26 September 2022

Weekly Market Review (26 Sept 2022) - What happened and What's Next

Market update

- Global indexes continue to tumble with S&P 500, Dow Jones, and MSCI Asia ex Japan dropped by respectively -4.6%WoW, -4.0%WoW, -4.3%WoW, hammered by the Fed’s hawkish stance in recent FOMC meeting. Although the FFR hike by 75bps was widely expected, but the dot plot appeared more hawkish than expectation (added +125bps by end-22). Unfavourable situation may continue as market react on the Fed’s hawkish tone by a notable higher US yield and stronger dollar. The Fed also increased focus on real rate which likely weight on stock market valuation. Not to mention, geopolitical tension seems escalated as Russia order partial mobilisation of troops. Asian central bank may fight global adverse situation by deplete its FX reserve or a more tighten policy to dampen local FX or otherwise accept currency depreciation. On the domestic side, JCI relative resilient which flat by +0.1%WoW in contrast with region weakening performance. Sector movements were mixed with solid performance shown by Healthcare sector and Consumer Non-Cyclical sector which respectively up by +1.1%WoW and +0.9%WoW. In contrast, Property and Real Estate sector and Transportation and Logistic sector were the main drag, which down respectively -3.4%WoW and -2.2%WoW. News flows to be watched within this week: US GDP annualized QoQ, Core PCE QoQ, Initial Jobless Claim, PCE deflator.

- Rupiah continue to depreciate by 0.6% WoW to IDR 15,038, but still outperformed with other EM currencies. In contrast, DXY strengthened by 3.3% WoW to 113.2.

- INDOGB traded lower for the week following higher UST. The short tenor yields increased the most by 19bps with 5yr was reported at 6.85% by the end of the week. The longer end of the curve also seen rising as 10yr was reported at 7.28% (+6bps WoW).

- Incoming bid in Tuesday’s sukuk auction slowed as it reached IDR17.1tn compared to IDR24.1tn in the previous auction. The newest series of 7yr (PBSG-001) was the most attractive during the auction, reaching IDR11tn or more than 65% of the total incoming bids. The government then decided to issue IDR6.3tn or lower than initial target.

- Based on DMO data, foreign ownership as of 15th Sept was reported at IDR743.23tn or 14.70%.

- Treasury yields rose after Fed hike its benchmark rate by 75 basis points on its September meeting. 10yr and 30yr yields reach highest levels in more than 8 years. Yield curve continued to be inverted as 2yr yield surges above 4.1% after the hike. By the end of the week, 10yr UST was reported at 3.69% (+24bps WoW).

Global news

- FOMC raised fed fund rate by 75bps to 3.00 – 3.25% in unanimous decision, marking a post-GFC high. The dot plot shows a 10-9 majority in favour of hiking through 4.25% this year, suggesting a fourth 75bp hike certainly remains open for November. Powell noted that participants expect the Fed to raise rate at sufficiently restrictive and stated that ‘no painless way’ to get inflation down.

- The US Manufacturing PMI up slightly to 51.8 in September (prior 51.5), with subdued improvement in the health of manufacturing sector. The Services PMI posted at 49.2 in September, up notably from the 43.7 position in August – as firms stated that pick up in new orders and client demand dampened the contraction.

- The US Existing home sales edged 0.4% lower to a seasonally adjusted annual rate of 4.8 million in August of 2022, the lowest reading since May of 2020, and following a downwardly revised 5.7% drop in July. It marks the seventh consecutive month of falls in existing home sales, reflecting this year’s escalating mortgage rates.

- The US Initial Jobless Claim rose to 213k, below market consensus 217k. It marked a slight increase from the previous week’s downwardly revised value (208k), which was the lowest since May, still pointing to a tight labour market.

Domestic News

- Bank Indonesia (BI) announced the increase of BI7DRR by 50bps in the recent RDG meeting to 4.25% which surprise the market as consensus expect hike to 4.0%. BI stated this decision was taken as a front-loaded, pre-emptive, and a forward-looking move to maintain inflation expectations.

- Asian Development Bank (ADB) revised Indonesia's economic growth in 2022 to 5.4% from 5% with an inflation rate of 4.6% as strong domestic consumption and exports can withstand global shocks. Meanwhile, in 2023 economic growth was revised down to 5% from 5.2% with an inflation rate of 5.1%.

- Money supply (M2) still grew positively in August by +9.5%YoY while money supply in narrow sense (M1) by +13.7%YoY. The M2 growth in August was mainly influenced by developments in credit, government finances, and the net foreign assets.

