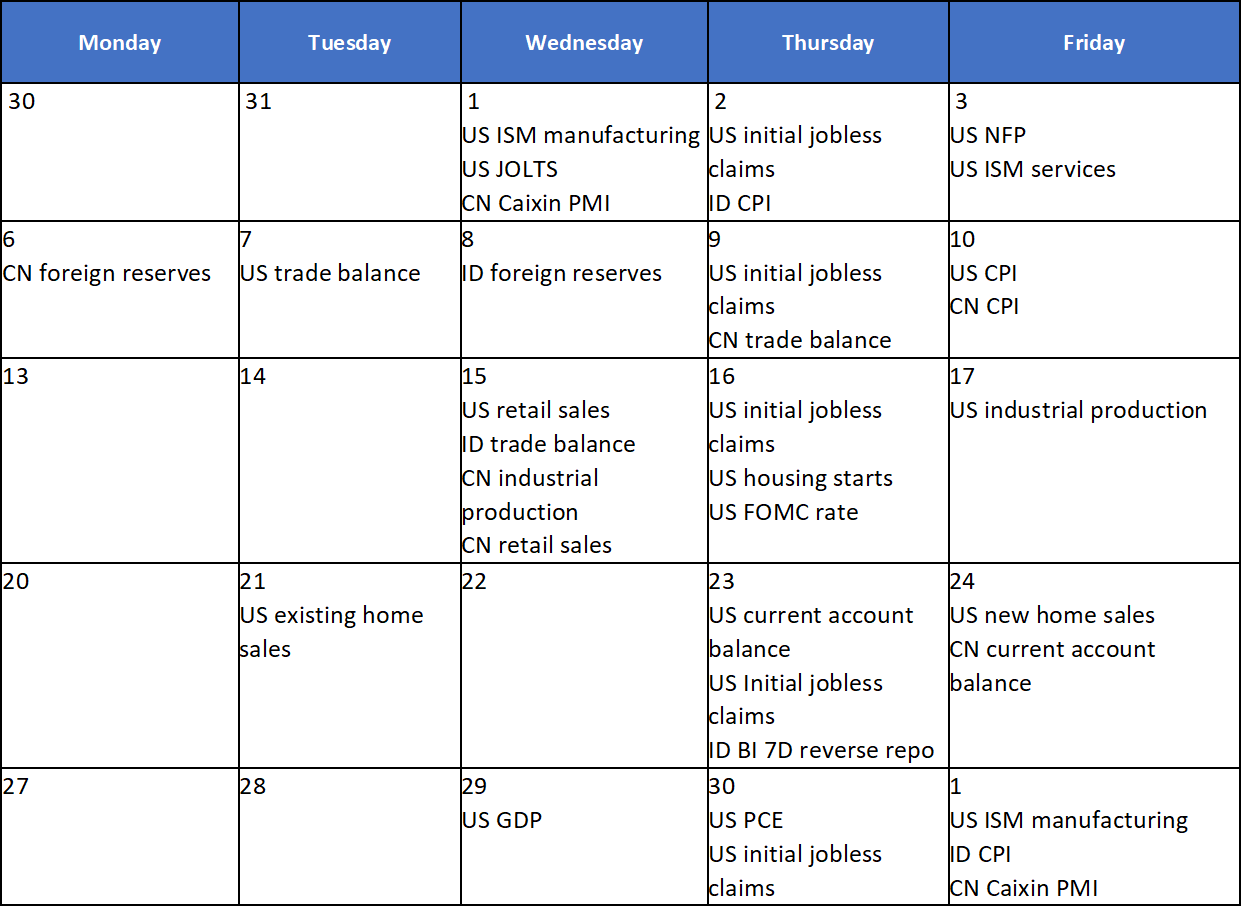

- Global indexes were closed lower last Friday and US indexes booked losses for three consecutive weeks (S&P and Dow Jones down by -5.8% and -4.8% WoW respectively). Investors were worried about economic slowdown in the midst of high inflation environment. Several key economic data fell short of expectation, ranging from retail sales to housing starts. In addition, the Fed raised its benchmark interest rate by 75bps earlier last week, the most since 1994. Powell reiterated central bank's commitment to bring down inflation and stressed that the Fed is “acutely focused on returning inflation to our 2 percent objective.” On the domestic side, JCI also booked a loss of -2.1% WoW. The major underperformers were industrial and energy sector, declined by -5.4% and 4.8% WoW respectively. Meanwhile, healthcare sector was the only one in the green territory, up by +1.9% WoW. News flows to be watched within this week: ID 7 days reverse repo, US existing home sales, US current account balance, US initial jobless claims, US new home sales and CN current account balance.

- Rupiah weakened by -1.9% WoW to IDR 14,823, one of the worst performing EM currencies. In contrast, DXY continue to strengthen by +0.5 WoW to 104.7.

- INDOGB curve bear-flattened as 5yr and 10yr sold off by 40bps and 28bps respectively triggered by the selloff in US treasuries post US CPI data and higher USD/IDR. By the end of the week, 10yr INDOGB was reported at 7.46%

- Total incoming bids in the Sukuk auction lowered to IDR 15.13tn compared to previous bid of IDR 20.22tn. Onshore investors seems the one who supported the demand as foreign participation might be lower due to hawkish Fed. Demand lowered almost in all series except the demand for 11.8yr PBS29 which increased by IDR 2.6tn to IDR 4.8tn. At last, government issued IDR 5.1tn with no GSO the next day.

