08 August 2022

Weekly Market Review (08 August 2022) - What happened and What's Next

Market update

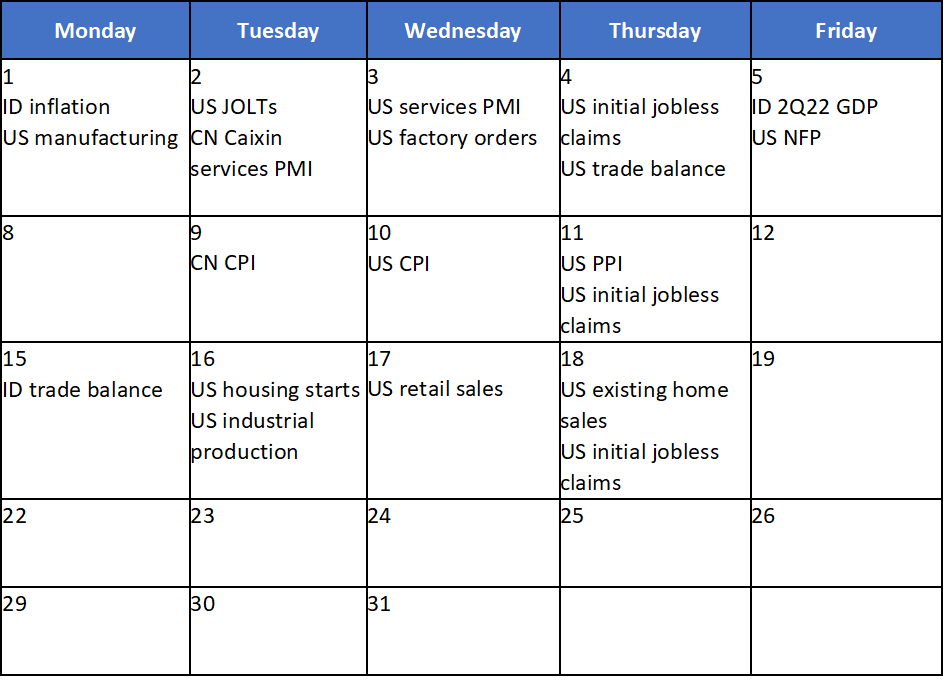

- Global indexes closed higher last week with S&P 500 by +0.4% WoW and MSCI Asia ex-Japan up by +0.9% WoW on ‘peak-inflation, peak-hawkishness’ theme despite an escalation in geopolitical tensions in the Taiwan cross straits. The visit of US House Speaker Nancy Pelosi in Taipei despite warnings from Beijing ignited tensions in the region, leading to military exercises by China in the areas around Taiwan, and sanctions on Speaker Pelosi and halting of military and climate talks with the US. On the other hand, Central Banks continue to march with their hawkish stance: BoE hiked official rates by +50bp; RBA lifted interest rates too by 50bp and upgraded inflation forecasts and lowered projected GDP growth; RBI delivered a hawkish hike raising the policy repo rate by 50bp to 5.40%. Elsewhere, OPEC+ meeting concluded with a nominal output hike of 100k barrels a day for September, which will unlikely ease market tightness. In hard data, US July payrolls were quite strong: NFP unexpectedly was strong on the upside rising 528k, unemployment rate unexpectedly ticked down to 3.5%, while average hourly earnings increased a hotter-than-expected 0.5% MoM. On domestic side, JCI also inched up by +1.9% WoW, mainly supported by Infrastructure and Technology sectors (+5.0% and +4.7% WoW respectively). On the other hand, Energy sector was the major underperformer, down by -4.8% WoW. News flows to be watched within this week: US CPI, PPI, initial jobless claims; and China CPI.

- Rupiah depreciated by +0.4% WoW to IDR 14,893, underperforming other currencies in EM. Meanwhile, DXY strengthened by +0.7% WoW to 106.6.

- INDOGB traded higher in the beginning of the week, but rally was held by global tension and upsized issuance in auction. Yields on the 15yr tenor was increased the most by 20bps to 6.98%. By the end of the week, 10yr INDOGB was reported 7.09% unchanged from prior week.

- Total incoming bids in Tuesday’s bond auction continued to increase to IDR 36.9tn compared to IDR 29.5tn in previous auction. Offshore participation continued to improve reaching IDR 6.9tn. Solid demand came for the 10yr totalling IDR 17.8tn and higher than previous auction. In line with the improving demand, government issued IDR 19.1tn or higher than initial target of IDR 15tn.

- Based on DMO data, foreign ownership as of 4th Aug was reported at IDR 761.48tn or 15.51%.

- US Treasury yields jumped sharply after much stronger than expected US July jobs report stoked expectations that the Fed will continue to aggressively raise interest rates to contain inflation. Meanwhile geopolitical tensions between China-US-Taiwan remained closely watched by market players. By the end of the week, 10yr UST was reported at 2.83% (+16bps WoW).

Global news

- US ISM manufacturing in July 2022 recorded 52.8, above consensus estimate of 52.0.