- According to BI, Indonesia's International Investment Properties in 2Q22 amassed a net liability totalling USD270.4 bn (21.3% of GDP), down from USD287.8bn (23.6% of GDP) in 1Q22, stemmed from a decrease in the position of Foreign Financial Liabilities (FFL) coupled with an increase of Foreign Financial Assets (FFA).

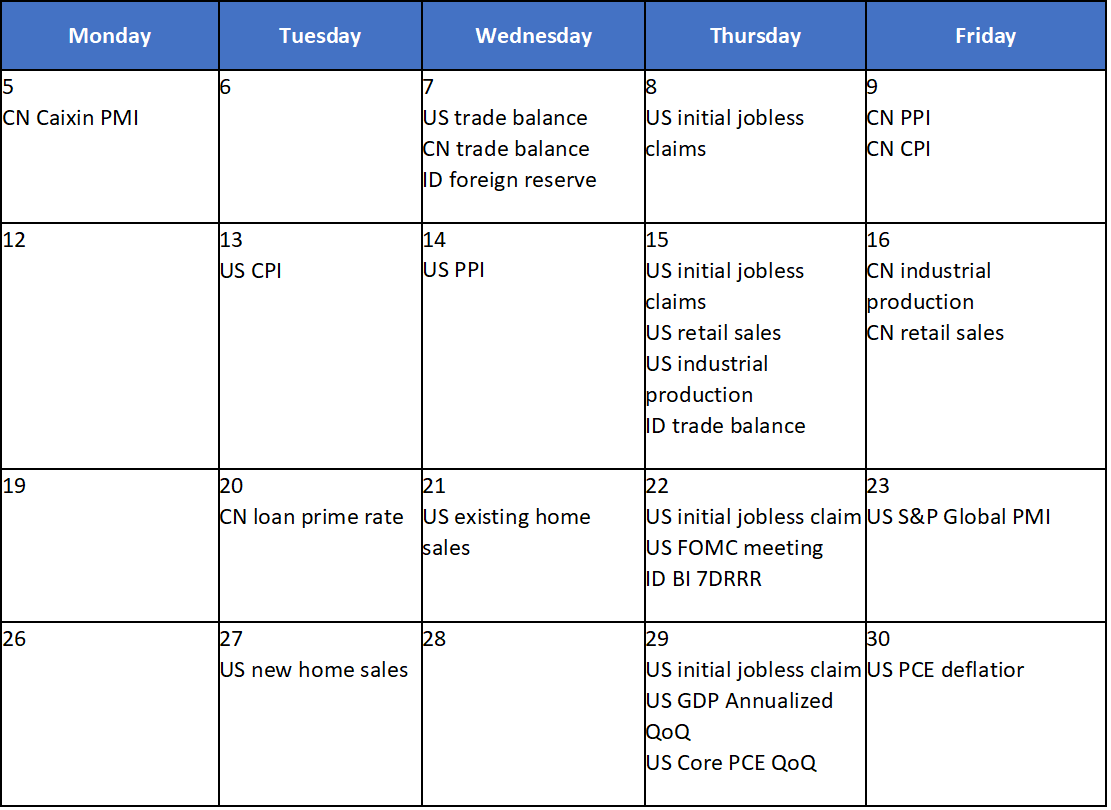

Calendar

September 2022

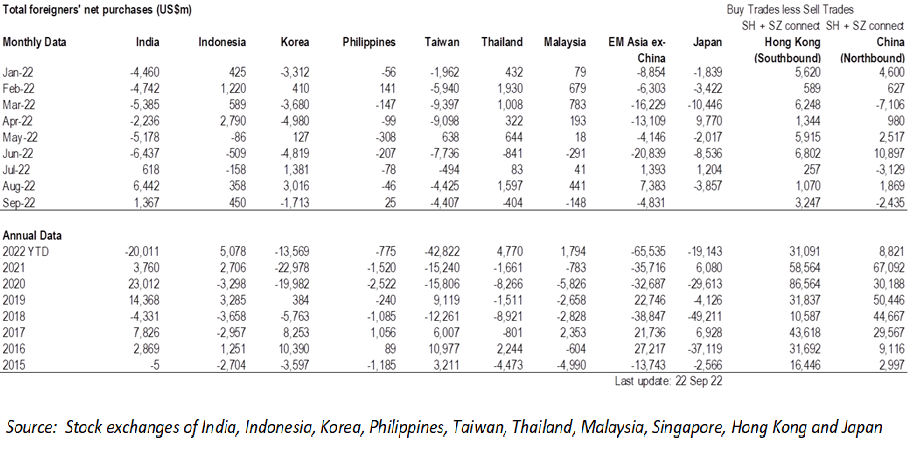

EM Equities Net Foreign Flow