- Based on DMO data, foreign ownership as of 15th June was reported at IDR 797.46tn or 16.56%

- The Fed increased the funds rate for the third time this year by 75bps instead for 50bps as inflation rate accelerated unexpectedly. Treasury yields pulled back from its week highest of 3.49% to 3.25% by the end of the week. (+10bps WoW).

Global news

- US retail sales in May-22 declined by -0.3% MoM, below consensus' expectation of +0.1% MoM prior's month figure of +0.7% MoM.

- US initial jobless claims increased by 229k, slightly higher than consensus estimates at 220k but lower than prior's week at 232k.

- US housing starts in May-22 was at 1.55mn fell short of expectation of 1.68mn and declined from 1.81mn.

- US industrial production index in May-22 up only by +0.2% MoM from 1.4% MoM in the previous month and lower than consensus' expectation of +0.4% MoM.

- China’s retail sales was down by -6.7% YoY in May-21, better than expectation of -7.1% YoY and previous month's figure of -11.1% YoY.

- China's industrial production rose mildly by 0.7% YoY in May-22 versus an expected -0.7% drop by consensus and - 2.9% YoY in Apr-22.

Domestic News

- Indonesia’s May-22 trade balance reported as a surplus of USD 2.9bn versus USD 7.6bn in Apr-22. Exports was at USD 21.5bn (-21.3% MoM) while imports is at USD 18.6bn (-5.8% MoM).

- Approaching the end of tax amnesty II program in 30 June 2022, there is a sudden surge of participants and a significant wealth declaraiton. Based on data, total declaration throughout 1 June to 15 June 2022 is IDR 83.6tn which is 304% higher tan the average declaration from January to May-22 of IDR 20.7tn. Meanwhile the total participants along that period had a steep rise to 32K participants (prev: 11K).

- Health Ministry revised its Covid-19 expectation from 5k/day to 20k/day in the Jul-Aug 2022 period.

- Bank Indonesia has conducted interventions in the FX spot and domestic NDF market to stem rupiah volatility. The central bank will ensure the rupiah market mechanism remain functioning well as the currency drops against the dollar, according to Executive Director for Monetary Management Edi Susianto on 17 June.

Calendar

June 2022

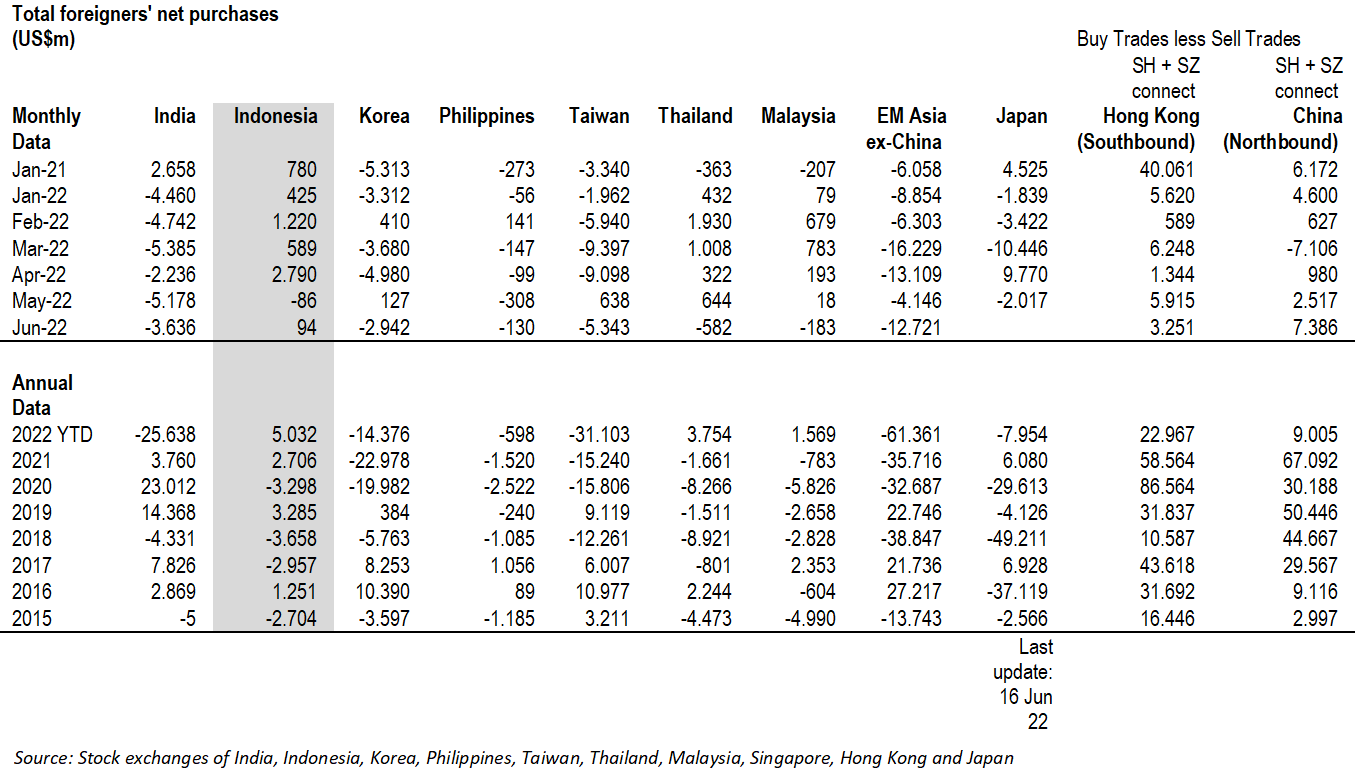

EM Equities Net Foreign Flow