25 July 2022

Weekly Market Review (25 July 2022) - What happened and What's Next

Market update

- Global indexes rallied across the board, with S&P 500, Dow Jones, and MSCI Asia ex-Japan, up by +2.5%WoW, +2.0%WoW, +2.4%WoW, respectively. Some investors expect that peak inflation might be finally at this point. This was signalled by softening commodity prices, weakening supply chain bottlenecks, overhang retailer inventory, and easing in Michigan inflation expectations. In addition, USD rally paused along ECB hikes. However, investors still query whether this sustained rally or not. Noting that, the Fed still on the tightening path and no signs yet of any moderation in actual inflation (such as the increases of US Core CPI MoM for three straight months). Hence, this week data reading (such as PCE, GDP, and FOMC meeting) will be very crucial. In Asia, most indexes were up on the back of foreign inflow. As matter of fact, foreign investor positioning in Asian stocks (even in USD terms) appears much more moderate now compared to the end of Feb when the geopolitical sparked. In line with the regional, on the domestic side, JCI recorded gain, up by +3.5%WoW (despite foreign investor reported net outflow of IDR4.02tn MTD). Most sectors were in green areas, except Healthcare sector which slightly down by -0.3%WoW. Energy sector came as the main outperformer with up by +6.0%, then it was followed by Technology sector, up by +5.8%WoW. News flows to be watched within this week: US FOMC rate decision, GDP Annualized QoQ, Core PCE QoQ, PCE deflator, Initial Jobless Claim; China PMI.

- Rupiah continued its weakening trend, by 0.2%WoW to IDR 15,018, in line with other EM currencies. Meanwhile, DXY also weakened by 1.2%WoW to 106.7.

- INDOGBs yield were traded higher as yields across the curve move up by 4-30bps WoW. Offshore selling pressure was aggressive after ECB surprise rate hike sending the yield on the front-end bond up by up 30-40 bps WoW. BI maintained benchmark rate at 3.5% but BI keen to bring the curve higher by increasing structural interest rate in money market. They also added that they would sell about IDR 70tn INDOGB tenor 0-5yr before moving to 5-10yr. By the end of the week, 10yr was reported at 7.45% (+7bps WoW).

- Total incoming in Tuesday’s bond auction were slightly higher than in the previous auction, reaching IDR 29.5tn compared to IDR 26tn in the previous. Solid demand came for 10yr which had the biggest demand reaching IDR 15.3tn (vs. prior at IDR 13.7Ttn) The government lowered the issuance to IDR 11.9tn or lower than initial target of IDR 15tn.

- Based on DMO data, foreign ownership as of 20th July was reported at IDR 752.38tn or 15.45%.

- US Treasury yields retreated further as weak economic data and a significant interest rate hike from the European Central Bank fuelled concerns about an economic slowdown. Concerns over U.S. economic outlook also weighed on investor sentiment after the release of more downbeat economic data. By the end of the week, 10yr UST was reported at 2.77% (-16bps WoW).

Global news

- The European Central Bank (ECB) increased its interest rate by half a percentage point, or 50bps, marking the first increase in 11 years. The Governing Council believes that further normalization of interest rates in upcoming meetings will be appropriate. The decision was made to ensure that inflation returns to its 2% target over the medium term.

- US Existing Home Sales slides further for the fifth-consecutive month in June, onto the lowest level in 2-years. In June, the Existing Home Sales fell to a seasonally adjusted annual rate of 5.12 million houses (prior 5.41 million). This figure fell by -5.4%MoM or -14.2%YoY.

- US Initial Jobless Claim recorded 251k, up by 7k from prior week (vs consensus estimation of 240k). This updated figure was the highest level since mid-November, indicating labour market started to cool.

- US S&P Global Composite Purchasing Manager’s Index (PMI) composite registered at 47.5, down notably from 52.3. This was signal of solid contraction in private sector output.

Domestic News

- According to Bank Indonesia (BI), Indonesia money supply (M2) growth in June-22 slowed at +10.6%YoY (vs May at +12.1%YoY). The soften growth is driven by higher credit growth, up by +10.3% YoY (vs May +8.7%YoY).

- In the latest governor meeting, BI decided to maintain its policy rate, BI7DRR, at 3.5%. The decision was taken after considering the sustained core inflation expectation level amid global economic downturn threats. Further, BI revised its FY22 current account forecast will be at +0.2 to -0.5 % of GDP (prior at -0.5% to -1.3% of GDP) and private loan growth target to 9% - 11% (previously at 6% – 8%).

- The Ministry of Investment stated that investment realization in 2Q22 reached IDR 302.2tn, or up by +7.0%QoQ (1Q22 was IDR 282.4tn). Cumulatively, 1H22 investment realization reached IDR 584.6 tn (+32%YoY). Furthermore, Foreign Direct Investment in 2Q22 reached IDR 163.2 tn (+39.7% yoy) or 54.0% of total investment. This FDI contribution is the highest compared to several past quarters.

- BI projected that Retail sales performance in June-22 to grow, reflected from the Real Sales Index (IPR) of 229.1 at June, or up by +15.4%YoY. This was in line with the increase in sales of F&B and Tobacco Group, Clothing Sub-group and Spare Parts and Accessories Group.

- The government announced that NIK are now officially integrated with NPWP, as tax-payer number. This movement could help data synergy within Indonesia ministries and agencies, as well support public if they forget its NPWP number.

Calendar

July

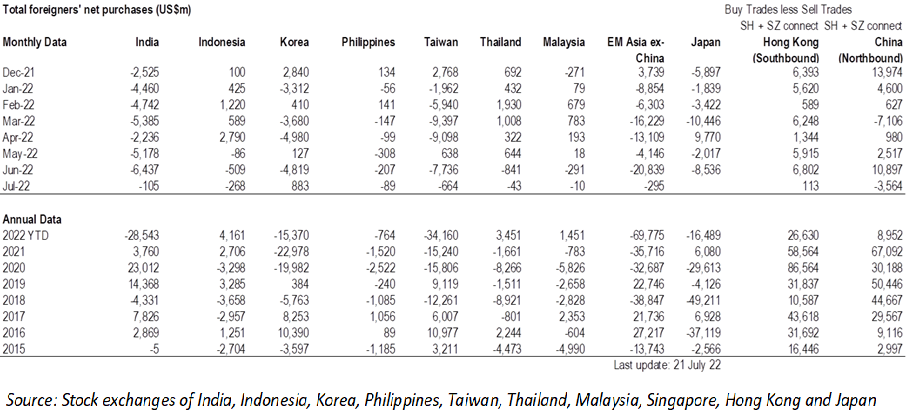

EM Equities Net Foreign Flow