29 August 2022

Weekly Market Review (29 August 2022) - What happened and What's Next

Market update

- Global indexes were mixed last week with US indexes tumbled more than -4% WoW on the back of Powell’s Jackson Hole speech that was more hawkish than expected, while MSCI Asia ex-Japan was up by +0.2% WoW. Powell invoking ‘Volcker’ and 1970s/1980s episodes of inflation suggests the Fed’s clear intent to keep rates high and “restrictive” until they have “confidence” that realized inflation is moderating. On the positive side, Beijing announced another package of roughly RMB 1tn in new stimulus measures to boost the economy: new quota of RMB300bn in policy bank financing tools; new quota of around RMB 500bn in local government special bonds (LGSB), which is carried over from previous years unused quota; RMB 200bn in new bonds to be issued by central government owned power generation companies. In addition, reports suggest that China and the US have reached an agreement on audits of US-listed Chinese firms. On the domestic side, JCI was down by -0.5% WoW last week. The main outperformer was Energy sector, up by +4.3% WoW. Meanwhile, the main drag came from Transportation sector, down by -4.7% WoW. News flows to be watched within this week: US non-farm payroll, unemployment rate, initial jobless claim; China PMI; and Indonesia inflation.

- Rupiah appreciated by 0.1% WoW to IDR 14,818, outperforming other EM currencies. DXY strengthened by +0.6% WoW to 108.8.

- INDOGBs were traded higher in price for the longer end of the yield curve as BI tried to flattening yield curve by buying the long ends and selling the short ends. Despite pressure on higher UST, INDOGB was traded in bullish note with offshore bought selected series across mid to long end area. Yields on the 10-30yr were down by 1-8bps, and by the end of the week 10yr INDOGB was reported at 7.04% (-8bps WoW).

- Solid demand in the Tuesday’s sukuk auction with total incoming bids reaching IDR 28.5tn. Incoming bids for new 3yr PBS036 offering series attracted the biggest demand reaching IDR 8.4tn or almost 30% of total sukuk incoming bids. The second biggest demand came from the longer tenors of 24.8yr which attracted almost IDR 7tn. At last, the government issued IDR 12.1tn or much higher than the initial target of IDR 9tn.

- The Ministry of Finance has settled another government bond issuance by private placement for the fund placement of the Voluntary Disclosure Program (VDP), amounting to IDR 1.6tn for the 5.4-yr FR94, which yielded 6.5%, and USD 24mn for the 9.4-yr USDFR003, which yielded 4.1%. The government also did a private placement program with BI under the burden sharing scheme SKB III agreement totalling IDR 40.4tn consisting variable rate bond with maturities between Aug 2027- Aug 2030.

- Based on DMO data, foreign ownership as of 25th Aug was reported at IDR 766.92tn or 15.51%.

- Treasury yields were higher after Federal Reserve Chair Jerome Powell delivered a speech on the central bank's tightening path. 10yr UST was as high as 3.11% ahead of the speech before retreating to 3.04% (+6bps WoW) by the end of the week.

Global news

- US 2Q22 GDP was revised up from -0.9% QoQ to -0.6% QoQ.

- US new home sales in July 2022 recorded 511k, below consensus expectation of 575k.

- US initial jobless claims recorded 243k, better than consensus expectation of 252k.

- US personal income in July 2022 recorded +0.2% MoM, below consensus expectation of +0.6% MoM.

- US personal spending recorded +0.1% MoM, below consensus expectation of +0.5% MoM.

- China lowered 1-yr loan prime rate from 3.7% to 3.65%.

- China lowered 5-yr loan prime rate from 4.45% to 4.3%.

Domestic News

- BI raised 7-day reverse repo rate by 25bps to 3.75%.

- The Center of Reform on Economics (Core) Indonesia projects that 2022 inflation could be around 7-9%, if the gov't raises the price of Pertalite to IDR 10k/litre. Meanwhile, if the price of Pertalite does not increase, inflation in 2022 is predicted to be around 5-6%, compared to the 2021 realization of 1.87%.

- The Indonesian Food and Beverage Entrepreneurs Association (Gapmmi) states that the price of food and beverage products in the country has started to increase recently, by around 5-7%.

- The gov't signalled an increase in cigarette excise rates in 2023, as seen in the 2023 RAPBN.

