15 August 2022

Weekly Market Review (15 August 2022) - What happened and What's Next

Market update

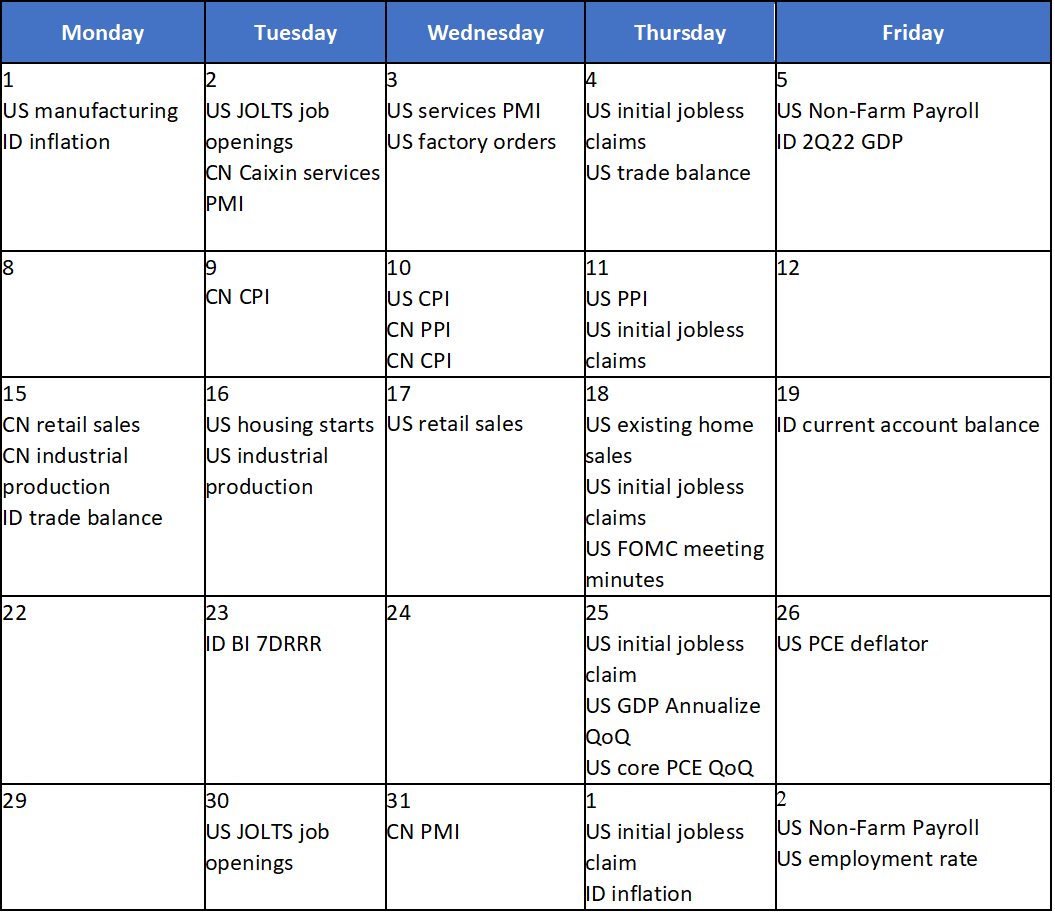

- Global indexes continued to gain across the board, with S&P500, DJI, and MSCI Asia ex-Japan up by respectively, +3.3%WoW, +2.9%WoW, +0.6%WoW. The rally was driven by the US Inflation moderation data reading thicken the idea that we may have passed ‘peak inflation’. Although, some investors still query whether this could be a sustain rally or not. This might depend on how sticky inflation could be, as well, the timing, duration, and depth of the US recession. Some Fed officials said against the idea that one month inflation data could fundamentally alter medium outlook. While US market recovered around 17% from mid-June low, Asian stocks have lagged due to mix local and global factors. On the domestic side, JCI slightly gain by +0.6%WoW, in line with the region. Sector movements were mostly flat or recovered higher, except Healthcare sector which underperformed by -0.6%WoW. In contrast, Basic Material sector and Energy sector were the most outperformers, up by respectively +2.9%WoW and +2.8%WoW. News flows to be watched within this week: US FOMC meeting minutes, retail sales, industrial production, existing home sales, initial jobless claim; China retail sales, industrial production; Indonesia trade balance and current account balance.

- Rupiah appreciated by 1.5% WoW to IDR 14,668, in line with other EM currencies. In contrast, DXY weakened by 0.9% WoW to 105.6.

- INDOGB was traded higher in price for the week, with yield across the curve lowered by 6-17bps. Ministry of Finance also introduced new benchmark series for 2023 on the upcoming Tuesday auction. By the end of the week, 10yr INDOGB was reported 6.99% (-10bps WoW).

