22 August 2022

Weekly Market Review (22 August 2022) - What happened and What's Next

Market update

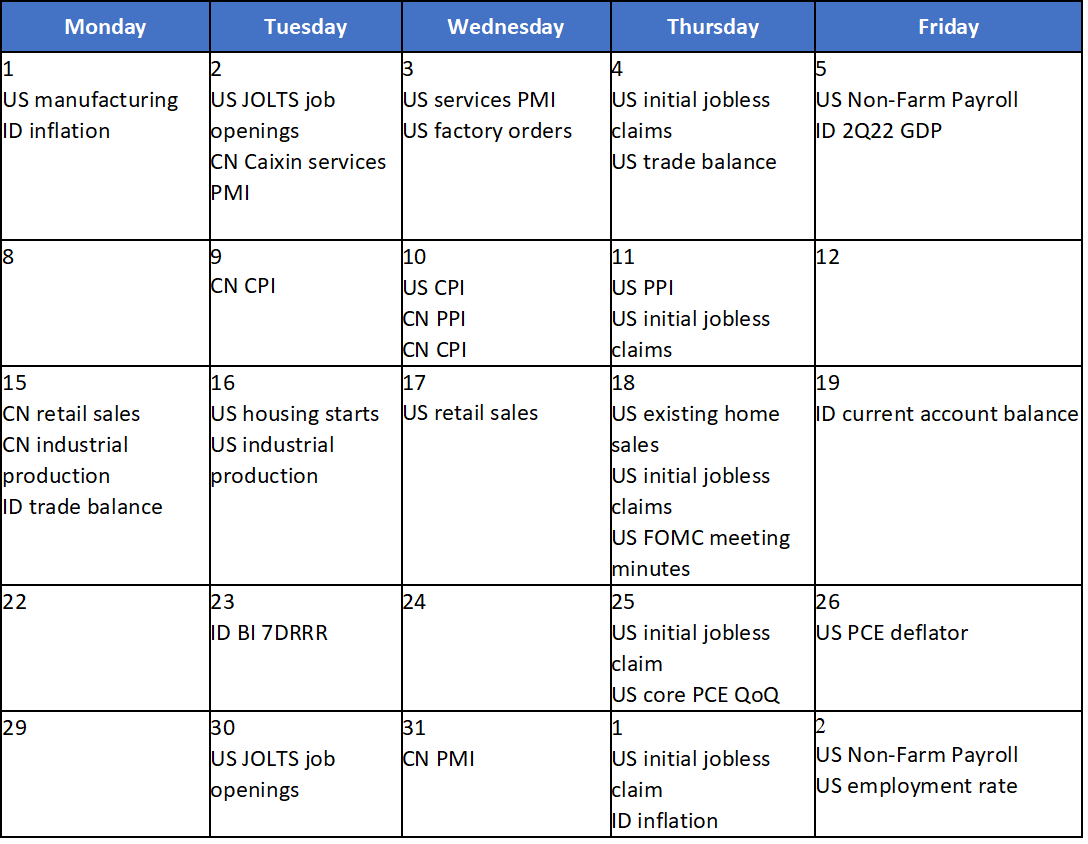

- Global indexes closed lower last Friday with US indexes snapping four weeks win streaks (S&P500 and Dow Jones down by -1.2% and -0.2% WoW respectively). US stocks fell on Friday as investors assessed a jump in Treasury yields and more hawkish comments from the Fed. St. Louis Fed President James Bullard mentioned that he would lean toward a 75-basis point hike in September. In addition, Richmon Fed President Tom Barkin said the Fed will do what it takes to drive inflation back toward its 2% target. On the other hand, JCI booked a slight gain of +0.6% WoW last week. The main outperformer was consumer non-cyclicals sector. Meanwhile, the main drag came from basic material sector, down by -3.2% WoW. News flows to be watched within this week: US initial jobless claim, US PCE and ID BI 7 DRRR.

- Rupiah depreciated by -1.2% WoW to IDR 14,838, in line with other EM currencies. In contrast, DXY strengthened by +2.4% WoW to 108.2.

- INDOGBs' yields were trade higher, with yields across the curve rose by 3-24bps. Yields were mostly increased on the medium to long tenor, with 10yr was reported back to 7.04%(+13bps WoW).

