01 August 2022

Weekly Market Review (01 August 2022) - What happened and What's Next

Market update

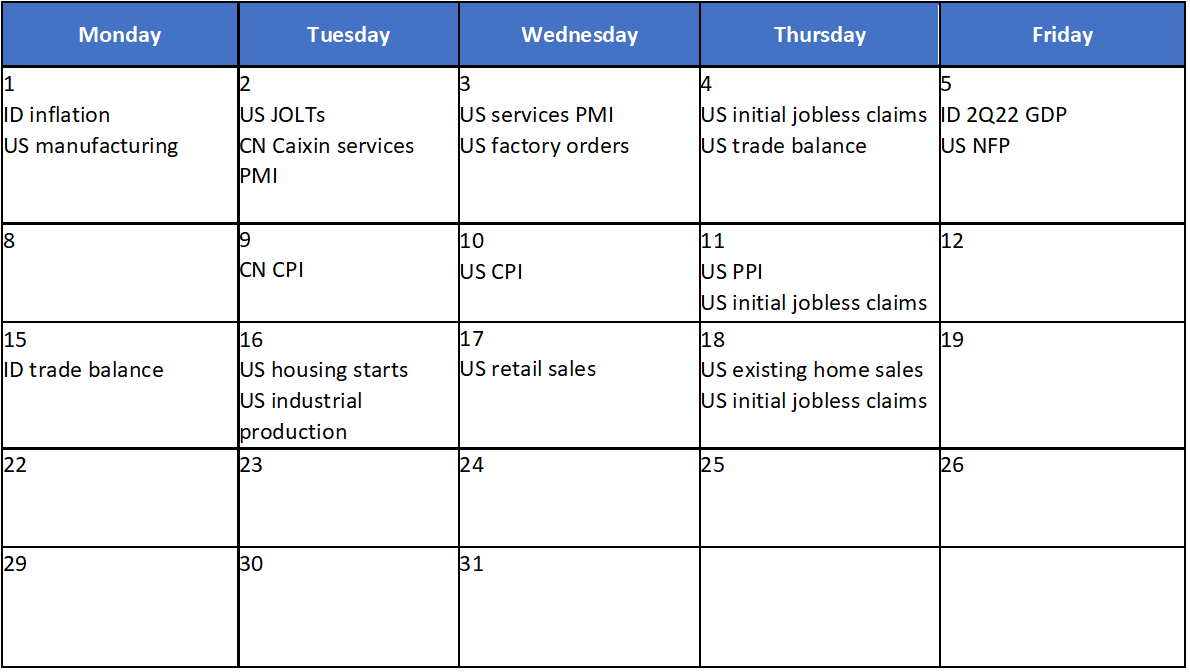

- Global indexes mostly closed higher last week with Dow Jones and S&P each up by +3.0% and +4.3% WoW respectively. US stocks rallied on Thursday after 2Q22 GDP showed that U.S. economy had contracted by 0.9%. The data marked a second consecutive quarter of contraction. In addition, in its post-meeting statement, the FOMC cautioned that "recent indicators of spending and production have softened." Investors greeted weak data as positive because they think this might pressure the Fed to slow the pace of interest rate hikes. On domestic side, JCI also inched up by +0.9% WoW, mainly supported by industrial and energy sector (+7.8% and 7.7% WoW respectively). On the other hand, healthcare and technology sector were the major underperformers, each down by -4.5% WoW. News flows to be watched within this week: ID 2Q22 GDP, US manufacturing, US JOLTs, US services PMI, US factory orders, US trade balance, US initial jobless claims, US NFP and CN Caixin services PMI.

- Rupiah strengthened by +1.2% WoW to IDR 14,833, one of the best performing currencies in EM. Meanwhile, DXY weakened by -0.8% WoW to 105.9.

- INDOGB traded higher with yields went down by 25-53bps along the curve. INDOGB rallied this week after FOMC meeting and following the lower UST after GDP print lower than the previous quarter. Short squeeze resumed that lifted INDOGB market higher especially the 15yr with yield lowered by 53bps over the week. By the end of the week, 10yr INDOGB was reported at 7.09% (-36bps WoW).