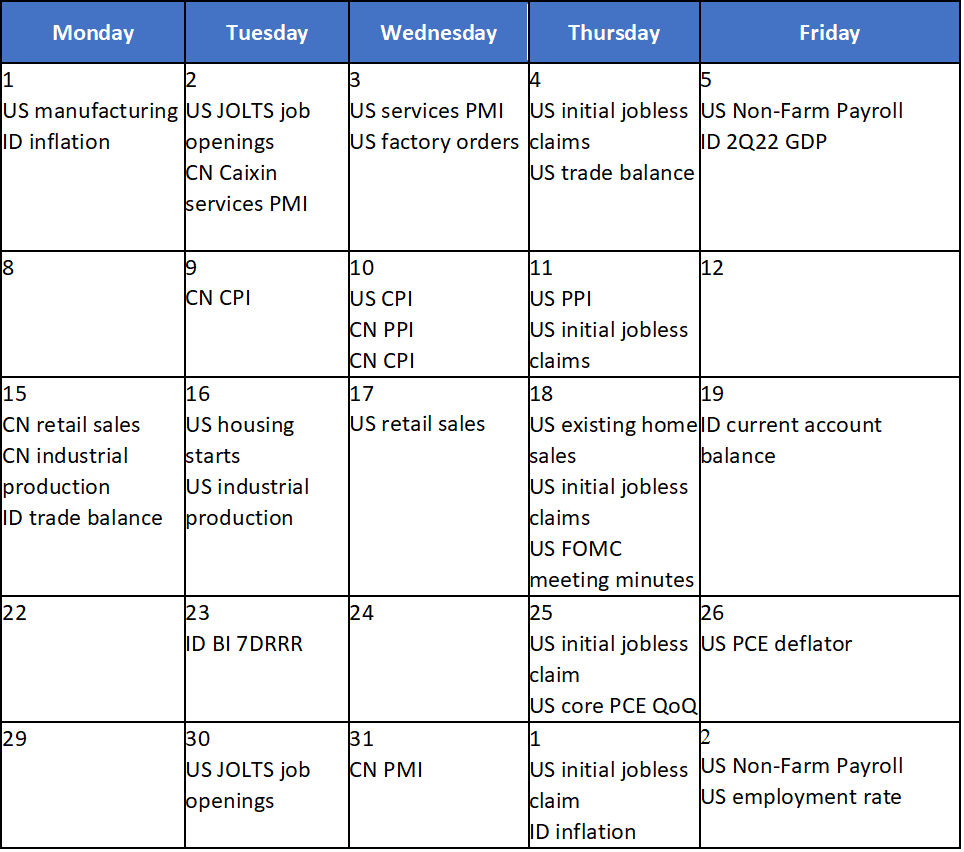

Calendar

August 2022

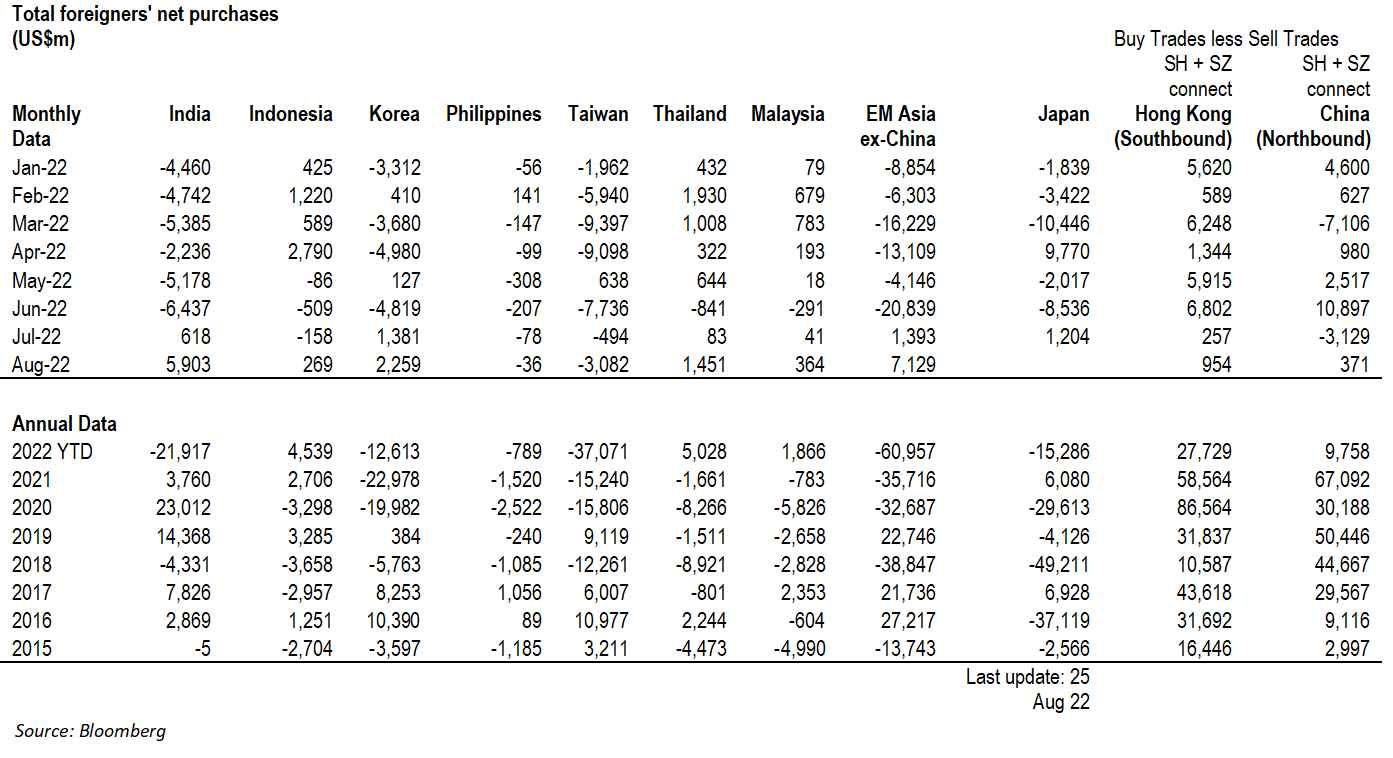

JCI foreign flow