- Demand for conventional bond auction on Tuesday was very strong with bid reached IDR 72.2tn, much higher than previous bids at IDR 36.9tn. The increasing demand mostly came from medium tenors, with the biggest bids coming from the new series reaching IDR 31.8tn or 44% of total incoming bids. Along with the improving demand, government issued IDR 21.65tn or higher than the newest initial target of IDR 19tn.

- Based on DMO data, foreign ownership as of 18th Aug was reported at IDR 768.31tn or 15.64%.

- US Treasury yields moved higher as market digested FED minutes and had repriced a more hawkish policy following the possibility of a more persistent inflationary pressure, a stronger labor market, and more resilient consumer spending, all of which should keep officials focused on inflation over stagnation risks. By the end of the week, 10y UST was reported at 2.98% (+14bps WoW).

Global news

- US existing home sales fell for six consecutive months in Jul-22 to 4.81mn (in line with consensus) from prior month's figure of 5.11mn . Sales were down -5.9% MoM and -20.2% YoY on the back of higher mortgage rate.

- US initial jobless claims fell from 260k to 250k for the period ended 13 Aug-22, slightly lower than consensus expectation of 252k.

- US retail sales was flat in Jul-22, slightly lower than consensus' expectation of +0.1% MoM and lower than prior figure of +0.8% MoM.

- US industrial production index rose by +0.6% MoM, better than expectation of +0.3% MoM and previous month's figure of 0%.

- China's retail sales up by +2.7% YoY in Jul-22, well below consensus' expectation of +5% YoY and slowed from +3.1% YoY in the prior month.

- Industrial production rose by +3.8% in Jul-22, missed expectations of +4.6% growth and a drop from the prior month’s +3.9% increase.

Domestic News

- Overall BOP was at +USD 2.4bn in 2Q22 vs. -USD 1.8bn in 1Q22. Current account surplus widened to USD 3.9bn or 1.1% of GDP in 2Q22 (+0.1% of GDP in 1Q22) but lower than consensus at USD 4.5bn. Financial account recorded lesser outflow of USD 1.1bn in 2Q22 (-USD 1.7bn in 1Q22), amidst smaller portfolio outflow of USD 0.4bn (-USD 2.1bn in 1Q22).

- President Jokowi shared the 2023 state budget structure, viewing resilient growth next year supported by maintained investment climate focusing on downstream sectors. In the 2023 state budget, revenue is set at IDR 2,443.6tn, or up by +32.36% YoY from 2022 budget stated in Perpres 104/2021 (non-revised); government expenditure on the other hand, is set at IDR 3,041.7tn, or up by +12.07% YoY. Overall, the development of 2023 revenue and expenditure are dependent on income from the mining activities, while spending is towards retaining the domestic purchasing power through energy subsidy. Significant improvement in revenue, coupled with absence of Covid-19 budget, hence allows fiscal deficit to come smaller in 2023 at -2.9% of GDP.

- Coordinating Ministry for Maritime and Investment Affairs, Luhut Binsar, mentioned President Jokowi’s plan to publicly announce his decision on Pertalite prices.

Calendar

August 2022

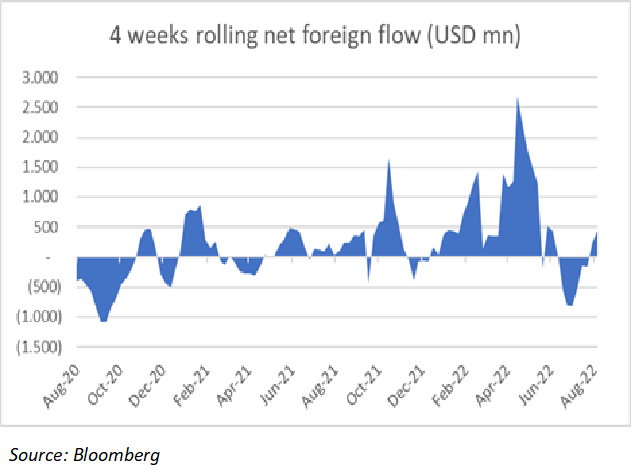

JCI foreign flow