24 June 2019

Weekly Market Review (24 June 2019) - What happened & What's next?

Market update

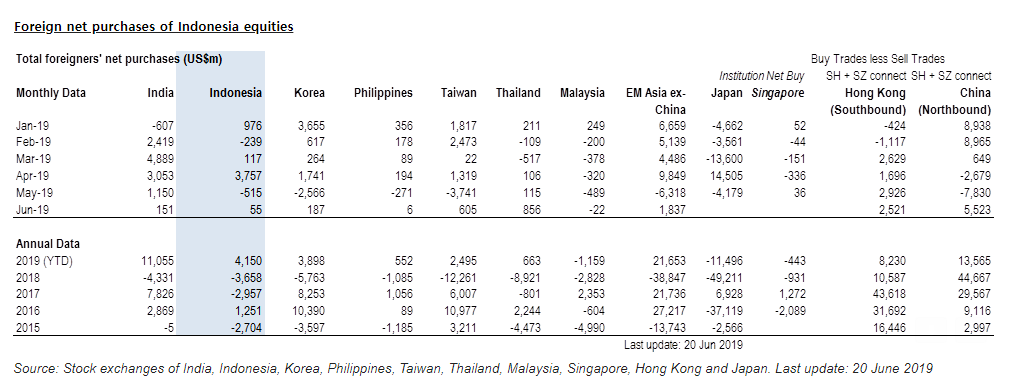

- Equities got a big lift this past week from supportive monetary policies as major CBs such as the Fed, the BOE, the BOJ and the ECB stayed rather dovish. Equities were first boosted by the FOMC as it signaled widely expected rate cuts and shifted policy forecasts towards being more accommodative. In Japan, the BOJ left the monetary policies unchanged with no change in the outlook for economic activity and prices, although market expectations of easing have heightened post the fall in long-term interest rates. Meanwhile, ECB President Draghi turned dovish and made it clear that the ECB stands ready to inject further stimulus into the economy. Ahead of the crucial G-20 this week, US blacklisted more Chinese tech companies, which could somewhat dampen hopes of a deal. On domestic side, JCI gained +1.0%WoW to 6,315.4 by the end of the week, supported by foreign inflow of USD20m. Trade sector was the worst performer with -1.3%WoW due to weak 4W industry volume. Meanwhile, Property sector was the best performer +4.4%WoW last week, due to dovish tone from BI and the proposal on luxury property tax cut. News flows to be watched within this week include Indonesia trade balance, G20 meeting, US 1Q GDP, US initial jobless claims.

- IDR appreciated to IDR14,155 (+1.2%WoW), in-line with the emerging markets. On the other hand, DXY fell to 96.2 (-1.4%WoW).

- Dovish statement from Fed meeting and reduction in Indonesia banks reserve requirement ratio by 50 bps made bond market yield decreased by 15-32 bps.

- Foreign investor reported net inflow of Rp 11tn over the week, mostly on 5 and 10 years series.

- After dovish statement from the Fed and weak US manufacturing PMI data released, 10 years US treasury yield decreased from 2.09% to 2.07% over the week.

Global news

- The Federal Reserve’s decision to leave rates unchanged at 2.5% while signaling readiness to cut them if the economic outlook doesn’t improve soon.

- European Central Bank signaled that policy makers could cut interest rates and resume bond purchases.

- Markit US Manufacturing PMI recorded slightly below at 50.1 vs. consensus estimate of 50.5.

Domestic News

- Bank Indonesia lowered the Rupiah Reserve Requirement (RR) from 6.5 to 6.0 percent effective 1 July 2019. On the other hand, BI kept policy rate steady at 6% while highlighting that they see room for rate cut going forward.

- Government is reviewing its plan to lower the corporate income tax (PPh) from 25% to 20%.

- Excise and customs tax grew by 35.1% YoY to Rp72.7tn as of May 2019. Income from cigarette tax grew by 60.17% to Rp53.66tn (34% of target at Rp158.66tn).

- Income tax from bond interest rates for infrastructure to be reduced to 5% from 15%.