- Total incoming bids on Tuesday sukuk auction increased significantly from previous auction, reaching IDR30.9tn compared to IDR12.5tn in previous auction. Short tenor series, still attract the biggest demand reaching IDR15.3tn, almost 50% of total incoming bids. The government finally issued IDR10.64tn or much higher than initial target of IDR7tn.

- Based on DMO data, foreign ownership as of 11th Aug was reported at IDR765.24tn or 15.58%.

- Long dated US Treasury yields rise amid signs of cooling inflation. 10yr UST was reported as high as 2.87% before it eases to 2.84% (+1bps WoW). The easing inflation made markets question the prospect for the Fed to slow the pace of rate hikes.

Global news

- US Consumer Price Index (CPI) inflation came below the anticipated rate at +8.5%YoY (vs consensus forecast at +8.7%YoY), indicating it may have peaked (prior month at +9.1%YoY). Price deceleration was mainly affected by the gasoline price, in line with normalizing global oil prices. Excluding the food and energy prices, core inflation sees smaller inflation by only +0.3%MoM or up by +5.9%YoY (prior figure was +0.7%MoM or +5.9YoY).

- US Producer Price Index (PPI) inflation also saw the first decline since April-2020 (early pandemic), where PPI unexpectedly fell -0.5%MoM in July of 2022, beating market increase forecasts of +0.2%MoM. The decline was mostly due to a 16.7% drop in gasoline prices.

- US jobless claim rose by 14k to 262k, highest since last November (although slightly below than market anticipate at 265k). Claims have been slowly trending higher, signal a cool breeze amidst some recent hot data labour.

- China consumer price hit a two year high, whereby headline CPI rose by +2.7%YoY, driven by price of pork, a food staple in China, which rose by 20.2%YoY. However, CPI figure was still below market expectation of +2.0%YoY increase.

- China PPI continued to moderate, which came below expectation at 4.2%YoY (vs consensus forecast at 4.9%YoY) and prior figure at 6.1%YoY. Falling producer price also points to limited potential upside to consumer price inflation.

Domestic News

- Indonesia trade surplus continued in July-22 at USD4.22bn, this came above expectation of USD3.95bn (USD5.1bn in Jun-22). Export grew by +32.03%YoY, less than June export growth of +40.68%YoY, driven by high commodity price start to normalize. Meanwhile import grew by +39.86%YoY, higher than June import growth of +21.98%YoY, mainly from oil and gas.

- The Ministry of Finance (MoF) updated that until the end of July 2022, the state budget has had a surplus of IDR106.1tn (+0.57% of GDP). The state revenues still grew by 50.3% YoY, reaching IDR1,551tn (reflected 84% of the FY target), while spending realization increased slightly by 5.6% YoY to IDR1,444.8tn (reached 53.2% of the FY target). As financing realization reached IDR196.7tn, hence, unspent budget (SilPA) became IDR302.8tn.

- The MoF also prepared a scenario for the use of reserve funds for the National Economic Management and Recovery (PC-PEN) program of IDR18tn as a support for social assistance in the event of a shock in the price of fuel oil and electricity. Until 05 Aug 22, the Ministry of Finance recorded realized budget of PC-PEN reached IDR168tn or 36.9% allocation of IDR455.6tn

- Government informed their concern around magnitude of Pertalite (subsidized) fuel consumption. As of July-22, Pertalite distribution already reached 16.8mn kilolitre from 23mn kilolitre full year quota (which then expected quota may expand to 28mn kilolitre). President Jokowi and Investment Minister Bahlil Lahadalia signal unavoidable fuel prices hike risk if surge oil price continues while fiscal heavily in burden.

- The government introduced the new 2W ride-hailing service tariff as ruled in the Kepmenhub KP 564/2022. Around +30% adjustment was made to the minimum tariff/service price.

Calendar

August

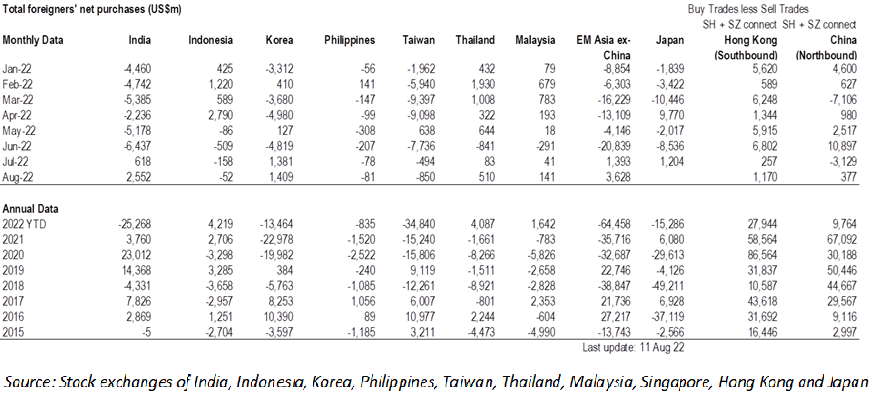

EM Equities Net Foreign Flow