- Total incoming bids in Tuesday’s sukuk auction was slightly lower than the previous one, reaching IDR 10.8tn. The short tenor PBS still attracted the biggest demand reaching IDR 5.6tn or almost 52% of total incoming bids. The government decided to issue IDR 5.9tn or slightly lower than initial target of IDR 7tn. The government held GSO the following day and accepted all incoming bids amounting to IDR 1.74tn. Hence, including the regular auction, the government has successfully issued IDR 7.6tn.

- Based on DMO data, foreign ownership as of 26th July was reported at IDR 749.55tn or 15.35%.

- US Treasury yields fell as market continued to weigh the prospects of recession following a second consecutive quarter of economic contraction. By the end of the week, 10yr UST was reported at 2.67% (-10bps WoW) meanwhile the 2yr was at 2.89% (-10bps WoW).

Global news

- The Fed decided to increase the benchmark rate by 0.75% to the 2.25% -2.5% range last Wednesday, in line with consensus expectation.

- US new home sales in Jun-22 recorded at 590k, lower than consensus expectation of 660k and prior's figure number of 642k.

- US initial jobless claims booked a 256k gain, lower than 261k in the previous week but higher than consensus' expectation of 249k.

- US core PCE index in Jun-22 was at +0.6%, slightly higher than consensus' forecast of +0.5% and higher than prior's month number of +0.3%.

- China’s official PMI reading for Jul-22 came in at 49, down from 50.2 in Jun-22 and lower than the expected 50.4.

Domestic News

- Headline CPI recorded higher at +0.64% MoM/+4.94% YoY in Jul-22 (vs +0.6% MoM/+4.35% YoY in Jun-22). The number is slightly higher than consensus' expectation of 0.53% MoM/+4.82% YoY, mostly due to increasing FnB prices and transportation at 1.16% MoM/+9.35% YoY and 1.13% MoM/+6.65% YoY respectively. Meanwhile, core inflation steadily increasing to +2.86% YoY in Jul-22 (vs +2.63% YoY in Jun-22).

- Indonesia’s broad money supply rose 10.6% y/y in June, according to Bank Indonesia. Broad money supply was IDR7,888.6t. Net claims on the central government contracted 14% y/y. Net foreign assets fell 1.7% y/y.

- The government has decided to temporarily remove palm oil export levy collection from 15 Jul-22 to 31 Aug-22. Levy for the period was set at US$200/t before removal. The collection shall reduce the effective export levy and tax collection from USD 488/t to USD 288/t. The export levy collection shall restart starting Sep-22 with USD 240/t max levy collection (USD 40/t increase from previous scheme or USD 528/t maximum export collection).

- Bank Indonesia (BI) decided to hold its interest rate unchanged at 3.5% along with its deposit and lending facility rates at 2.75% and 4.25%. BI signaled that adjustment to the interest rate may only takes place if there is meaningful pressure on core inflation and after the excess liquidity has been drained from the financial system.

Calendar

August 2022

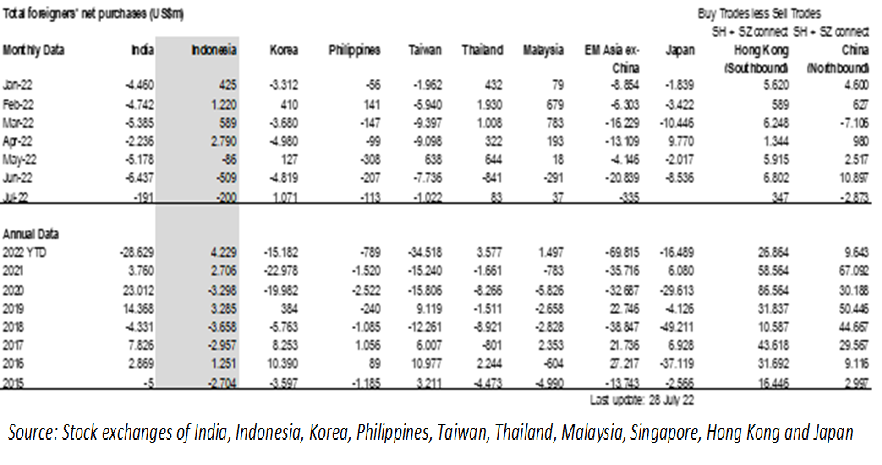

EM Equities Net Foreign Flow