- US ISM services in July 2022 recorded 56.7, above consensus estimate of 53.5.

- US trade balance in July 2022 recorded deficit USD 79.6bn.

- US non-farm payrolls in July 2022 recorded 528k, above consensus estimate of 250k.

- US unemployment rate in July 2022 recorded 3.5%, below consensus estimate of 3.6%.

- US hourly earnings rate in July 2022 recorded +5.2% YoY, above consensus estimate of +4.9% YoY.

- US initial jobless claims recorded 260k, in-line with consensus.

- China Caixin manufacturing PMI in July 2022 recorded 50.4, below consensus estimate of 51.5.

- China Caixin services PMI in July 2022 recorded 55.5, above consensus estimate of 53.9.

- China foreign reserves in July 2022 recorded USD 3,104bn, above consensus estimate of USD 3,051bn.

- China trade balance in July 2022 recorded USD 101.3bn, above consensus estimate of USD 89bn.

Domestic News

- Indonesia 2Q22 GDP recorded +5.44% YoY, above consensus estimate of +5.17% YoY.

- Indonesia foreign reserves in July 2022 recorded USD 132.2bn.

- As fuel price continues to remain elevated, Ministry of Transport issue a regulation to allow airlines to increase prices of its flight tickets max 15% from the maximum limit rate for jets and max 25% for propeller planes.

- Non-tax revenue realisation in 1H22 has reached IDR 218tn or 58% of the target.

Calendar

August

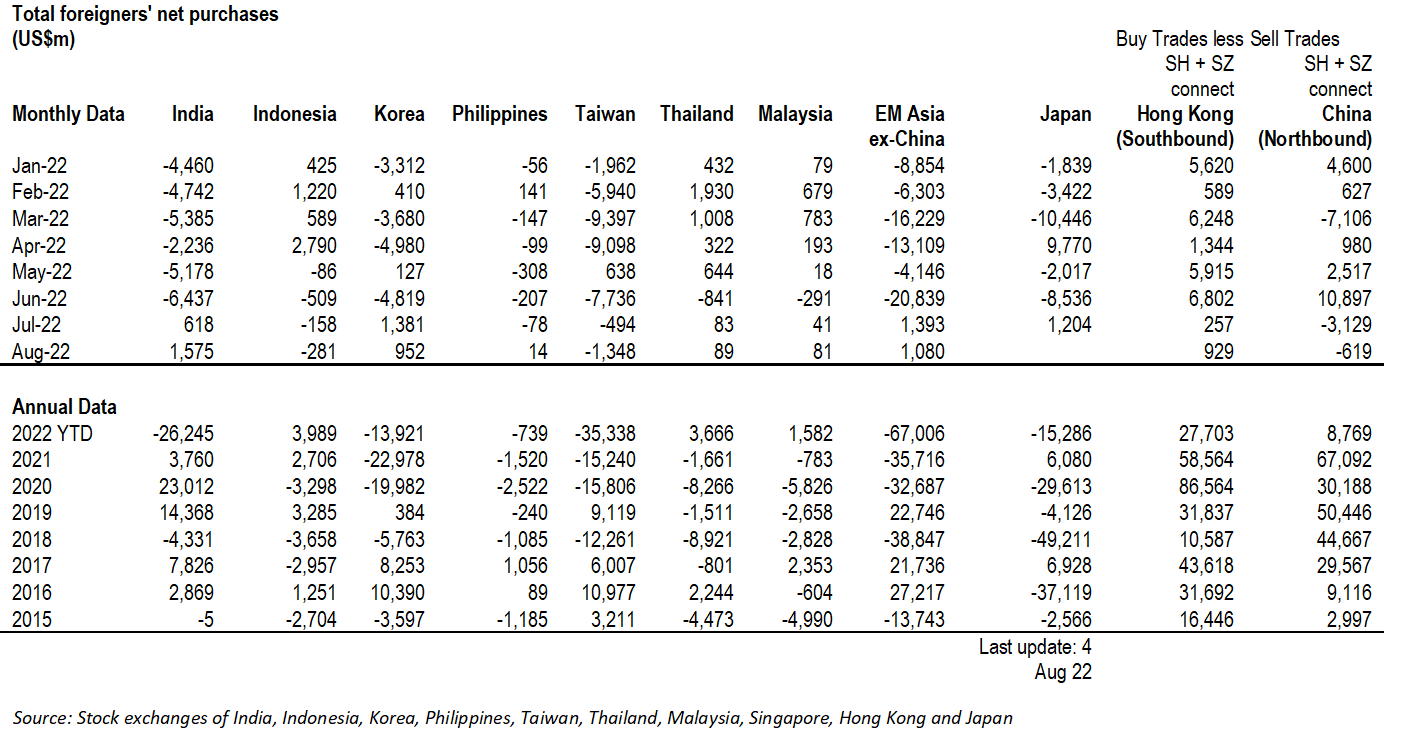

EM Equities Net Foreign Flow